Less cash, more fraud

Speaking at the 2016 World Economic Forum in Davos, John Cryan, the CEO of Deutsche Bank, predicted “CashMoney in physical form such as banknotes and coins. More I think in ten years time probably won’t (exist). There is no need for it, it is terribly inefficient and expensive”. Mr. Cryan also focused on the way in which cash supports the underground economy.

Surprisingly, 10 months later, Deutsche Bank Research, the macroeconomic analysis arm of the group, publish an interesting report entitled Cash, freedom and crime – Use and impact of cash in a world going digital.

The report observes that “demand for euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More cash is on the rise”. Euro notes in circulation trebled in value between 2003 and 2016. But the report also stresses that “abolishing cash will not eliminate profit-driven crime”. Moreover, the report provides some striking illustrations that cash and crime are not connected.

- The share of cash in payments does not reflect the size of the shadow economy. Germany and Austria are cash-intensive economies with small shadow economies, while Sweden is a low-cash country with a relatively high shadow economy.

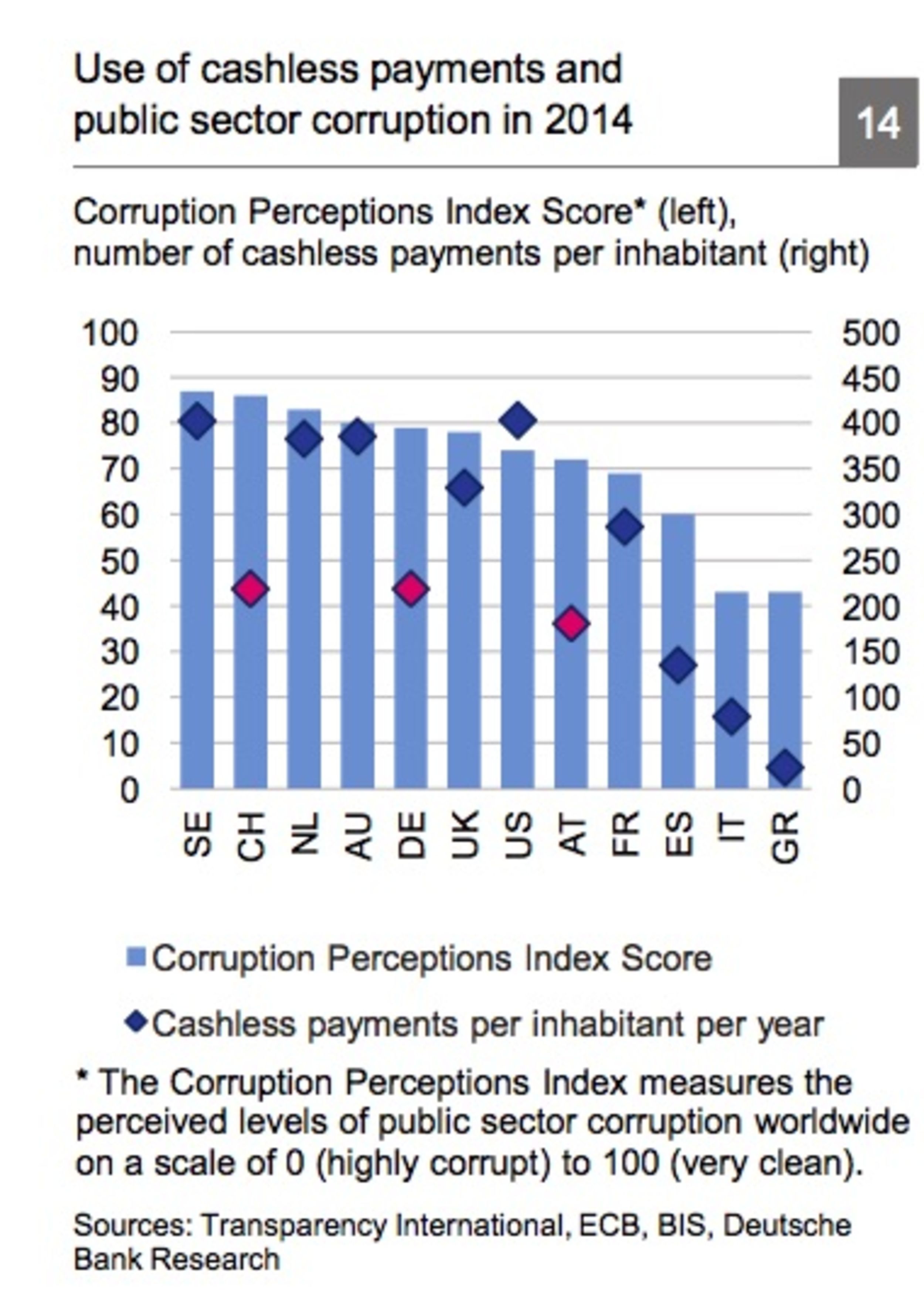

- High cash usage does not lead to high corruption levels. Countries such as Switzerland, Germany or Austria, where the share of cash payments is high all have a low level of perceived corruption.

