Reasons to Introduce a New Series or Upgrade

It is an old saying that banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More issuers must be at least one step ahead of the counterfeiters, and indeed from the beginning notes have been developed in pace with the counterfeiting threats. There have been times when issuers have been able to relax for decades, but also periods when innovations in reproduction technology have forced paradigm changes in banknote security.

Nevertheless, counterfeiting threats are not the only reason for an introduction of a new note series or an upgrade. Monetary or political reforms, user requirements, costs and the prominence of banknotes as a state business card have gained further importance over the course of time.

Early Developments against Counterfeiting

Early banknote issuers used watermarked paperSee Banknote paper. More, which was not readily available to the public, different typefaces and ornaments, reliefs, seals and vignettes in printing their notes. Intaglio printingA printing method, which also acts as a security feature, and gives the image a raised print effect that is difficult to achieve with other systems. The printing parts of the plate are recessed by engraving into a metal plate. The engraved plates are applied to the paper at very high pressure. The compression of the paper and the transfer of a thick layer of ink give the intaglio print a distinct tactility. More was introduced early on as an alternative to the other main printing method, letterpress. Over the years new printing methods more suitable to high volume security printing were developed, as well as new methods for engravingMarking with incision or etching an intaglio printing plate to create a design which will be transferred on the paper or another substrate during the printing. More the plates, which made the notes more difficult to imitate.

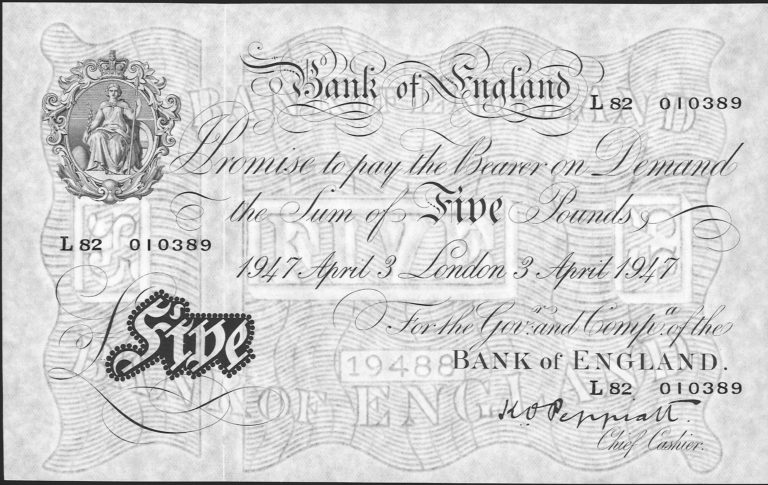

A new printed security feature – the guilloche – was introduced in the early 19th century. Then it was almost impossible to imitate the notes using the methods available and no major upgrades were needed for decades. As an extreme example, the design of the British white fiver, the £5 note, required only minor upgrades between 1809 and 1956. For an international currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More the stability of the design was a virtue.

The 5-pound note required only minor upgrades between 1809 and 1956 (211 x 133).

The measures introduced by mid-19th century were generally successful against counterfeiting until photography was invented and photographic techniques were brought into play by counterfeiters. These techniques forced a paradigm changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More in banknote security during the second half of the 19th century. Print colours, which were more difficult to imitate – like the green in US dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More notes (‘greenbacks’) or azure blue and rose in French notes – were introduced, together with special antiphotostatic inks. Furthermore, coloured fibresA banknote security feature incorporated randomly during the manufacture of the paper. The fibres can be made of silk, plastic or metal, and may be visible, invisible, or fluorescent under UV light. More and planchettes were incorporated into the paper. In addition, owing to the developments in intaglio printing, the registration of the inks became so good that it was extremely difficult to imitate the banknotes.

Over the following 100 years or so, improvements in banknote security were largely attributable to advances in printing methods and machines. No changes to prevent counterfeiting were generally needed for several decades. For example, the Swedish 100 krona banknote remained almost unchanged between 1896 and 1964. Similarly, following the standardisation of the size and design of US Federal Reserve notes in 1929, there were no significant changes until the 1990s.

