Understanding the True Costs of Payments: a Consumer Perspective

The costs of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods for consumers are difficult to determine, not recorded in a harmonised manner on an international level and consequently vary significantly from country to country. In this new and novel study, Fabio Knûmann [1], Deutsche Bundesbank, Malte Krüger, Aschaffenburg University of Applied Sciences and Franz Seitz, OTH Amberg-Weiden Technical University of Applied Sciences, have recorded financial costs, including account-related fees, ATM or payment cards fees, as well as the costs of loss or fraud. But they have also measured non-monetary costs in the form of the time and the costs of data disclosure.

In today’s world, consumers have an abundance of payment options at their disposal, ranging from cashMoney in physical form such as banknotes and coins. More to various card payments and mobile payment methods. Each of these payment instruments comes with its own set of costs and benefits, which can significantly impact consumer choices. However, not all costs are visible and obvious. We aren’t always just paying with our moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More, but also with our time – and increasingly with our data. For central banks, it is important to ensure that consumers have both cost-effective cash and non-cash payment options and thus genuine freedom of choice. Fortunately, this is the case in Germany. However, ensuring that it remains this way is not something that we can take for granted.

Examining the costs

When considering the costs of payment instruments for consumers, many might initially think of fees associated with bank accounts, cash withdrawals, or payment cards. However, households also incur costs from lost cash or payment card fraud, as well as non-monetary costs such as time spent going to an ATM, paying at the point of sale, or verifying bank statements. Additionally, with tech companies entering the payments space, business models based on the commercial use of customer data are becoming more prevalent. These companies often provide services free of charge but use customer data for personalised advertising, meaning consumers pay with their data. Our study, which surveyed households about fees incurred, financial losses, time spent, and data disclosure, provides a comprehensive picture of the costs of payment transactions from the consumer’s perspective.

Source: Costs of Cash and Card Payments from a Consumer Perspective, Fabio Knümann, Malte Krüger and Franz Seitz

Monetary costs: what are you really paying?

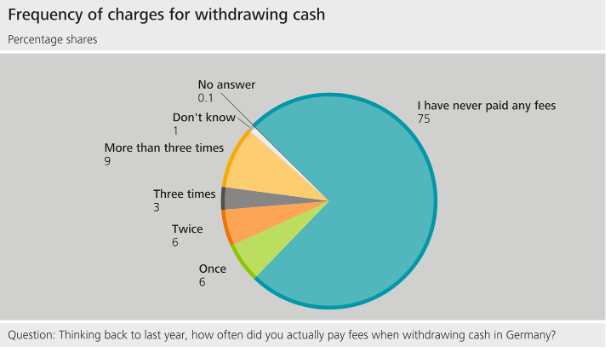

Fees are a significant component of payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More costs. Around 80% of respondents pay account management fees averaging €5 per month, applicable to all account holders. Additionally, almost all consumers in Germany have a debit card, with half also having a credit card. While most debit card fees are included in account fees, credit card fees average €2.50 per month for all credit card holders. Withdrawal fees are another cost factor to consider. One in four respondents stated that they had paid fees for withdrawing cash at least once in the past year, with the average fee for the most recent fee-incurring withdrawal being €4.60.

Financial losses can occur due to theft or fraud. We found that 7% of respondents had lost cash or had cash stolen from them over the past two years, with the average annual financial loss for those affected being around €88. For payment cards, 8% of respondents had experienced financial losses due to loss, theft, or fraud in the last two years. Looking at the amounts not reimbursed, those affected lost, on average, €33 on a yearly basis. That being said, when viewed across all individuals, such losses fortunately make up a smaller proportion of the total costs associated with cash and card payments than the role played by other cost factors.

Source: Costs of Cash and Card Payments from a ConsumerPerspective, Fabio Knümann, Malte Krüger and Franz Seitz

Hidden costs: time, privacy, and data in the modern payment landscape

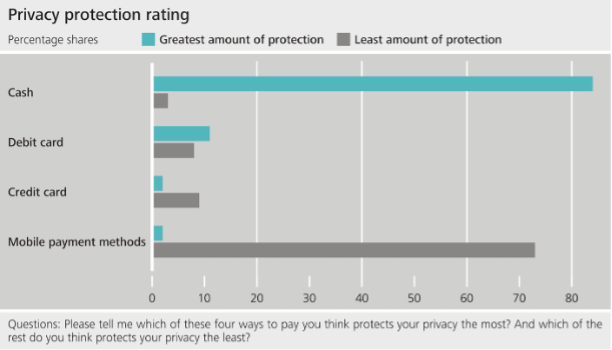

Using payment instruments involves spending time on various activities. For instance, checking bank statements takes consumers an average of 20 minutes per month. Obtaining cash takes up around 9 minutes per withdrawal, with an average of 27 withdrawals per year. These activities contribute to the overall cost of using different payment methods. Another significant non-monetary cost is data disclosure. Our study revealed that just under 85% of respondents believe cash protects their privacy the most. Around 75% think mobile payment methods offer the least privacy protection.

To assess the costs of data disclosure, we used two approaches: asking consumers how much they would pay to delete their personal data after using a debit or credit card, with 60% willing to pay at least €0.50, and examining the market value of payment data through Germany’s largest loyalty program, Payback. By averaging the costs from both approaches, we determined that the average cost of data disclosure amounts to €0.43 per card transaction.

