Japan’s Mission towards a Cashless Vision

Japan has risen as a world leader in innovation and is now home to the latest, cutting-edge set of technologies that it may come as a surprise to find out that the country falls behind the global lead for e-commerce and digital transactions. That’s right, the Japanese are known to be loyal to their yen – so much so that the Japanese government is pushing for alternative, digital payments.

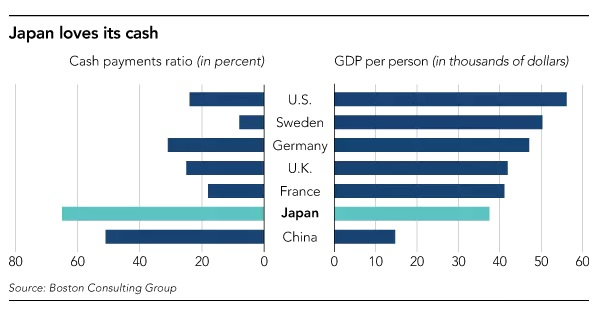

About 65% of payments in Japan are settled in cashMoney in physical form such as banknotes and coins. More, more than twice the average 32% among other rich economies, according to a study conducted by the Boston Consulting Group. Moreover, cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More in Japan amounts to over 20% of the nation’s GDP, which is significantly higher than the U.S. (8.3%), China (9.5%) or the Eurozone (10.7%). It’s also interesting to note that as of 30 September 2018, Japanese households had JPY 1,860 trillion (roughly USD 17 trillion) in total financial assets of which over 50% was held in cash, reports the Federal Reserve BankSee Central bank. More of San Francisco.

The Ministry of Economy, Trade, and Industry released a report entitled “Cashless Vision” in April 2018 that aims to boost the nation’s use of digital payments by 2025. The report found that credit and debit cards, e-money and other forms of digital payments were less used than in other developed nations.

The government will subsidize card loyalty programmes

The government plans to roll out a nine-month points program in October of this year designed to encourage small retailers to accept digital payments. Shoppers paying via credit card, e-money and other non-cash methods will receive points worth 5% of purchases at small and midsize outlets. But even with the government’s backing, moving Japan away from cash is far from certain as card processing fees continue to increase for merchants and citizens have a specific emotional attachment to its physical currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More, the Tokyo Review reports.

A study published by Hiroshi Fujiki entitled Cash Usage Trends in Japan: Evidence Using Aggregate and Household Survey Data finds that the decrease in cash demand due to the increase of credit cards in both day-to-day transactions and regular payments would have a very modest impact. In fact, the study gathered enough data to calculate and infer the maximum impact of any possible decreases – amounting to at most 0.45% for regular payments and a 0.51% decrease in the total cash circulation in Japan.