Spain: Valencia Fights Depopulation by Subsidising ATMs

The regional government of the Valencian Community in Spain has increased its subsidies for the deployment of ATMs in 135 small towns without banking branches. As of January 29th, 2021, the Valencian Agency Against Depopulation (Avant) offers up to EUR15,000 yearly per ATM to banking entities and independent ATM operators, which represents an increase of EUR4,000 on the original subsidy.

Independent operators should have been active for a minimum of four years, manage networks of at least 500 ATMs, and be registered with Banco de España, the Spanish central bank. The Generalitat also homologated ATMs’ technical requirements to current industry standards and substituted the need to provide a minimum of 50 hours per year of in-person assistance with remote videoconferences.

The government had initially launched the subsidies program on March 3rd, 2020, a week before the beginning of Covid-19 lockdowns. The original call for applications offered subsidies of up to EUR11,000 yearly per rural ATM. After no Spanish bank applied to receive grants to install rural ATMs in the Valencian community during the pandemic, the Generalitat voided the program in July 2020.

Access to CashMoney in physical form such as banknotes and coins. More in Rural Areas is Critical to Fighting Depopulation

Territorial depopulation has been a constant problem in Spain and Western Europe for decades. From 2001 to 2018, 63% of Spanish municipalities lost population, and 48% of municipalities lost between 10% and 50% of their total inhabitants. In March 2019, the Generalitat passed an act to protect universal access to public services and infrastructure. As of September 2019, 215 out of 452 municipalities in the Valencia region had less than 1,000 inhabitants.

Ximo Puig, President of the Valencian Generalitat, has said that fighting against depopulation and financial exclusion in rural communities is a priority of his administration, as “There cannot be a ‘territorial gap’ that marks the existence of first and second class citizens.” According to the president of the Castellón deputation, José Martí, increasing the availability of ATMs in rural areas is a crucial policy for “overcoming the financial gap[, which] is essential for inland populations, who need an expansion and improvement in the catalogue of existing [financial] services to make people’s lives easier, promote local entrepreneurship and attract possible investments that help increase the number of population.” Avant’s director Jeanette Segarra has said that preserving financial services is critical to prevent depopulation in small and rural communities and that rural ATMs help small business owners, the elderly, the ill, and people with limited mobility.

Subsidising the Cash CycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More

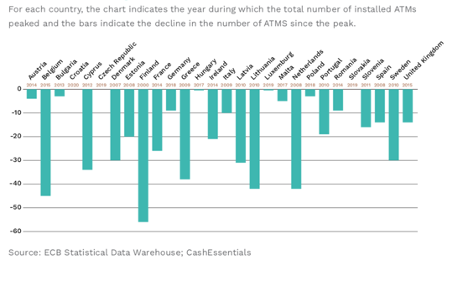

Bank desertification in rural communities is widespread throughout Western Europe as most countries are seeing a reduction of the network of bank branches and ATMs (see Graph 1). In Finland, the number of ATMs has been halved since 2000, whereas in Spain, ATM numbers peaked in 2008 and have declined by around 15% since.

In several countries, the public sector – at a national or local level – is now contributing to finance the cash infrastructure. In 2019, the Banque de France launched an initiative to ensure equal access to cash throughout the French territory. Brink’s France launched a new ATM solution in 2019 whereby it installs and operates an ATM and charges a fee to the municipality. The cost is estimated at EUR1,500 per month but can be lower depending on the number of withdrawals.

In December 2019, the British ATM network LINK launched a Community Access to Cash Delivery Fund to promote financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More by installing ATMs in small and rural communities. Early in 2020, a new law came into effect in Sweden requiring banks to provide adequate cash services to rural users, the elderly, migrants, and people with disabilities, among others. Nina Wenning, the CEO of Bankomat, the Swedish interbank ATM network, has called for the central bank to further subsidise the cash cycle by compensating retailers for collecting cash or installing secure cash-handling equipment.

In February 2019, the Xunta government of the autonomous community of Galicia and the Federation of Municipalities and Provinces of Galicia (FEGAMP) signed an agreement to subsidise the installation of ATMs in municipalities lacking financial services. According to the Spanish National Institute of Statistics, as of December 31, 2019, 42 municipalities in Galicia (13% of the total) did not have a banking or financial entity. The province of Ourense has the most municipalities with no financial services (26), followed by A Coruña (10), Lugo (4), and Pontevedra (2 municipalities).