Global Developments in Coins v Banknotes

We have recently read that the US Treasury has confirmed that the production of US one centFraction of a currency representing the hundredth of the unit of account. More coins will stop once the stocks of blanks have been used up. Respectively, on the other side of the Atlantic the German National CashMoney in physical form such as banknotes and coins. More Forum advocates rounding up or down to the nearest 5 euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More cent for cash payments in Germany. It even proposes that the rounding rule (applied from the beginning in Finland), should be applied across Europe as uniformly as possible. Cash means both notes and coins. Therefore, the monitoring of both is important to the future of cash.

Another stimulus to this article are the regular updates on global demand for banknotes. The data is sometimes limited to the total value of cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More and no information is readily available on notes and coins individually. Hence, it is appropriate to dig deeper into the statistics on coins for better understanding.

This article addresses recent statistical trends of both paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More instruments from various angles. It will start with some general statistics about coins vs. notes. Thereafter, it will focus on the note/coin boundary and trends in the issuance of new coinA coin is a small, flat, round piece of metal alloy (or combination of metals) used primarily as legal tender. Issued by government, they are standardised in weight and composition and are produced at ‘mints’. More vs. note denominations. It will conclude with a study of the replacement of low-end paperSee Banknote paper. More notes on the one hand with high-value coins and the other with more durable note substrates.

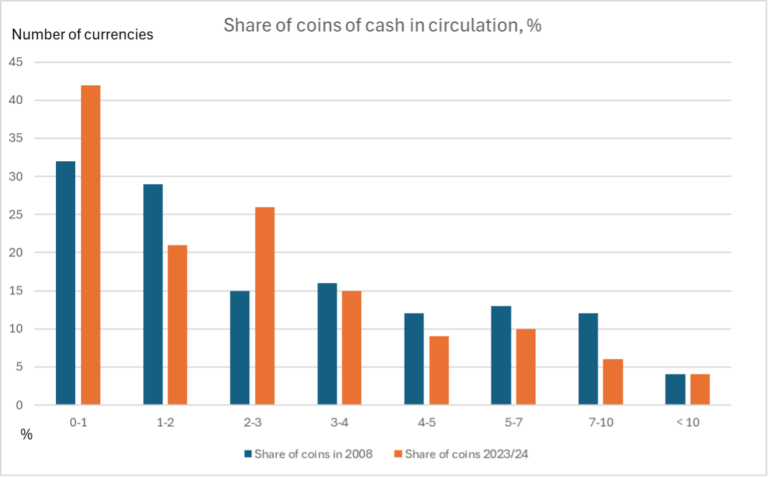

Share of coins of cash in circulation

Let us start with the share of coins of the total cash in circulation and examine how this share has developed during the last 15 years or so. This development is depicted in Figure 1. Data is compiled in 2008 and in 2023/24 (133 currencies).

According to Fig.1 the share of coins has been slightly decreasing. This means that the growth rate of the value of notes in circulation has been recently higher than that of the value of coins. This is understandable, because notes are demanded for both transactions and increasingly as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More, but coins are mostly used in small transactions or received as changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More.

There are, however, a few exceptions to this general picture. Because, particularly, low denominationEach individual value in a series of banknotes or coins. More coins are lost or hoarded by the public, they are deposited to central banks on a smaller scale than notes. This means that there is a continuous additional demand for coins even if the value of notes might decrease. Such development results in an increase in their share of cash in circulation.

Currently the share of coins is less than 2% for almost half of the 133 currencies. Many low-end coins have been withdrawn from circulation because of inflation, or because their production and distribution costs have become higher than their face valueThe figure or amount written on the banknote or coin which indicates the amount of its economic value. It is usually written in letters and numbers. More. At the same time, low-end notes have been replaced only partly with coins, because more durable substrates have been introduced increasingly to notes.

Before addressing these developments in more detail, the denominational structures of the currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More series will be studied.

Denominational structures of currency series

The denominations of a currency series affect how many units of cash are required to make any given payment. The greater the number of denominations, the fewer coins or notes will be needed.

Mathematically, the smallest number is required when the denominations follow a binary series 1, 2, 4, 8, 16 and so on, but calculations are difficult for values that do not follow the decimal system. Therefore, many countries have chosen a series that resembles the binary series as closely as possible: 1, 2, 5, 10, 20, etc.

However, it is not the only possibility and there are various traditions which may even differ between the note and coin series. For example, a series which doesn’t include any ‘2’s, (1, 5, 10, 50…) might be logistically easier to handle and store and from cost perspective more affordable, even if a greater number of pieces are needed than in a series resembling the binary series.

