Less is more: cash in Iceland

When cashMoney in physical form such as banknotes and coins. More payments drop, critics are quick to declare a country “cashless”, like in the case with Sweden. Such statements are misleading because they fail to present the subtleties of consumer paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More behavior. In fact, growth in card usage does not automatically mean that cash is less popular.

Blogger JP Koning looks at cash and card usage in Sweden versus Iceland in a recent article for BullionStar. His findings are very interesting and demonstrate that cash has other uses beyond payments, particularly as store-of-value.

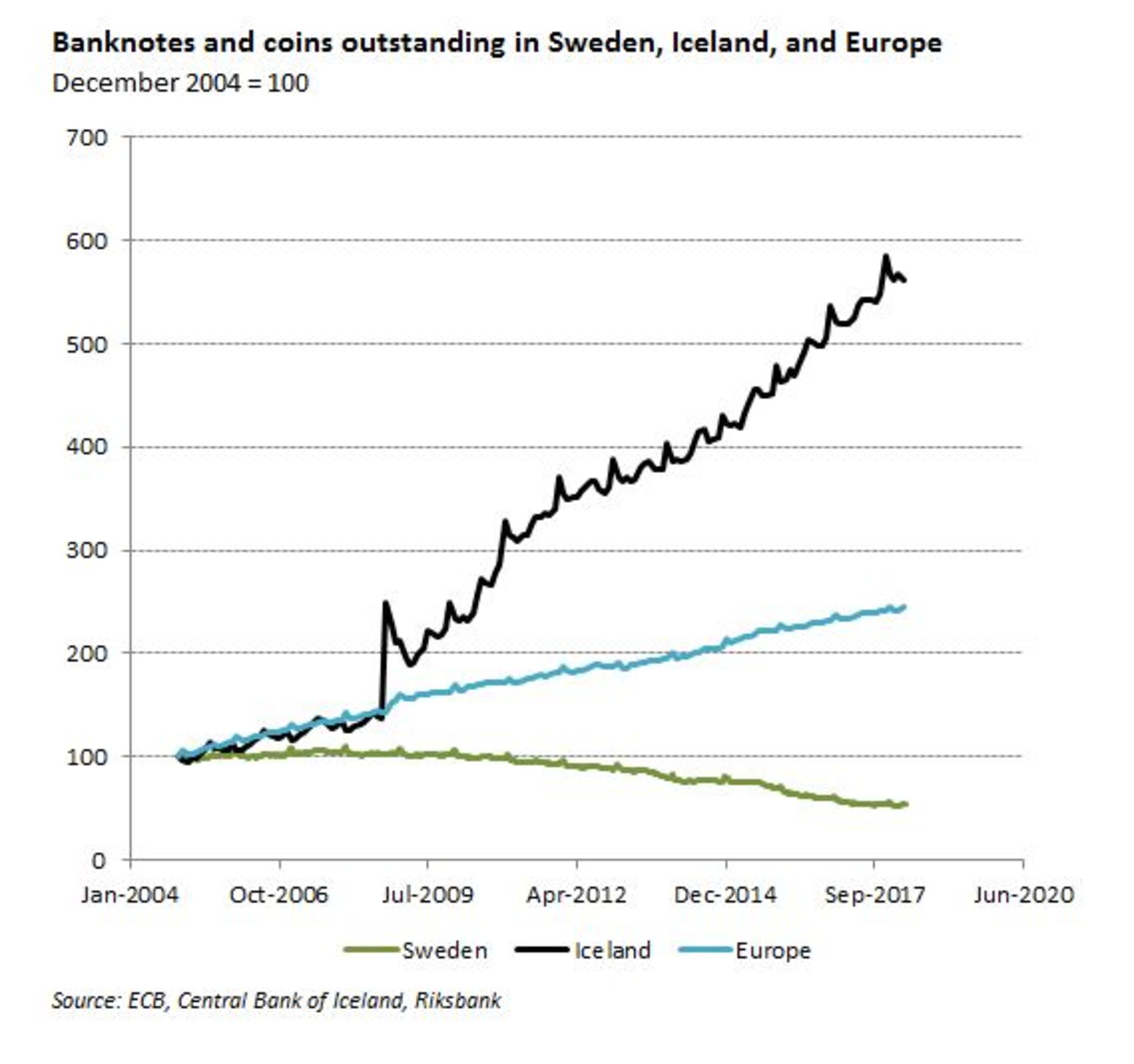

According to Koning’s numbers, cash-to-GDP ratios in Iceland were much lower than in Sweden back in 2006. Yet, since the 2008 financial crisis a massive boom in cash demand is recorded, as can be seen from the graph here below.

Iceland was one of the countries that suffered the most from the financial crisis. Three major commercial banks – Kaupthing, Glitnir and Landsbanki – who together were 10 times the country’s total GDP, went bankrupt. The inevitable consequences of their reckless behavior put this small Scandinavian nation’s economy on its knees and led to overall resent and loss of trust in financial institutions.

As a result, Icelanders quickly turned to a bank-free savings option: cash. Thanks to low interest rates and the availability of high denominations – including the 10,000 krónur which was issued in 2013 to meet demand – Icelanders have engaged in a silent protest against the financial institutions they despise.

As Koning puts it “Iceland shows that banknotes–in particular large denominationEach individual value in a series of banknotes or coins. More ones–are a universally available ultra-safe investment. It took a crisis for this to be evident”. So critics should be cautious when they look at cash only from a payments perspective, because it offers much more to consumers than simply being a shopping tool.