India: Cash in Circulation Grew by 15% Last Year

Demand increased due to heightened uncertainty caused by the pandemic

In August, the Reserve BankSee Central bank. More of India (RBI) published its Annual Report for the fiscal year 2020 which ends on 30 June. The report states that “The demand for currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More started to increase in the wake of heightened uncertainty caused by COVID-19 pandemic. The Reserve Bank took a series of measures in order to meet the enhanced demand. In addition, note printing presses, paperSee Banknote paper. More mills and banks were also directed to put in place a business continuity plan/contingency plan to avoid any disruption in continuous supply of currency.”

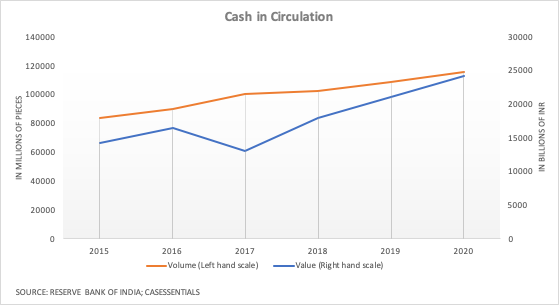

Over 116 billion notes in circulation

The value and volume of banknotes in circulation increased by 14.7% and 6.6%, respectively, during 2019-20. This represents a value of INR24 trillion (approx. $330 billion) and a volume of 116 billion pieces or just under 90 notes per person. In value terms, growth was slightly below the 2019-18 figure (17%) and substantially lower than the 2018-17 figure (37.7%) which was exceptionally high following the demonetisationSee Demonetised banknote. More experience in late 2016. The two highest denominations INR500 and INR2,000 account for 83.4% of the total value of coins in circulation. The INR2,000 note which was introduced following the demonetization has seen its share decline from 37% of the total value in 2018 to 23% in 2020. On the other hand, the circulation of INR 500 and INR200 has increased substantially both in value and in volume.

The RBI revealed that no new INR2,000 notes were printed in 2020. Overall, printing volumes declined by 13.1% in 2020, and the actual supply of notes to the RBI by 23.3% mainly due to disruptions caused by the Covid-19 pandemic and the ensuing lockdown.

The total value of coins in circulation increased by 1.8% in 2019-20 while the total volume increased by 1.2%.

CounterfeitThe reproduction or alteration of a document or security element with the intent to deceive the public. A counterfeit banknote looks authentic and has been manufactured or altered fraudulently. In most countries, currency counterfeiting is a criminal offence under the criminal code. More notes continue to decline

The number of counterfeit notes continued to decline for the second year in a row. 296,695 pieces were detected in April March 2020, compared to 317,384 pieces in 2019 and 522,783 in 2018. Over half the counterfeits are INR 100 notes.

Continued Efforts to Facilitate Access to CashMoney in physical form such as banknotes and coins. More

In spite of government efforts to promote digital payments, including fining retailers who fail to accept digital payments, banks and fintechs have innovated during the pandemic to facilitate access to cash. In Chennai, Indian Bank launched a mobile ATM service to ensure convenient and safeSecure container for storing money and valuables, with high resistance to breaking and entering. More access to cash. Popular Payments App, PhonePe now allows customers to withdraw cash free-of-charge from shops that the company has partnered with. The RBI has launched the MANI (Mobile Aided Note Identifier) mobile application to aid visually impaired people in identifying the denominationEach individual value in a series of banknotes or coins. More of currency notes.

However, according to Indian media, ATMs in West Bengal have been running short of currency as private entities entrusted with the replenishment have been suffering from staff shortages due to Covid-19 lockdown.

Challenging economic prospects ahead

India has recently posted the largest economic contraction among major economies as the GDP shrank by 23.9 between June 2020 and June 2019. GDP is expected to further contract by 5% in 2021. The World Bank estimates that the pandemic risks reversing years of economic gain in India and that it could push millions back into poverty.