Russia: Cash and Cash Infrastructure

CashMoney in physical form such as banknotes and coins. More in Russia: An Overview, 1994-2021

Cash remains the most used payments instrument in Russia, although the country’s currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation to GDP ratio declined in the 2010s. According to the Bank of Russia (CBR), currency in circulation grew between December 1994 and the 2008 global financial crisis, except for a few months in 1996 (see Graph 1). After an abrupt decline in early 2009, cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More continued growing, albeit slower. The growth rate of cash in circulation slowed even more after Russia invaded Crimea in 2014.

Graph 1. Russia: Currency in Circulation, December 1994-December 2021 (RUR trillions)

Note: Currency in circulation includes cash in credit institutions’ vaults and excludes cash in transit, cash in ATMs and CBR vaults, and precious metal coins in circulations. Source: CBR Monetary and Financial Statistics (Monetary Base-Broad Definition); CashEssentials.

During the early weeks of the Covid-19 pandemic, cash withdrawals rose to 1 trillion roubles (RUR), more than during all of 2019. Currency in circulation grew 6.9% in March 2020 and 5.1% in April 2020.

As of January 1, 2022, cash in circulation reached RUR14.09 trillion. There were 6.833 billion banknotes, with a value of RUR13.97 trillion, and 70.295 billion coins, with RUR118.6 billion.

Cash Infrastructure and Cash Withdrawals in Russia, 2009-2021

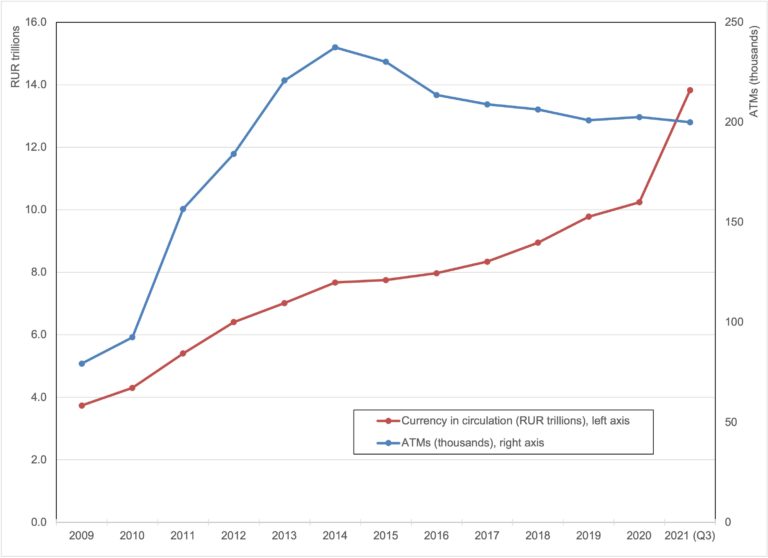

The number of ATMs in Russia overgrew between 2010 and 2014, as Graph 2 shows. Their number decreased between 2014 and 2018 and has since stabilized. About 25% of ATMs in Russia recirculate notes, offering cash withdrawal and deposits.

Graph 2. Russia: Currency in Circulation (RUR trillions) and ATMs (thousands), 2009-2021Q3

Note: Figures for 2021 exclude Q4. Source: CBR Monetary and Financial Statistics (Monetary Base-Broad Definition); CBR National PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More System Statistics (“Devices located in Russia that can be used for carrying out transactions with and without payment cards”); CashEssentials.

The volume of cash withdrawals grew at an average annual rate of 9% from 2010 to 2016, started declining in 2017, and experienced a drastic fall in 2020 due to the Covid-19 pandemic (see Graph 3). By value, cash withdrawals thrived from 2010 to 2016 (with an average annual rate of 16.6%) and grew more slowly through 2019.

Graph 3. Russia: Cash Withdrawals (value in RUR trillions, volume in billions of withdrawals), 2010-2021Q3

Note: Figures include cash withdrawals with cards issued by Russian and foreign banks. Figures for 2021 exclude Q4. Source: CBR National Payment System Statistics (“Key Indicators of the National Payment System (NPS) development”); CashEssentials.

Cash Withdrawals during the Covid-19 Pandemic

The public’s demand for cash spiked in the early days of the Covid-19 pandemic. At the time, the CBR) advised banks

- to quarantine cash and disinfect their facilities and equipment,

- to “limit cash depositing and withdrawing from (to) ATMs with recirculation […] to ensure continuous cash circulation,” and

- to “encourage their customers to choose cashless means of payment for goods and services, such as online transfers and contactless payment.”

Consumer safety watchdog Rospotrebnadzor encouraged Russians to switch to digital payments in 2020, citing World Health Organization advice, omitting the agency’s denial shortly after.

Cash withdrawals declined less by value (-1.5%) than by volume (-17.9%) in 2020. That means that although Russians were using ATMs less, they still withdrew nearly the same amount of cash as before the Covid-19 pandemic.

Russia: Western Sanctions and Cash Withdrawals

Cash withdrawals plunged in 2021, both by value and by volume. The demand for foreign and domestic cash has spiked after the invasion of Ukraine and Western sanctions against Russia.

- Daily cash withdrawals reached RUR111 billion on February 25, their highest level since the beginning of the Covid-19 pandemic.

- Massive cash withdrawals and runs on savings could trigger a banking panic and cause a financial meltdown in Russia, said Elina Ribakova, deputy chief economist for the Institute of International Finance.