The Future of Cash: Shaping Resilience in an Uncertain World

A World in Flux: The Context of Uncertainty

The global landscape is increasingly characterized by uncertainty. In 2022, Stephen Polosz, former Governor of the Bank of Canada and author of The Next Age of Uncertainty – How the World can Adapt to a Riskier Future, mapped out five tectonic forces – an ageing workforce, mounting debt, rising inequality, technology and climate changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More – that are shaping the future. Since, geopolitical tensions and economic volatility have been generating additional uncertainty, creating a complex web of interconnected challenges. These uncertainties are no longer temporary anomalies but represent a new normal that demands robust and flexible systems. We are not facing isolated changes but overlapping, compounding transformations—what scholars now describe as a “polycrisis.” This context requires a proactive approach to ensure that paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More systems, including the role of cashMoney in physical form such as banknotes and coins. More, are prepared to navigate these multifaceted challenges.

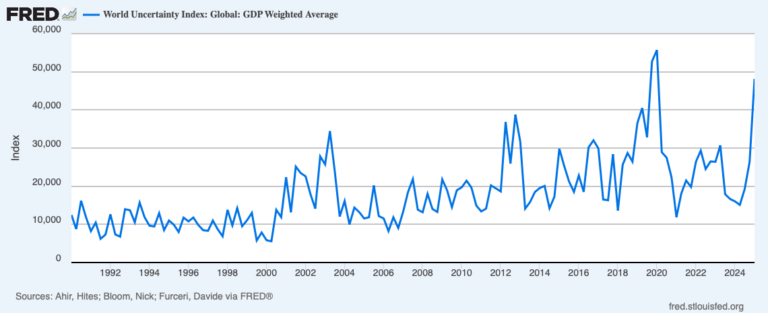

Historically, periods of heightened uncertainty have fueled demand for cash. The World Uncertainty Index, which tracks the frequency of the word “uncertainty” in global news reports, is not far from its historical peak, at the height of the COVID-19 pandemic, during which global cash demand experienced exceptional growth. During uncertain times, cash has often been seen as a safeSecure container for storing money and valuables, with high resistance to breaking and entering. More haven, with individuals and businesses increasing their cash holdings as a hedge against uncertainty. This trend underscores the enduring relevance of cash in uncertain times and highlights the need to ensure its resilience and accessibility as part of a broader financial strategy.

Geopolitical and Economic Volatility

Geopolitical tensions and economic volatility are significant drivers of global uncertainty. Trade disputes, political instability, and shifting alliances create a dynamic environment that impacts financial systems worldwide. The ongoing trade tensions between major economies, such as the U.S. and China, and the economic fallout from conflicts like the Russia-Ukraine war, exemplify this volatility. These factors contribute shifting the debate towards more sovereignty and more resilience rather than convenience.

Technological Disruptions

Technological advancements, particularly in digital payments and financial technologies, are transforming the financial landscape. The rise of stablecoins, digital wallets, and peer-to-peer payment systems is challenging cash-based transactions. While these innovations offer convenience and efficiency, they also introduce new risks and uncertainties, including cybersecurity threats, regulatory challenges and loss of privacy.

Climate Change and Sustainability

Climate change and sustainability concerns are adding another layer of complexity to the global economy. The transition to a low-carbon economy requires significant investments and policy changes, which can disrupt traditional financial systems. The need for sustainable finance is driving change towards a greener cash ecosystem.

Shaping the Future of Cash

In this context of growing uncertainty, it is not enough to simply adapt the cash cycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More to accommodate digital payments and technological advancements. Instead, a proactive approach is needed to shape the future of cash and ensure its resilience.

Building Resilient Financial Systems

To prepare for the challenges ahead, financial systems must be designed with resilience in mind. This involves developing robust frameworks that can withstand economic shocks, geopolitical instability, and technological disruptions. By investing in infrastructure, technology, and policy measures that support cash transactions, we can ensure that cash remains a reliable and accessible option for all.

Ensuring Inclusivity and Accessibility

As digital payments become more prevalent, there is a risk of further excluding populations that rely on cash. Crises have had a profound impact on global poverty. The COVID-19 pandemic pushed nearly 70 million more people into extreme poverty. The Russian invasion of Ukraine has exacerbated poverty both within Ukraine and globally.Ensuring the inclusivity and accessibility of cash is crucial for maintaining financial stability and social equity. This requires efforts to modernize cash infrastructure, improve access to cash services, and promote financial literacy.

Fostering Innovation and Collaboration

Shaping the future of cash also involves fostering innovation and collaboration among stakeholders. By encouraging partnerships between financial institutions, technology companies, and policymakers, we can develop innovative solutions that integrate cash with digital payment systems. This collaborative approach can help create a more resilient and adaptable financial ecosystem. Strategic innovation in the cash ecosystem could evolve around:

- Unleashing new forms of demand enabling stronger financial and social inclusion;

- Reconfiguring value chains that align with evolving consumer preferences and technological advancements;

- Building a more sustainable and resilient cash ecosystem.

The Core Discussion at the Future of Cash Conference

The upcoming Future of Cash Conference in Warsaw this November will provide a platform for global leaders, policymakers, and industry experts to discuss these critical issues. The conference will focus on how to shape the future of cash in an uncertain world, emphasizing the need for proactive strategies that ensure preparedness and resilience.

By bringing together diverse perspectives and fostering dialogue, the Future of Cash Conference aims to drive meaningful action towards building robust and inclusive financial systems. The discussions and insights from the conference will be instrumental in shaping policies and initiatives that support the continued relevance and reliability of cash in the global economy.

Join us at the Future of Cash Conference in Warsaw this November to be part of this crucial conversation and help shape the future of cash in an uncertain world.