- The relationship between cash usage and money launderingThe operation of attempting to disguise a set of fraudulently or criminally obtained funds as legal, in operations undeclared to tax authorities, and therefore not subjected to taxation. Money laundering activities are strongly pursued by authorities and in most countries, there are strict rules for credit institutions to cooperate in the fight against money laundering operations, to declare and report any transactions that could be considered suspicious. More is also unclear. While both EuropolA body created within the European Union (EU) which supports the EU Member States in the fight against terrorism, cybercrime and other serious and organised forms of crime, like currency counterfeiting. More and the Financial Action Task Force (FATF) observe that moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More laundering often involves cash at one stage of a process, it cannot be excluded that this is merely because authorities have become more efficient at spotting illegal flows of cash. Meanwhile, in Sweden where cash is declining, the number of detected money laundering cases has increased tenfold between 2008 and 2015.

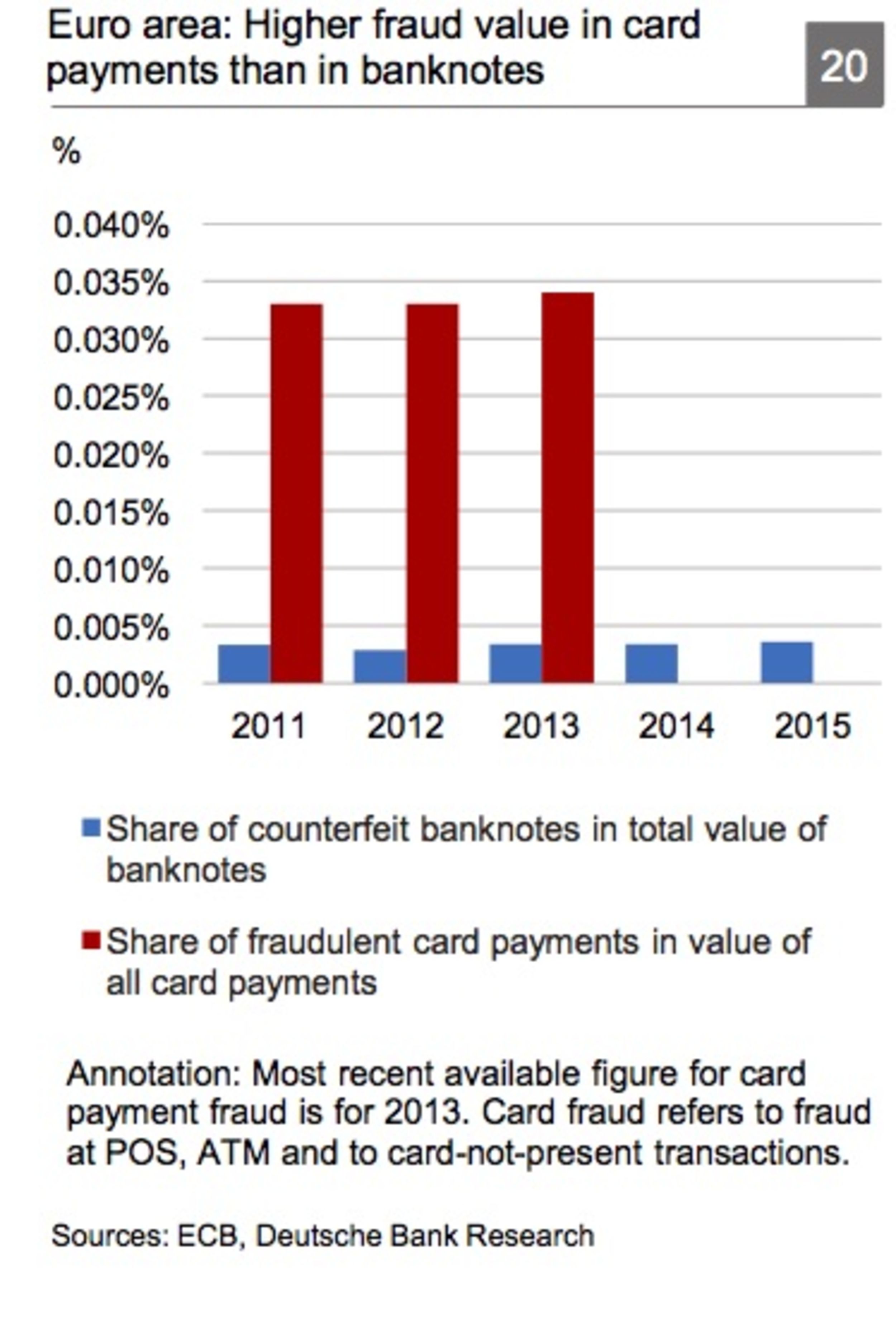

- Cash is far more fraud-resistant than cards. In 2013, the value of counterfeitThe reproduction or alteration of a document or security element with the intent to deceive the public. A counterfeit banknote looks authentic and has been manufactured or altered fraudulently. In most countries, currency counterfeiting is a criminal offence under the criminal code. More banknotes in the Eurozone amounted to €32 million whereas card fraud totalled €430 million.It is surprising that while banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More counterfeit data is available almost real-time, the last available data for card fraud is three years old.