Again, stability was and is an important aspect for an international currency. But there were also other long-lived designs with minor upgrades like the Argentinian 5 peso note between 1899 and 1958 or the Danish 500 krone note between 1910 and 1962.

Also, other banknote designs might have lived longer, but hyperinflation after World War I and monetary reforms after World War II led to changes. All European countries which took part in the latter war, except Great Britain and Italy, implemented a monetary reform sooner or later after the war. All these post-war monetary reforms included the substitution of the existing banknote series with a new one, if only to change the colours.

However, when there was time enough to develop a new series, many issuing authorities used the opportunity to give the new series also a fresher look which better reflected the aspirations of the time. Achievements and personalities in arts and science displaced classical and societal motifs.

When a new series with a fresher look had been introduced, many currencies again had long-lived designs. Examples are the Australian 10 dollar note with only minor design changes between 1966 and 1993, the Chilean 1,000 peso note between 1978 and 2009, the German 20 mark note between 1961 and 1991, the Finnish 5, 000 markka between 1955 and 1986, and Hungarian 100 florin note between 1947 and 1997.

The Hungarian 100 florin note needed only minor changes between 1947 and 1997 (166 x 72).

However, monetary and political reforms weren’t restricted only to the aftermath of World War II. They have been a popular reason for the introduction of a new series or an upgrade during the last half century or so.

Impacts of Political and Monetary Reforms

When considering the frequency of the issuance of a new note series or an upgrade one might be surprised by how large the role of political and monetary reforms has been.

One of the first actions of independent states is to have their new status mirrored in the major business card, the design of the currency. It takes time to establish the authority to issue the notes, and often it is first the government, then a monetary agency or authority and only finally the central bank. All these changes are reflected on the design of the notes, often only by an upgrade of the series with a text indicating the new issuer.

Besides establishing an issuing authorityThe entity authorised to issue money of legal tender in a country. Generally, the expression is synonymous with a central bank or a monetary authority. More, many new states have renamed the currency so that it better mirrors their culture. In many cases, the new name has been introduced simultaneously with the new note series, but sometimes the old colonial currency is used first. Accordingly, after the notes of a new independent state had first been nominated in the colonial currency eg. franc, the name has later been changed to ariary, dinar, dirham, ouguiya, syli or zaire. The pound has been later changed to cedi, dalasi, kwacha, naira, pa’anga or rand. All these monetary reforms have then been mirrored on the notes.

Let us look at the numbers. Currently, we have a good 150 central banks and monetary authorities which issue their own currency, not reckoning with those central banks which share a common currency or use an external currency (mainly the dollar or euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More). However, the number of central banks was still fewer than 60 before the 1950s. So, a huge number of political and monetary reforms has taken place in between, which has brought about a great number of new note series or upgrades. Table 1 describes these developments during various decades since the 1960s.

Table 1

| Decade | New issuing authorities | Other monetary or political reforms | In total |

| 1960s | 62 | 22 | 84 |

| 1970s | 54 | 27 | 81 |

| 1980s | 31 | 16 | 47 |

| 1990s | 53 | 38 | 91 |

| 2000s | 12 | 16 | 28 |

| 2010s | 5 | 8 | 13 |

| 2020s | 3 | 3 | 6 |

The high figures in the 1960s and 70s were based particularly on the birth of new independent states in Africa. Nevertheless, the highest total amount of changes occurred in the 1990s. This reflects mainly the collapses of Soviet Union and Yugoslavia and the fall of communist regimes in Eastern Europe.

Correspondingly, the large number of other monetary or political reforms in the 1990s mirrors the renaming of currencies due to high inflation eg. Yugoslavia had five monetary reforms and Angola and Brazil three. Every monetary reform meant that a new note series was issued and sometimes even a provisional series by overprinting the earlier one. Furthermore, several of the new independent states born from Soviet Union and Yugoslavia introduced first a provisional currency in a form of a coupon before establishing a more permanent solution.

