The Surprising Evolution of Cash Demand in 2020

The ECB publishes statistics on a monthly basis and the latest available figures are from February 2020; Chart 1 shows the evolution of the value of banknotes in circulation between December 2010 and February 2020.

Chart 1. Evolution of Value of Banknotes in Circulation

Source ECB

Throughout the last decade, cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More has experienced continued growth at a Compound Annual Growth Rate of 4.41%. The €500 denominationEach individual value in a series of banknotes or coins. More has been declining since 2016, when the ECB announced that it would no longer be issued. All other denominations experienced growth.

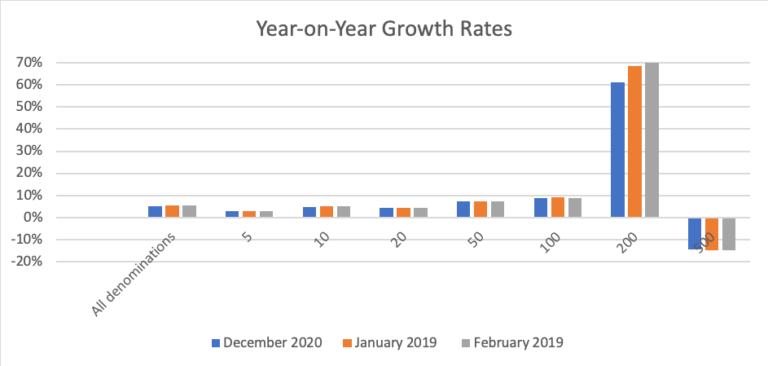

Chart 2 shows the year-on-year growth rates of banknotes in circulation between December 2019 and February 2020, broken down by denomination.

Chart 2: Year-on-year growth rates of banknotes in circulation

Chart 2: Year-on-year growth rates of banknotes in circulation

Source: ECB

2019: year of the €200

The growth of cashMoney in physical form such as banknotes and coins. More in circulation has accelerated in the first months of 2020, from 5% in December to 5.61 in February. This is true for all denominations with the exception of the €500, which is no longer issued, and the €100, which has been stable. 2019 has clearly been the year of the €200 which grew by 61.4%.

The impact of the pandemic will likely kick in from March onwards. The outbreak was identified as a pandemic on 11 March 2020. But there are some early signs of the impact on the demand for cash.

France and the UK are seeing ATM withdrawals drop

The Banque de France reported that ATM withdrawals declined by 30 to 50% depending on the region and explains that this is the logical consequence of the confinement. In The UK, the Guardian reports that cash usage has been halved within days as shops close. The ATM network operator Link stated on 24 March that “As expected, consumers’ ATM and cash use has fallen significantly, (by around 50%) over the past few days and this is likely to continue as people move to follow the Prime Minister’s instructions to stay at home.”

Germany and the US are storing more cash

In Germany on the other hand, cash withdrawals more than doubled, according to the Financial Times. As in other countries, Germany has seen a boost in contactless payments even though the Bundesbank was amongst the first central banks to ensure that banknotes and coins do not pose a particular risk of infection for the public. However for the FT, Germans worry that they could lose access to their moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More because of the social lockdowns and financial turmoil stemming from the pandemic.

In the US, Consumers are rushing to ATMs in response to the pandemic, according to a survey by MagnifyMoney. The report found 28% of Americans stored cash as economic uncertainty mounts. Younger Americans, those with larger household incomes and parents with children under the age of 18 were all more likely to withdraw cash. Those who have stored cash said they were primarily motivated by three factors: the possibility of banks shutting down ; the convenience of having cash during emergencies; the desire to ensure access to funds. NPR confirms that banks are seeing more cash withdrawals and cites Jelena McWilliams, chairman of the Federal Deposit Insurance Corp., which safeguards bank accounts: “Forget the mattress. Forget hoardingThe term refers to the use of cash as a store of value. However, the term has a negative connotation of concealment, and is often used in the context of the war on cash. See Precautionary Holdings. More cash. Your money is the safest at the bank.” The New York Times reports that large-denomination bills were in such high demand that at least one Bank of America branch wasn’t able to satisfy some customers taking out tens of thousands of dollars at a time.

It is far too early to measure the impact of this crisis on cash demand and whether there will be long-lasting effects. But these early signs indicate that we will likely see radical changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More ahaead.