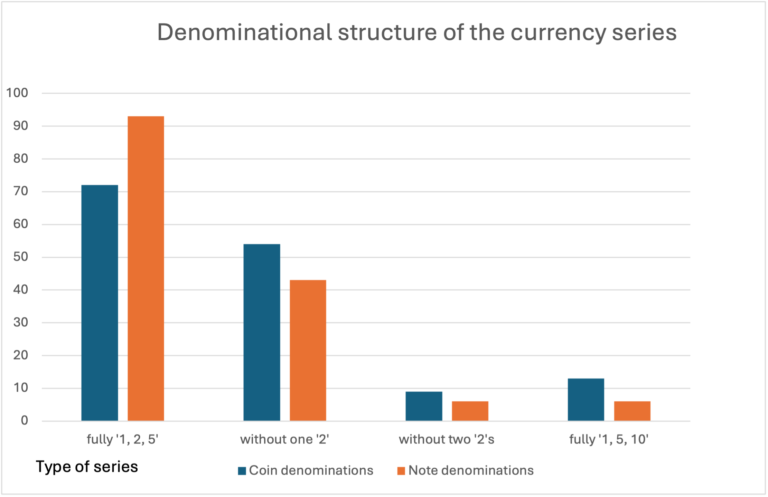

Figure 2 describes the current denominational structures of 148 currencies. Both coin and note series are divided into classes which follow 1) fully 1, 2, 5, .., or 2) mostly 1, 2, 5 … (one denomination ‘2’ is not included in the series) or 3) are closer to 1, 5, 10,.. (two ‘2’s are not included in the series) or 4) follow fully 1, 5, 10,…

According to Fig. 2 the most popular note and coin series is a series which resembles closely the binary series. Around 65% of the note series and 46% of the coin series follow fully 1, 2, 5, 10, 20 … (including currencies which include a 2.5 or 3 denomination instead of 2 etc). The main reason that there is a difference in the popularity of this currency structure between note and coin series is that in several cases the coin series doesn’t include the denomination 0.02 or 2 while including the subunit (0.01) or unit (1) of the currency.

Note/coin boundary

Another issue related to the structure of a currency series is the note/coin boundary. A widely used system to define the boundary is the so-called D-metric model, developed by Payne and Morgan in the 1980’s.[1] They studied a number of currencies and observed that the transition point between coins and notes was between D/50 and D/20, where D is the average day’s pay. Payne’s and Morgan’s study was not based on any theory but the result of their observations.

At the time of their study such durable note solutions we have today were not available. Therefore, it is not self-evident when making the same study today whether the note/coin boundary would be within the same range. However, two questions are interesting in this context – whether there is a clear transition point between coins and notes, and how often monetary authorities have replaced a low-end paper note with a high-value coin vs. a more durable note substrateThe physical media or support on which the image is printed, such as paper, polymer or hybrid, etc. More.

The first question will be studied below and the second question in a later section of this article.

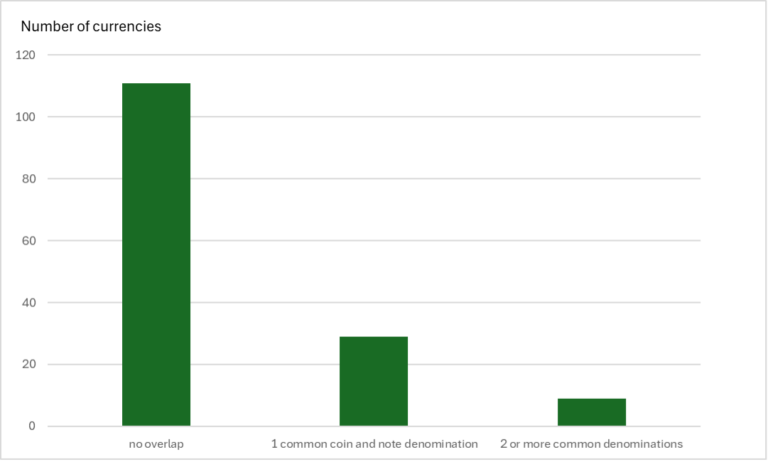

Logistically, the most appropriate solution would be a clear transition point between coins and notes, meaning that there is no overlap by the issuance of a common coin and note denomination. This is indeed the situation regarding the great majority of currencies, as depicted in Figure 3.

According to Fig. 3, more than 73% of currencies have a transition point from the highest coin denomination to the lowest note denomination. However, 38 currency authorities are issuing at least one common coin and note denomination.

Denominational coin data is not available for all currencies. Based on those currencies from which data is available, it seems that when a common coin and a note denomination exists, the note is in most cases preferred by the public. Such examples are (in brackets the starting year of issuance of a common coin and note denomination and the current share of the coin): 1 EGP (2006: < 20%), 10 HKD (1993: 16%), 10 INR (2010: 24%), 10 MDL (2018: 27%), 10 RSD (2003: 20%), 20 LKR (2021: 7%), 1 USD (1971 (base-metal $1 coin): 28%) and 50 UYY (2011: 24%).

Evidently, a common coin and note denomination might have a differing purpose. For example, in Germany before the euro cash changeover the DM5 coin was very popular in vending automate use and the DM5 note was seen less frequently in circulation.