The deaths of heads of state or monarchs has had no major impact on the numbers. First, not only did Elizabeth II but also some other monarchs reign for an extensive period. Second, even if there are currently a good 20 issuers which use portraits of a head of state or monarch on most or all their notes, not all of them use the current incumbents. It also takes time to design the new notes. Quick introductions of new notes have occurred mainly when the portraits of rulers like Idi Amin, Reza Pahlavi and Saddam Hussein have been replaced.

Since the 2000s the number of new issuing authorities and other monetary or political reforms have rapidly decreased. In the 2020s new notes have been issued so far by only three new issuing authorities, namely the Central Bank of Eswatini, Saudi Central Bank and Central Bank of United Arab Emirates.

Correspondingly, monetary reforms with implications for banknotes have been implemented in Sierra Leone and Venezuela, and a succession change in United Kingdom (notes featuring King Charles III have now been issued by the Bank of England).

As an interim conclusion, when comparing the issuance of new note designs during different periods, one shouldn’t forget the role of political and monetary reform, even if security has through the decades been the main reason for a new series or upgrade.

Frequency of Enhancing the Security of Banknotes

Earlier examples have shown that up to late 1980s it was not unusual that a banknote design could have a lifetime of 20−30 years or even longer. However, around the same point of time new threats were looming on the horizon – threats that would trigger an even greater paradigm shift in banknote security than the invention of photography.

As known, the new threats were caused by the launch of colour copiers in the late 1970s and the proliferation of inkjet printers and innovations in digital imaging and printing technology from the 1990s onwards. These new threats necessitated the development and incorporation of new security features into the notes, particularly optical features such as holograms, micro-optic structures and special inks, which are difficult to reproduce. Furthermore, a real paradigm shift in the thinking about banknote substrates was caused by the development of polymerA substrate used in the printing of banknotes, made of biaxially oriented polypropylene (BOPP) polymer. Polymer banknotes were first introduced in Australia and are widely used around the world. More resulting with also other innovative substrateThe physical media or support on which the image is printed, such as paper, polymer or hybrid, etc. More solutions.

The response of many issuing authorities to these new threats was to be prepared to shorten the lifetime of the notes. This new thinking was reflected in the 1993 report of the National Academy of Sciences to the US Treasury which concluded that ‘every feature should be viewed as having a finite lifetime, since the threat will continue to evolve as reprographic technology continues to advance and the social environment changes’.

One of the two strategies the Academy addressed was ‘A proactive strategy to currency design … in which new features are incorporated in anticipation of future threats, before a large increase in counterfeiting occurs. Relative to the reactive strategy, this approach employs a much lower threshold of tolerance.’ [1]

The EurosystemThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More had a similar attitude and started the preparations for the next euro series even before the launch of the euro notes in 2002. The same thinking was mirrored also in the 2011 report of the Bank of Canada describing the move to polymer banknotes: ‘because central banks usually undertake the development of a new note series only at intervals of eight years or more…’. [2]

Table 2 addresses the introduction of new note series or upgrades during the last 40 years. Included are only introductions where the main reason to change has been security – even if, as often happens, the central bank takes the opportunity to fulfil other purposes.

Accordingly, the changes described in Table 1 are excluded, even if they may have enhanced the security of the notes. Second, in this ranking of reasons security has been considered the main reason even if the change has been used to improve, for example, user requirements such as reducing the size of notes or adding features for the visually impaired.

If known, the dateThe year in which a medal or coin was minted. On a banknote, the date is usually the year in which the issuance of that banknote - not its printing or entering into circulation - was formally authorised. More for the introduction of a new series or an upgrade has been used, not the date printed on the notes. Often the dates printed on the notes refer to a decision or law, which might have been made several years before the actual introduction of the notes.

Evidently, there is the question of what differentiates a new series from an upgrade? In most cases an upgrade is easy to define. The same overall design has been retained and only one (or several) new security features have been added. Or if the design has been retained but it is printed on a new substrate. Even if the sizes of the notes have been changed, but the design retained, it is classified as an upgrade, if it has enhanced the security.

