“The Future of CashMoney in physical form such as banknotes and coins. More: An Asian Perspective ”, a new report by AGIS Consulting, provides unique analysis of a diverse group of Asian countries—, Hong Kong, Indonesia the Philippines, Singapore, South Korea, and Thailand—this paperSee Banknote paper. More looks at the complex ecosystem of stakeholders involved in the issuing and circulation of cash across these growing societies. The report finds that innovation and cooperation between the private actors and public authorities are fuelling the circulation of cash in a continent that will soon be the epicentre of the world economy.

Asia is the continent of records

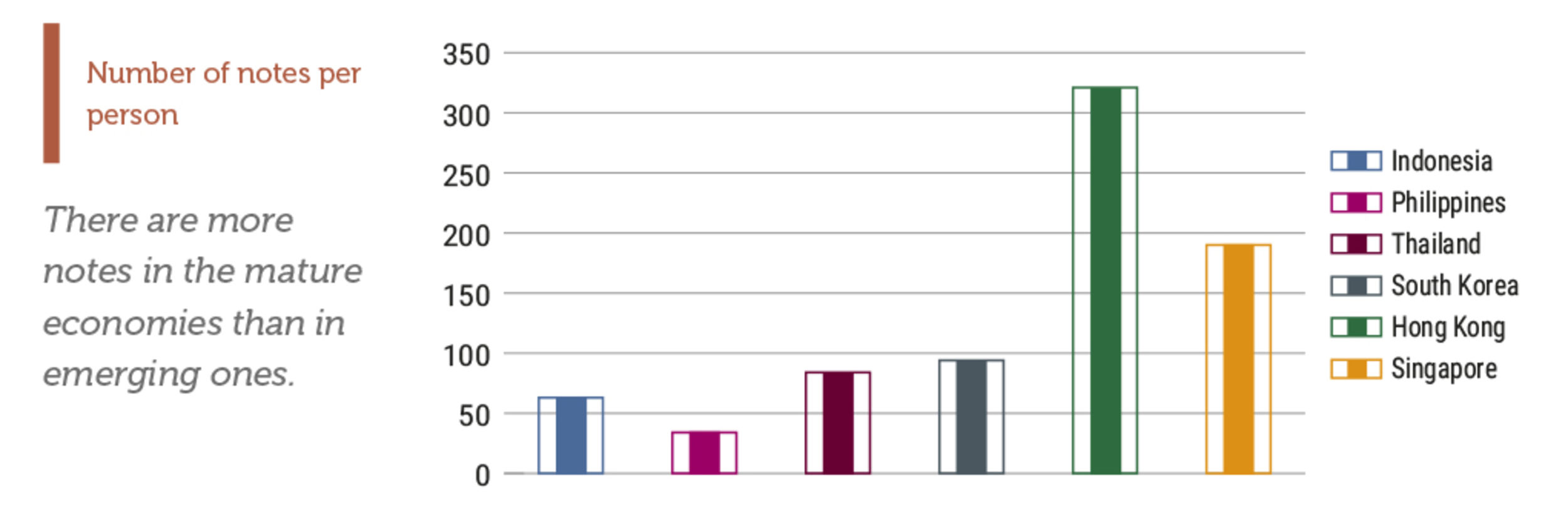

In the land where coins and banknotes were born, the six countries cited in the report live up to the continent’s reputation as an innovator in currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More. Hong Kong has the highest number of banknotes per person. Indonesia is home to the largest banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More printing factory. The Philippines use a unique banknote paperThe most widely used banknote substrate throughout history, usually made from cotton, of short fibres, which give a banknote special characteristics of touch, sound and firmness. It can include other fibres of different origins. More which combines cotton and abaca a local plant. “Asia is at the forefront of innovation in payments,” says the report’s author Guillaume Lepecq of AGIS Consulting. “New mobile paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More systems, as well as alternative financial service providers, are extending the reach of finance to previously underserved populations, making delivery of cash more efficient and driving financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More and development.” Given the sheer size of Asian markets and their sustained growth, the future of cash will be determined by Asia.

Accounting for over three-quarters of the world’s banknotes, its growing economies offer fresh insight into how factors like GDP growth, interest rates and cultural traditions influence the presence of banknotes among populations.