Reasons behind the introduction of a new note or coin denomination

There are basically two reasons to introduce a new coin or note denomination: 1) an inflation correction necessitates the introduction of a higher coin and/or note denomination or 2) a new coin or note denomination inside the coin/note series is needed to make the series more effective. Of course, the objective to make the currency series more effective is also behind the inflation correction, but the root cause is inflation.

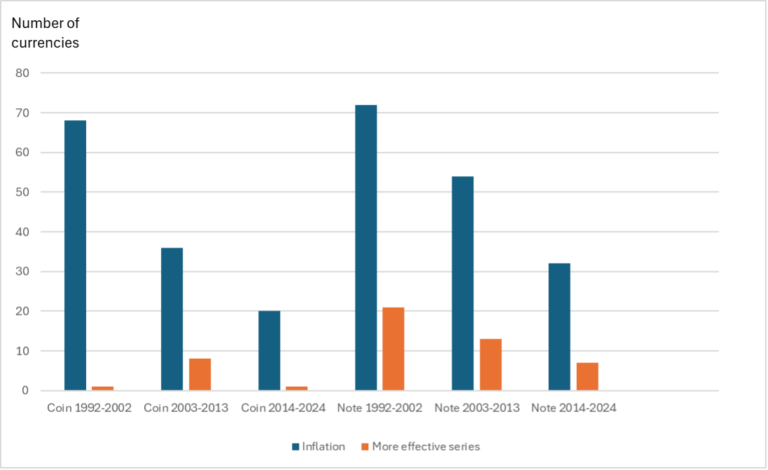

Introductions of new coin and note denominations have been classified based on these two reasons during three periods of equal length since 1992. Renewals of the entire coin and note series because of redenomination of the monetary unit have been excluded from the study. The results are illustrated in Figure 4.

The first observation regarding Fig. 4 is that introductions of new high denomination coins and notes have decreased continuously. The development can be partly explained by the inflation periods in the 1990s following the collapse of the Soviet Union and Yugoslavia and the post-collapse transitions in many countries, as well as by the hyperinflation in some developing countries.

However, this was no longer the explanation during 2003−2013, because the average inflation even increased a bitIn computers, the basic unit of digital information; contraction of BInary digiT. More during 2014−2024. Therefore, a more probable explanation is that the accelerating development of new digital payment instruments has had an impact on the need to issue new high denominations.

Secondly, in view of the fact that the study includes 148 currencies, the issuance of totally new high coin or note denomination seems to happen quite rarely. There are some extreme examples in this respect. The US$1coin has been the highest circulating dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More coin since 1794 and the Swiss 5 franc coin respectively since 1850. Similarly, the 1,000 krone note has been the highest note denomination in Norway since 1877.

The issuance of a new coin or note denomination to make a currency series more effective is even a much rarer incident than the issuance of coin or note at the high end. Only a few cases have occurred recently like the new 200 FCFA coin of the Banque des États de l’Afrique Centrale or the 200-riyal note issued by the Qatar Central Bank in 2020.

Replacement of a low-end paper note with a coin or a more durable note substrate

Traditionally, an inflation correction to the currency series meant that a new high-value note was introduced, and simultaneously the low-end note was replaced with a high-value coin. Hence, it is interesting to study what kind of impact the development of more durable note substrates has had on this tradition.

The development will be again studied during three periods of equal length – 1992−2002, 2003−2013, 2014−2024. Renewals of the entire coin and note series because of redenomination of the monetary unit are again excluded from the study.

Durable substrates include polymerA substrate used in the printing of banknotes, made of biaxially oriented polypropylene (BOPP) polymer. Polymer banknotes were first introduced in Australia and are widely used around the world. More, composites and applied protective films. The study will focus only on the low-end note, ie. the note/coin boundary. Moreover, only transitions to more durable substrates which have shown to be permanent are included. The results of the study are illustrated in Figure 5.

According to Fig. 5, the introduction of more durable substrates to replace low-end paper notes has had a gradual negative impact on the use of coins for the same purpose. There were only six issuing authorities that began to replace the low-end paper banknotes with more durable substrates during the first period.

During the next period 2003−2013 coins were still used in the majority of new decision-making situations regarding the note/coin boundary, but during 2014−2024 more than half of the issuing authorities which were confronted with the situation selected a more durable note substrate. This means that the note/coin boundary is changing no more often than it used to do in the past.

Concluding remarks

The study on recent global trends regarding coins vs. notes has led to some interesting results. It is perhaps not surprising that the share of coins of the total cash in circulation is decreasing, because notes are increasingly used also as a store of value. However, some differences between the denominational structure of coin vs. note series are of interest.

The traditions regarding the denominational structures of currency series seem to be very strong, because only in a very few cases new denominations inside the series are introduced.

Probably the result which will be followed with greatest interest is the development of the use of coins vs. more durable note substrates in replacing low-end paper notes. This, particularly in view of the increasing number of suppliers of more durable note substrates.

[1] Payne, L. C., and Morgan, H. M., “UK Currency Needs in the 1980s,” The Banker, April 1981, pp. 45-53.