China sees growth in cash demand

The first notes appeared under the Song Dynasty, in China between AD 960 and 1279. Today, it is estimated that around half the world’s banknotes circulate in China.

Two decades of payments innovation

In 2002, the card scheme Union Pay was launched by the leading commercial banks. The brand has experienced strong growth since and has overtaken both Visa and Mastercard, both in terms of the number of cards issued and the value of transactions. In 2017, the scheme accounted for 44% of the world’s payment cards, according to RBR.

China is also home to mobile paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More giants Alipay – owned by Ant Financial – and WeChatPay – owned by Tencent – with over one billion and 700 million users respectively. By contrast, Apple Pay has 127 million worldwide. The explosive growth of both companies is largely based on their seamless integration with eCommerce, social media and other functions into user-friendly apps.

China has also been heavily involved in crypto-currencies. According to Wired,” “China has 70 per centFraction of a currency representing the hundredth of the unit of account. More of the world’s crypto-mining capacity, and over 70 per cent of that capacity is nestled in the mountains of Sichuan, where abundant hydroelectric power makes the price per kilowatt some of the cheapest anywhere in the world.”

Banknote demand is growing in China

These revolutionary developments have led some observers to predict that China is seeing a rapid decline in cashMoney in physical form such as banknotes and coins. More demand. In January 2018, The Wall Street Journal reported “The Cashless Society Has Arrived— Only It’s in China”; in November an article in Quartz concluded “China’s cashless economy threatens to leave its elderly – and their moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More – behind”.

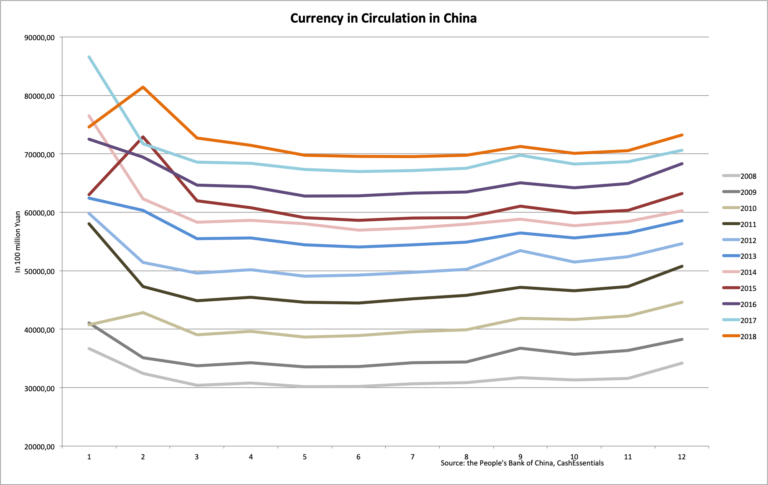

However, according to data from the People’s Bank of China, currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation is growing in China, and has been growing non-stop since 2008. Between 2008 and 2018, the value of cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More has more than doubled as illustrated by the chart below.

The number of ATMs has also been growing steadily, from 520 thousand units in 2013 to over 961 thousand in 2017, according to the Bank for International Settlements.

At a lower pace

If cash demand has been growing, the growth rate has been declining. This is largely explained by slower economic growth.

Between 2009 and 2011, currency in circulation grew faster than GDP, at double-digit rates. Since 2012, currency in circulation has been outpaced by GDP growth with the exception of 2016 when currency in circulation grew by 8% whereas GDP grew by 6.7%.

The Central Bank has been responding

The People’s bank of China has been closely monitoring developments in digital payments and has been taking measures to ensure the acceptance of cash. Over 600 merchants have been ordered to stop rejecting cash, including Alibaba’s Hema supermarket. It has also voiced its concerns following ‘cashless week’initiatives launched by mobile payments platform Alipay, during which merchants from selected cities were strongly encouraged to exclusively accept Alipay, giving participating users a chance to win financial rewards.

More recently, there have been reports that the government is planning to eliminate bitcoinBitcoin is commonly said to be a cryptocurrency, a digital means of exchange developed by a set of anonymous authors under the pseudonym of Satoshi Nakamoto, which began operating in 2009 as a community project (Wikipedia type), without the relationship or dependency of any government, state, company or body, and whose value (formed by a complicated system of mathematical algorithms and cryptography) is not supported by any central bank or authority. Bitcoins are essentially accounting entries i... More mining in the country in a sign of growing pressure on the cryptocurrency sector, on the grounds that it wasted resources or polluted the environment.