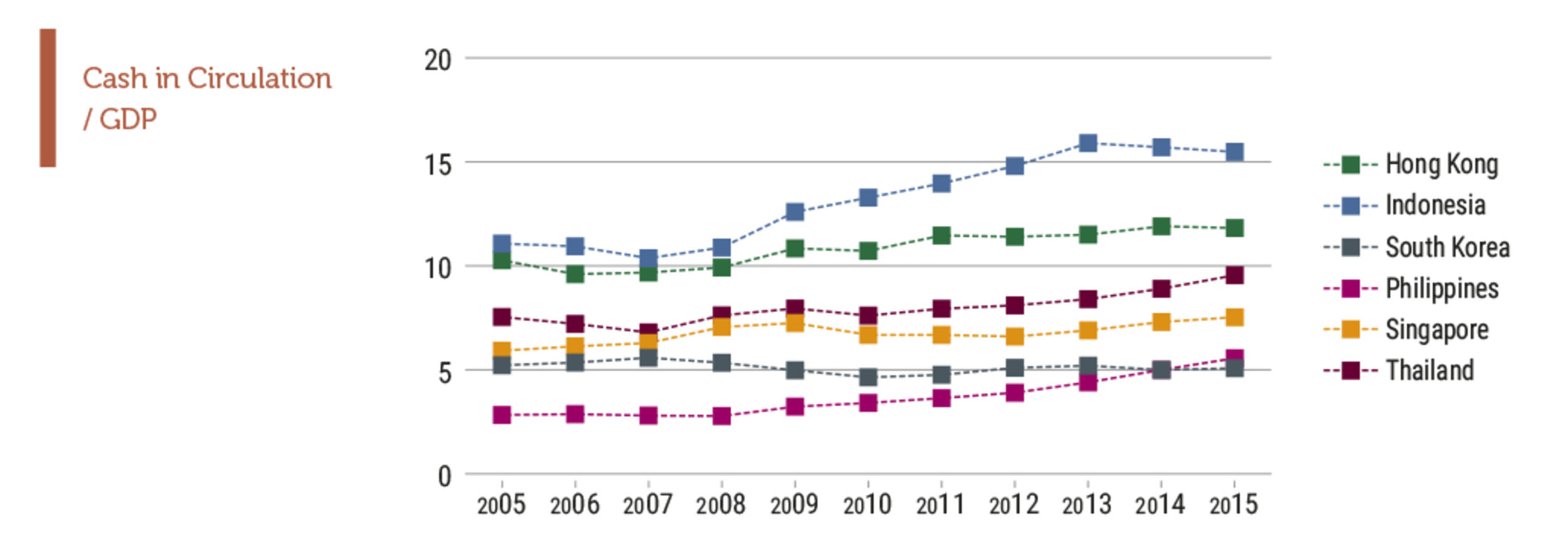

Of the six countries under the microscope, those with a dense banking structure boasting a highly-banked population—Hong Kong, South Korea and Singapore—are more cash intensive, measured both in terms of the value of cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More in relation to GDP and by the number of banknotes per person. Cash demand in the other three countries whose economies are still emerging—Indonesia, the Philippines and Thailand—has been driven primarily by economic growth and financial inclusion.

Drivers of Cash Growth: Low interest rates, GDP, festive demand, contingency and international travel

Over the past decade, the reduction in the opportunity cost of holding cash, triggered by low interest rates, contributed to increase cash circulation. A linear relation between GDP and cash in circulation is observable in an area where economic growth has been particularly pronounced. The tradition of giving cash on festive occasions and the need for a reliable means of exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More during catastrophes or humanitarian crises make cash more desirable for local populations. For international visitors to the region, whose numbers continue to grow, cash is more trustworthy than cards and electronic systems, and provides transparency regarding poor exchange rates.

All six countries experienced growth in cash demand between 2004 and 2015. Excluding Indonesia, each country saw an increase in the ratio of cash-in-circulation to GDP. The study also finds that the sophistication of the payments market does little to deter a population from using cash. For instance, Hong Kong, Singapore and South Korea all have amongst the most advanced payments markets in the world, in terms of penetration of bank accounts and debit cards, and of new technology. Yet, their CIC/GDP ratios remain relatively high. As purchasing power continues to increase, cash will endure as king for these countries’ businesses and consumers.