Riksbank Governor Calls for Further Legislation to Protect Cash

Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More has been on the rise in Sweden since mid-2017 and as in many other countries there was a spike in demand in the first half of 2020. Between end of March and end of June, cashMoney in physical form such as banknotes and coins. More in circulation grew by 6%.

Source: Riksbank.

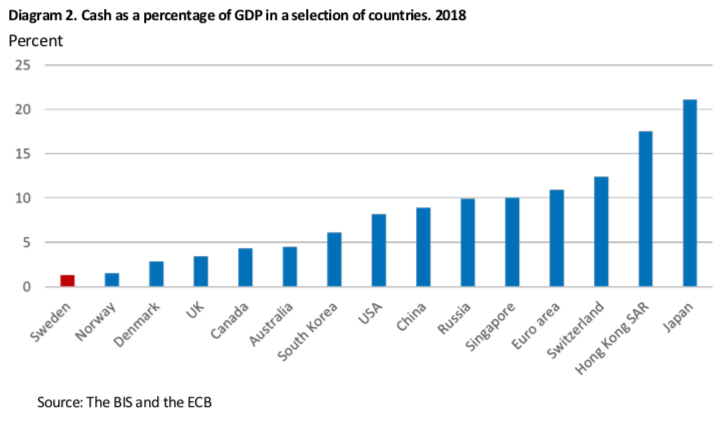

Nonetheless, Sweden remains at the bottom of the league when comparing cash in circulation to GDP.

A new law came into effect on January 1st requiring banks to provide an adequate level of cash services. The law was designed to protect the more fragile people such as the elderly, migrants, those with disabilities, the rural or those who do not have access to digital payments.

Riksbank Governor wants to do more to protect cash. In an Economic Commentary, the Governor presents a vision for the future of moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More and payments.

“Money and how we make payments are changing. Not so very long ago, cash was totally dominant. Now we have money in accounts and we make payments in the form of transfers between accounts. This development has many benefits. But if we do not adapt our money and legislation, it will also entail risks and potential losses.” says Ingves.

Cash is still needed

Cash fulfills important functions today. It offers a safeSecure container for storing money and valuables, with high resistance to breaking and entering. More alternative to commercial bank money. It works when the electrical or digital infrastructure is down. It works for those who are digitally excluded.

If cash continues to decline at the same pace as before, Sweden will in practice be a cashless society within a decade or two, predicts Ingves and this would mean that citizens would no longer have access to State to Central Bank moneyA liability of a central bank, including banknotes in circulation and banks’ deposits with the central bank. More. Consequently, the Riksbank is investigating whether it is possible, and desirable, to issue a digital complement to cash, a so-called e-krona. Just like cash, the e- krona would be issued by the Riksbank and available to the general public.

Cash needs strong legal protection

“I do not believe the Riksbank can do very much to stop the development towards a decline in the use of cash. But we should do what we can.” says Ingves.

“However, I believe that stronger legal protection for cash could slow down the decline in its use. If it were to be established by law that one was forced to accept cash in Sweden, more of us would probably choose to have cash in our wallets.” The Central Bank had proposed to the Parliament in April to establish a committee to review the concept of legal tenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More. In June 2019, the Riksdag forwarded this proposal to the Government, but unfortunately no expert group has yet been appointed.