Source: Costs of Cash and Card Payments from a ConsumerPerspective, Fabio Knümann, Malte Krüger and Franz Seitz

How much does it all add up to?

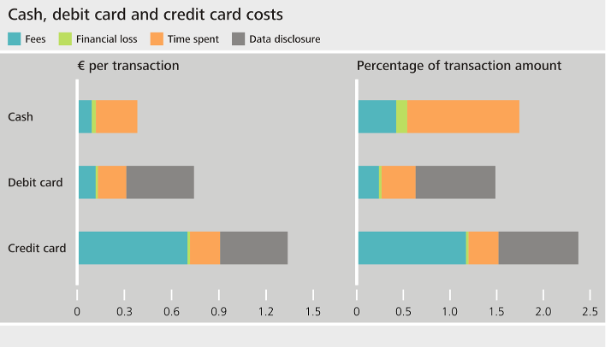

When considering the overall costs of different payment methods, it’s important to look at both the cost per transaction and the percentage of the transaction amount. This allows for a comprehensive comparison, as each payment methodSee Payment instrument. More has different transaction structures and average amounts. Cash payments cost €0.38 per transaction, or 1.74% of the transaction amount. Debit card payments are €0.74 per transaction (1.49%) and credit card payments €1.34 per transaction (2.38%). These figures present a mixed picture: cash payments are the most cost-effective per transaction, while debit cards are the most economical in relation to the transaction amount. Credit cards, however, are the most expensive option in both cases.

Source: Costs of Cash and Card Payments from a ConsumerPerspective, Fabio Knümann, Malte Krüger and Franz Seitz

How much is cash worth to consumers?

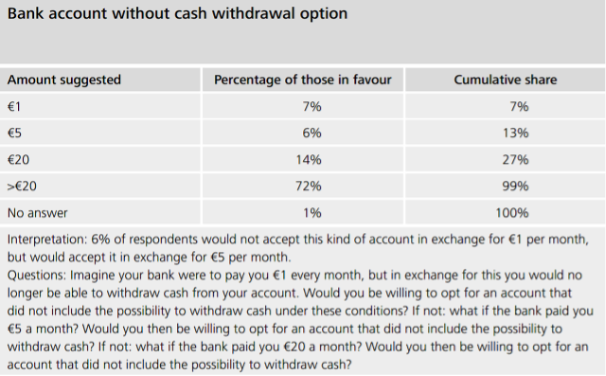

Having explored the costs, it is also important to reflect on the benefits. The significant role of cash in daily transactions raises an interesting question: how much is cash worth to consumers? To answer this, the participants were asked how much compensation it would take to get them to accept a cashless bank account. The results showed that they would need an average of nearly €25 per month. This compensation is considerably higher than the current actual account costs, which average around €5 per month.

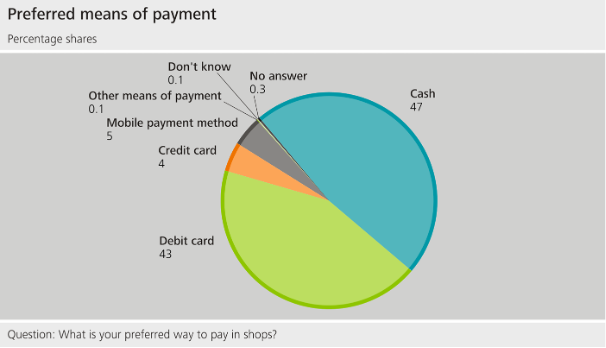

Additionally, 47% of respondents prefer to pay with cash, while 43% favour debit cards. Mobile payment methods and credit cards are less popular, with 5% and 4% of votes respectively. The high compensation required to forgo cash, along with the strong preference for cash as a payment method, underscores the importance of cash in the daily lives of German consumers.

Source: Costs of Cash and Card Payments from a Consumer Perspective, Fabio Knümann, Malte Krüger and Franz Seitz

Conclusion

There is no clear ranking of the different costs associated with payment instruments from the consumer perspective in Germany. Consumers in Germany enjoy genuine freedom of choice between affordable cash and cashless options. This is indeed good news. However, the cash infrastructure is showing signs of strain. The number of bank branches and ATMs is decreasing. While cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More options exist, they cannot fully replace traditional access and deposit facilities (which is particularly crucial for merchants). Ensuring access to and acceptance of cash in the future is essential to prevent downward spirals, and maintaining a robust cash infrastructure is vital to preserving cost-efficiency and consumer freedom of choice.

[1] Fabio Knümann is a Senior Economist in the cash department at the Deutsche Bundesbank. He is responsible for topics such as cost of payment and access to cash. The article represents the author’s personal opinions and does not necessarily reflect the views of the Deutsche Bundesbank or the EurosystemThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More. It is based on the study “Costs of Cash and Card Payments from a Consumer Perspective”, authored by Fabio Knümann (Deutsche Bundesbank), Malte Krüger (Aschaffenburg University of Applied Sciences) and Franz Seitz (OTH Amberg-Weiden Technical University of Applied Sciences).