The Future of Money: from Globalisation to Sovereignty?

During the last decade, moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More has experienced a huge wave of globalisation, mirroring the overall globalisation of the economy. This is true for both cashMoney in physical form such as banknotes and coins. More and digital payments.

According to the Federal Reserve Bank of Chicago, nearly 80% of $100 —and more than 60% of all US bills — are held overseas, up from roughly 40% in 2010.

Source: Ruth Judson, 2017, “The death of cash? Not so fast: Demand for U.S. currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More at home and abroad, 1990-2016.”

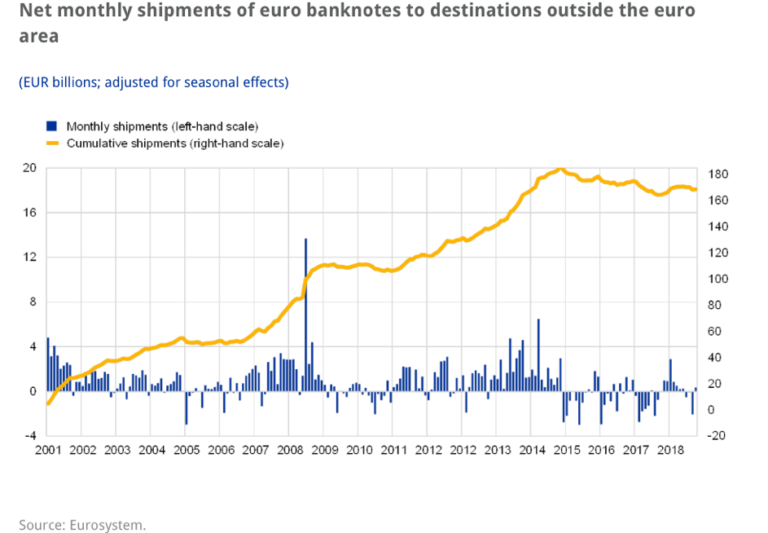

In the case of the euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More, net monthly shipments of euro banknotes outside the euro area have risen by almost 50% from around €115 billion in 2010 to €170 billion in 2018. This amounts to 14% of the value of euro banknotes in circulation. However, the European Central Bank estimates that between 20% and 25% of the value of euro banknotes are held outside the euro area, as the figures do not take into account other informal channels such as tourism or remittancesMoney sent home from emigrants working abroad. More by migrants.

An unprecedented wave of consolidation has led to the creation of global payments giants

But the trend has been even more spectacular in the payments industry, where an unprecedented wave of consolidation has led to the creation of global giants. In January 2019, US paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More processor Fiserv agreed to acquire First Data for $22 billion. Two months later, UK-based Worldpay sold itself to its US competitor FIS for $34 billion. In May, Global Payments agreed to a $21.5 billion merger with TSYS. In January 2020, Worldline acquired Ingenico for €5 billion.

The last decade also saw the arrival of the GAFAs and the BATX into the payments arena. ApplePay was launched in 2014. Google wallet kicked off in 2011. In 2018, Facebook announced the launch of its digital currency Libra in 2020. AliPay and WeChat Pay were licensed respectively in 2010 and 2011. All of these payment services have benefited from the international reach of their parent companies. AliPay for instance has been expanding rapidly outside of China, targeting markets frequented by big-spending Chinese tourists. It is currently accepted in 54 countries.

Is the tide shifting?

Will this wave of globalisation continue in the next decade? Or will the industry be impacted by the rise of protectionism throughout the globe? Here are some early signals of how the tide may shift.

In recent years, several countries including Russia, India and China have either developed national payments networks or lent government support to local payment groups. China and India have fully nationalised their payments systems.

In November 2019, 20 European banks started planning the launch of a Pan-European Payment System to challenge the dominance of Visa and MasterCard in Europe and counterAutomatic device for the counting of banknotes or coins. More Big Tech firms. One participating banker was quoted as saying “European payments sovereignty does not exist.” The move has been supported by the ECB and Benoît Cœuré member of the ECB board, said: “The EurosystemThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More welcomes the strategic initiative of a number of major European banks to create a true pan-European retail payment solution that has the potential to meet the vision of our strategy”.

In December 2019, the West African Monetary Union has agreed to reform the monetary agreements it had with France and rebrand the CFA Franc Eco. Beyond the symbolic changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More of name, two key decisions were taken: members will no longer be required to hold reserves with the French central bank and France will no longer be represented on the Board of the new monetary authoritySee Central Bank More. Other countries in the region could be tempted to join the Eco. West African nations such as Nigeria and Ghana have, for decades, been in talks with the West African Monetary Union about creating their own currency to promote regional trade and investment.

In May 2018, the Swedish government distributed a public information leaflet to the entire population explaining what measures to take in the event of a war or a cyber-attack. The pamphlet concludes that each individual should have enough cash stashed away, preferably in small denominations.

“This idea of finding a way to have national control on certain kinds of payments is not new — it’s a fantasy that’s been going on for a long time.” Ajay Banga

Ajay Banga the CEO of MasterCard sees governments shifting towards nationalization of payment systems. According to the Financial Times, he fears consumers, wary of their privacy, could shift back towards cash. MasterCard has thrived under the era of globalization; it reported revenue of $17 billion in 2019, three times the level of a decade ago. Banga says: “Global companies [could] get disallowed from working in a bunch of big markets around the world because these markets begin to say ‘I don’t want you around’. It gets exacerbated in days of populism and nationalism that we’re going through.”

Arguably, the most striking evidence of the return of monetary sovereignty occurred when Facebook unveiled plans for the launch of its Libra digital currency in July 2019. The announcement triggered a spate of reactions from central banks, policy makers and regulators worldwide. French finance minister Bruno Le Maire and then President of the G7 Group of Finance Ministers said that he would block the development of Libra on European soilSee Soiling. More as it poses a threat to “monetary sovereignty”. Mu Changchun, Deputy Director of China’s central bank’s payments department suggested that monetary sovereignty and legal currency status were under threat from Facebook’s proposals. In reaction, the PBOC has accelerated its plans to launch its own digital currency. Several of the initial backers of Libra including Visa, MasterCard, PayPal, Stripe and Vodafone have since abandoned the project.