Freedom of choice, or the multiplication of payment tools

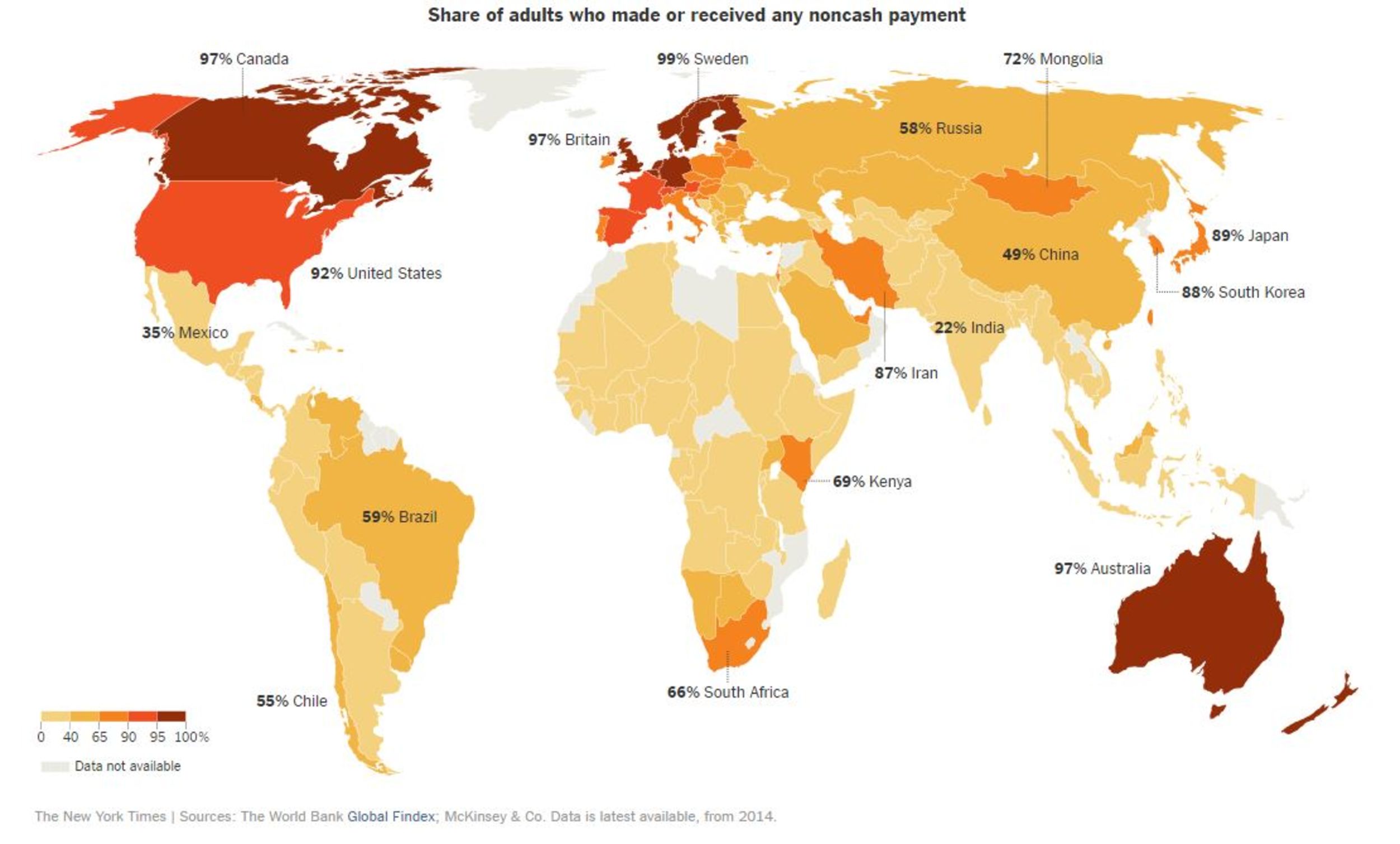

Even though electronic moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More is gaining ground across the globe (see The New York Time’s graph here below) this is not – as one might believe – particularly affecting cashMoney in physical form such as banknotes and coins. More usage. Indeed, as the use of mobile and contactless payments continues to rise, so does the use of cash. According to Deloitte’s Chief Economist in the UK, Ian Stewart, despite all the hype linked to BitcoinBitcoin is commonly said to be a cryptocurrency, a digital means of exchange developed by a set of anonymous authors under the pseudonym of Satoshi Nakamoto, which began operating in 2009 as a community project (Wikipedia type), without the relationship or dependency of any government, state, company or body, and whose value (formed by a complicated system of mathematical algorithms and cryptography) is not supported by any central bank or authority. Bitcoins are essentially accounting entries i... More and others, there could be another, more “established” player that could join the pool of digital paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More options: the central bank via an all-digital currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More.

As Stewart rightly states, “practical problems [also] stand in the way of bitcoin becoming a digital currency. Wide fluctuations in its value mean that it does not meet one of the definitions of an effective currency – that it offers a stable store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More”. This is a crucial point for any currency – be it virtual or physical – and it could become the key argument for the development of an all-digital currency by central banks.

Such a development would allow governments to maintain control on a country’s monetary policy, without the risk of it slowly being taken over by private actors such as Apple, Google, or any other non-governmental player that is participating in today’s electronic payments race.

What could be the positive aspects of an all-digital central bank-issued currency? Maintaining consumer confidence in a country’s legal tenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More as well as keeping the grip on monetary policy. And what about the downsides? Stewart lists them as being linked to what currently makes Bitcoin attractive to some users: the loss of anonymity that is associated to cash or Bitcoin usage. Indeed, it is highly unlikely that a government-issued digital currency would preserve cash’s central attributes: privacy and anonymity. Because governments generally criticise cash as a tool often used by criminals and tax evaders, it is more likely that they will seek to make the digital currency into something that can be easily traced – a likely cause for consumer opposition and fuel for the “big brother” argument.

Another important advantage, from the government’s perspective, is that “an all-digital currency would also enable a central bank to set interest rates below zero – enabling the bank to penalize holders of money in order to stimulate spending […] in a world of very low interest rates, digital cash would help restore the power of monetary policy,” writes Stewart.

Nevertheless, it is still too soon to panic as “2.7 million people in the UK, 5% of adults, spread relatively evenly across all age groups, rely almost entirely on cash to make their day-to-day payments. It is an important budgeting tool.” And regardless of the multiplication of alternative payment methods, cash usage is growing between 5%-10% each year, worldwide.

To read the original article, click here.

To view the New York Times’ statistics on noncash payments worldwide [paywall], please click here.