Several central banks even make the classification easy because they number or name their note series. In such cases upgrades are limited to only change of the colour of one note which has created confusion with another one or a mistake in the design or copyrightDesignates the rights of the author. Copyright is represented by the symbol ©. More issues with photographs used in the design or similar.

There are also three different issuance scenarios – all at once, in two phases or staggered. The benefit of introducing all denominations at the same time is useful for several stakeholders, eg. because machine operators are not obliged to upgrade their machines for each new denominationEach individual value in a series of banknotes or coins. More. It is also useful from the point of view of communications about the new notes.

However, this approach is more demanding if the volumes are big, and therefore many issuers do the introduction in two phases or more or less staggered. The benefit is that not being obliged to produce all notes for a certain date, they can be upgraded continuously.

In case the new series or upgrade has been issued crossing two periods in Table 2, it is included in the period when the issuance began. Furthermore, sometimes a series commemorates a certain event or person. However, if it is issued for permanent circulation in significant volumes, it is included because it has enhanced security.

Table 2

| Period | New series | Upgrades | In total |

| 1985−1994 | 84 | 55 | 139 |

| 1995−2004 | 73 | 90 | 163 |

| 2005−2014 | 76 | 68 | 144 |

| 2015−2024 | 59 | 43 | 102 |

The message of Table 2 is clear, even if the last year of the current decade is still ongoing. Introductions of new series or upgrades had its peak in the period 1995-2004 and has since then decreased in two consecutive decades. This means that the average lifetime of a note series is increasing.

Two reasons are evident. The continuous efforts of the banknote industry have increased both the durability and security of the notes. Their current level provides confidence to the issuers against the counterfeiting threats even if the reproduction technology is continuously developing. Furthermore, sustainability is a more recent reason to increase the lifetime of a note series.

Based on Table 2 it is useful to go still one step deeper to the problematics and consider the average lifespan of recent security upgrades.

Average Lifespan of Recent Security Upgrades

The lifespan of recent security upgrades of 161 issuers – including central banks, private banks (one issuing bank from each of Hong Kong, Macao, Northern Ireland and Scotland) and governments of British Crown Dependencies and Overseas Territories etc. – has been studied. From each issuer the two latest security upgrades have been considered and the longer lifespan has been selected.

For example, if an issuer last enhanced the security of their notes in 2018 and before that in 2007, the lifespan of the latter series or upgrade has been selected (ie. lifespan of 11 years). If the issuer has staggered the introduction of the new series or upgrade, the lifespan of each denomination is counted, and the average is used. Sometimes, only a few denominations, eg. the high denominations, are security upgraded, which evidently has an impact on the average lifespan of the whole series. However, the lifespan of new higher denominations or replacement of low denominations with coins because of inflation are not taken into account in the calculations. The results are presented in Figure 1.

Figure 1: The lifespan of recent security upgrades of 161 currencies.

According to most recent developments the median lifespan of a security upgrade is 13 years. Figure 1 also shows that the perceptions of issuers regarding the counterfeiting threats differ significantly from each other. There are issuing authorities which can live with a lifespan of close to 20 years between security enhancements of their banknotes. On the other hand, there are issuers which prefer to make security upgrades of their notes in less than 10 years.

Concluding Remarks

This article has addressed the reasons for issuing a new series or an upgrade.cEven if the political and monetary reforms had a major impact on the developments during the second half of the 20th century, the main reason, not surprisingly, has been the security enhancement of the notes. The constant efforts of the industry have provided good opportunities for this. The issuers can select between various substrates and use several different optically variable features to make the reproduction of the notes difficult.

Furthermore, the issuers can mix the substrates and feature portfolio and use different issuance scenarios.

Most important, however, is that the issuers base their policy on the challenges they have to address, be they security, durability, costs, environmental sustainability, business continuity, the impacts to stakeholders.

[1] https://nap.nationalacademies.org/read/2267/chapter/1#xi

[2] https://www.bankofcanada.ca/wp-content/uploads/2011/06/spencer.pdf