Nigeria’s Cashless Policy is harming micro, mini and medium enterprises

The Central Bank of Nigeria (CBN) first introduced a Cash-less Nigeria Policy in 2012 which aimed to reduce – not eliminate – the amount of physical cashMoney in physical form such as banknotes and coins. More circulating in the economy in an attempt to encourage more electronic-based transactions. This policy imposes a cash handling charge on daily cash withdrawals and deposits.

According to the new rules, withdrawals exceeding N500,000 for individual customers will face a processing fee of 3% whereas deposits will incur a 2% fee. For corporates, the fees are respectively 5% and 3% for amounts exceeding N3,000,000.

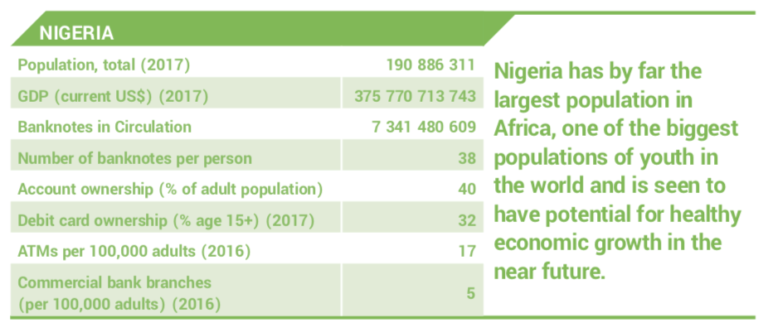

Nigeria had over 7 billion banknotes in circulation in 2017 for a population of 190 million people. However, only 40% of the population are banked.

Source: The African Cash Report

Introducing the new cash policy

Cash-less Nigeria was introduced for several reasons, including:

- To drive the development and modernisation of Nigeria’s paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More system to meet its 2020 vision goal of being among the top 20 economies.

- To reduce the cost of banking services (including cost of credit) and drive financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More by providing more efficient transaction options.

- To improve the effectiveness of monetary policy in managing inflation and driving economic growth.

Negative consequences associated with high cash usage

According to the CBN, the cash policy aims to curb the negative consequences associated with the high usage of physical cash in the economy, including:

- High cost of cashAlthough banknotes are delivered to the citizens free of charge and their use does not involve a specific fee, costs are generated during their manufacturing, storage and circulation process, which are covered by different social agents (central banks, commercial banks, retailers etc). More: There is a high cost of cash along the value chain – from the CBN and the banks, to corporations and traders.

- High risk of using cash: Cash encourages robberies and other cash-related crimes. It also can lead to financial loss in the case of fire and flooding incidents.

- High subsidy: CBN analysis showed that only 10% of daily banking transactions are above 150k, but this 10% accounts for the majority of high value transactions. This suggests that the entire banking population subsidises the costs that the minority 10% incur in terms of high cash usage.

- Informal economy: High cash usage results in a lot of moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More outside the formal economy, thus limiting the effectiveness of monetary policy in managing inflation and encouraging economic growth.

- Inefficiency & corruption: High cash usage enables corruption, leakages and money launderingThe operation of attempting to disguise a set of fraudulently or criminally obtained funds as legal, in operations undeclared to tax authorities, and therefore not subjected to taxation. Money laundering activities are strongly pursued by authorities and in most countries, there are strict rules for credit institutions to cooperate in the fight against money laundering operations, to declare and report any transactions that could be considered suspicious. More, among other fraudulent cash-related activities.

Not everyone is on board with the transition. Ben Kalu, Chairman of the Committee on Media and Public Affairs, said the House is,“Deeply worried that the implementation of the cashless policy on withdrawals has negative impacts on micro, mini, small and medium enterprises, which are clearly the engines of growth of the economy and employment generation”.

Moreover, the House was concerned that the CBN did not put people first when crafting the policy, contradicting Section 14(2)(b) of the Constitution of the Federal Republic of Nigeria, 1999 (As Altered) which highlights “the security and welfare of the people as the primary purpose of government”.