The ‘CashTech Forum’: building an innovative future for cash

CashEssentials today launches the CashTechThe expression was first coined by CashEssentials and is the encounter of cash and technology. It brings together innovative companies who leverage software and modern communications technology to improve cash services: access to cash; acceptance of cash; and the efficiency of the cash cycle for all stakeholders. More Forum, with the mission of promoting innovation and technology to ensure a sustainable and future-proof cashMoney in physical form such as banknotes and coins. More ecosystem, so safeguarding and improving the world’s dominant means of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More for the benefit of all: cash.

CashTech is an initiative of CashEssentials, the Paris-based transnational think tank specializing in payments and monetary systems.

CashTech is the encounter of cash and technology, bringing together innovators, start-ups, scale-ups, and incumbent organisations, who leverage technology, innovation, and creativity to facilitate access to cash, improve its acceptance, and generally improve the efficiency of the circulation of cash throughout the economy.

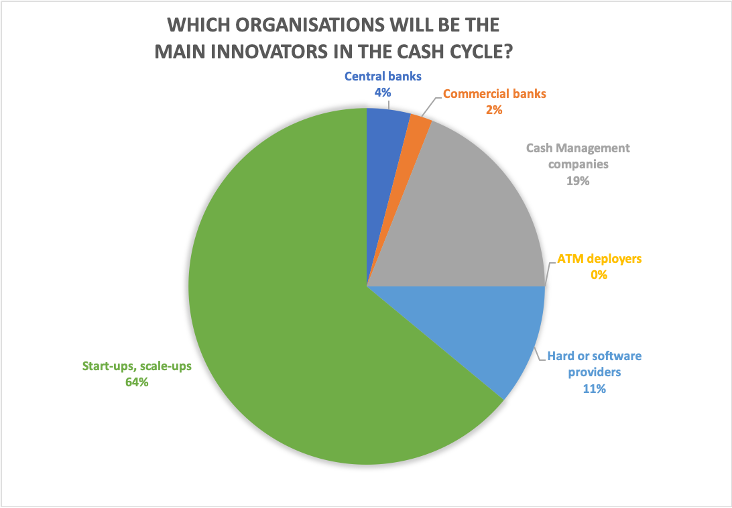

During a 2020 CashEssentials webinar, participants were invited to indicate which organisations they believed would be the main innovators in the cash cycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More. 64% responded that start-ups and scale-ups would drive innovation well ahead of cash management companiesCompanies specialized in the logistical handling of cash including several of the following operations: transportation, storage, counting and processing, packaging, replenishment and servicing of ATMs. See Cash-in-Transit. More and hard or software vendors.

Source: CashEssentials Webinar

Why CashTech?

The argument against cash runs is that digital payments have grown exponentially in the coronavirus pandemic, capping decades of sustained growth in new ways to shop and pay, ranging from contactless cards to payment apps and the recent explosion in cryptocurrencies. Cash, it is held, is under existential pressure.

But central banks have recorded exceptional spikes in cash demand during the pandemic as consumers boost their precautionary holdingsBanknote demand motivated by the store of value function of banknotes, for saving purposes or as a precaution for uncertainties. See Hoarding. More, confirming the role of cash as a crisis safe-haven. Never has there been so much cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More. And yet, public and investor interest focus more on those seeking to displace cash than innovators intent on facilitating its use.

But what if digital could be harnessed to preserve cash – instead of working to overturn it – by simplifying cash usage, shortening the cash cycle, and reducing handling costs for retailers?

CashTech seems to offer just that perspective.

CashTech means a three-way win for all consumers, retailers, and banks. Consumers get an additional high-density cash distribution network. Retailers get to offer new services, notably cash withdrawal, with the additional benefits of more cross-selling and foot traffic through the store. For commercial banks, CashTech allows them to expand their network at a minimal cost.

Who are we?

CashTech assembles a fast-growing group of transnational technology companies, mostly young start-ups, harnessing and variously adopting the technology of CashTech. Also involved is a range of supporting benefactors and professionals in academia, the corporate world, business, banking, and non-state actors like charities and non-government organizations. We are small, pragmatic, and unideological.

The founding members of the CashTech Forum are:

- Cashway, a Paris-based provider of cash services, including virtual banking agency, bill payment in cash, and cash payment for online shopping.

- Kasssh, a UK-based start-up that allows consumers to pay online purchases with cash.

- Pipit Global provides a digital platform connected with payment institutions in developing nations to accept cash payments from their diaspora.

- Shrap offers a digital alternative to coins that allows people to pay in cash and receive changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More for low-value transactions free of charge, conveniently and anonymously.

- Socash is a Singapore-based start-up building Asia’s largest distribution network for cash.

- Sonect is a Swiss company that turns every cash registerSee See-through register. More into an ATM. Thanks to the Sonect platform, cash can be withdrawn easily, largely independent of infrastructure, and therefore cost-effectively.

- Viafintech, headquartered in Germany, offers a wide range of services from cash withdrawals and deposits to cash payment options for bills and online purchases, cashless payment methods, and gift-card solutions.

An open forum

The CashTech Forum is open to all interested in further promoting innovation in the cash cycle. If you would like to contribute to shaping the future of moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More, please be in touch.

The CashTech Forum is, first and foremost, a platform allowing innovators to showcase their solutions. We also encourage discussion and exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More of best practices among start-ups to identify opportunities and hurdles and encourage cooperation.

Guillaume Lepecq, Chair of CashEssentials, said: “CashTech is an indicator of the dynamism of the cash community. It illustrates how digital can be used to preserve and enhance – not displace – cash in a pluralist payments market.”