Malaysia to Impose Caps on Cash Payments and Subsidise Digital Payments

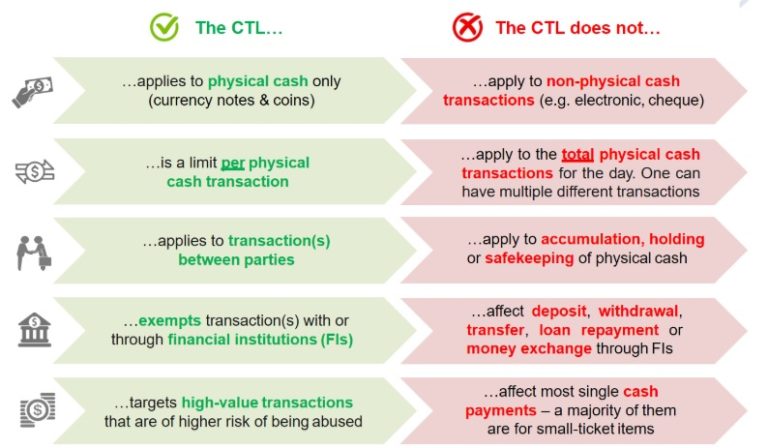

Bank Negara Malaysia, Malaysia’s central bank, is proposing to set a Cash Transaction Limit (CTL) of RM25,000 or around US$6,000 this year. The CTL is designed to reinforce efforts in promoting financial integrity and to complement other measures such as the Suspicious Transactions Report (STR) and the Cash Threshold Report (CTR) that facilitate monitoring, investigations and enforcement actions by law enforcement agencies. Moreover, it seeks to:

- Increase scrutiny by public over those who are using cashMoney in physical form such as banknotes and coins. More paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More for high-value transactions, making it more difficult for criminals to abuse the system

- Enlists the help of Malaysians and businesses to insist that large payments be made through traceable methods

- Provides legal obligation for parties to reject large cash payments, thus protecting them from unknowingly facilitating money launderingThe operation of attempting to disguise a set of fraudulently or criminally obtained funds as legal, in operations undeclared to tax authorities, and therefore not subjected to taxation. Money laundering activities are strongly pursued by authorities and in most countries, there are strict rules for credit institutions to cooperate in the fight against money laundering operations, to declare and report any transactions that could be considered suspicious. More scheme

Source: Bank Negara Malaysia

Meanwhile, Reuters reports that the government is launching a programme to subsidise digital payments by a total RM450 million ($110 million) in a drive to boost digital payments. The moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More will be distributed to nearly half its citizens’ Southeast Asian e-wallet operators Grab, backed by SoftBank Group telecom company Axiata’s Boost and Touch‘n Go, which is backed by banking group CIMB (CIMB.KL) and China’s Ant Financial. Every Malaysian aged 18 years and above and earning less than 100,000 ringgit a year will be eligible to receive a one-time shopping handout of 30 ringgit through one of the e-wallets, the finance minister said in a statement.

In 2017, the volume of ATM cash withdrawals in Malaysia was stable at 763.9M with a value of RM 396,956.7 million, a 2% annual increase, according to the 2017 Financial Stability and Payment Systems Report. Malaysia’s Finance Minister Lim Guan Eng believes cash is a public good and is urging government departments to ensure that such option remains for the public.

“For me, personally, I am the traditional type. I prefer to pay in cash. But the public should be given an option, especially rural folks or the older generation, as they are still not very used to (digital payments). It should be done gradually, in phases.”

Promoting financial integrity is a perfectly legitimate policy, however, numerous organisations have concluded that cash payment limitations would have limited effectiveness on curbing illegal activities. In 2018, the European Commission concluded that “While tax fraud and the use of cash are often associated, the study demonstrates that the relationship between the two is not always clear-cut.” In 2019, the Bundesbank published a study on the extent of illicit cash use in Germany and concluded that it is very difficult to provide hard research-based evidence about the scale of the cash demand resulting from the shadow economy and criminal activity.

Canadian Economist Pierre Lemieux has argued that “Not only would banning cash as we know it inconvenience a lot of people, but also, as we shall see, it would come with many new regulations and controls. For example, it would require tight regulation of crypto-currencies, harassment of “cash hoarders,” and prohibition of prepaid cards (which are too similar to cash).”

It may not be a coincidence that Reuters estimates that subsidizing digital payments may “help the government deflect concerns over the cost of living, which late last year led the ruling coalition to lose a by-election by a bigger than expected margin.”