No citizen left behind

The cashless movement might be moving ahead too quickly without properly evaluating the current state of affairs. In order to go cashless, the minimum requirement is that all citizens be equipped with a bank account. Yet, according to the 2015 Global Findex Database, 39% of the world population still does not own a bank account in a formal financial institution. Indeed, only 50% of people living in developing countries have access to banking services, compared to 94% in advanced economies (OECD member countries).

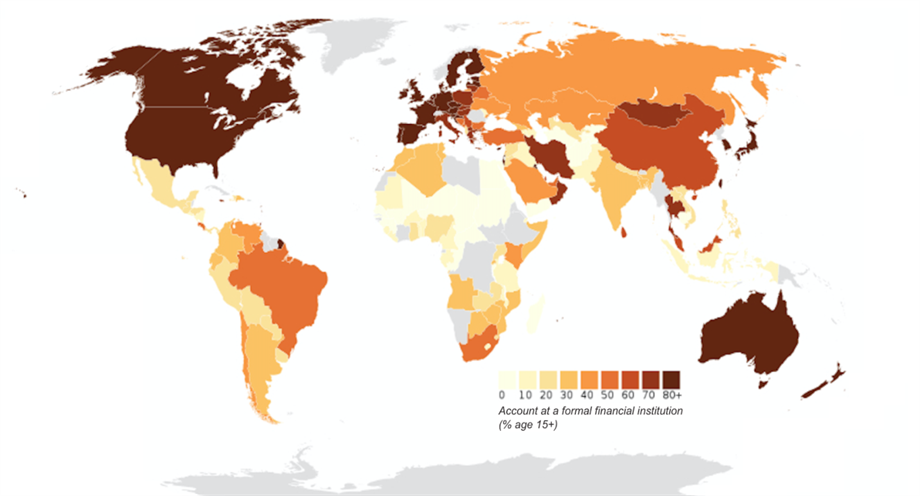

The chart below demonstrates the disparities between the different regions in 2015:

Source: Center for Financial InclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More, Mapping the Invisible Market

In addition to those statistics, only 23% of debit card holders living in advanced countries reported using a card to make payments, and only 14% in poor regions. A coalition of banking institutions created in 2015, including MasterCard and Visa, is currently pushing to address the situation and invest resources to make banking services more accessible in developing countries. The aim is to reach universal financial accessibility by 2020.

Although more than 80% of the US population made use of banking services in 2015, 7% of households still do not own a current or savings account, which means that about 15.6 million adults are currently unbanked in the US.

By law, even Norway, a country pushing for a cashless society, requires banks to accept and provide cashMoney in physical form such as banknotes and coins. More services to its clients. We mustn’t forget that cash is still the most widely used payment methodSee Payment instrument. More and that pushing for changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More too fast will only result in some – usually the most vulnerable – to be left behind.

To read the original article, click here.