Time to reinvent the ATM

In 2009, Paul Volcker, former Chairman of the Federal Reserve, berating a banking industry that had taken finance to the brink of disaster, quipped that “the ATM has been the only useful innovation in banking for the past 20 years”. Whether the ATM is the only useful innovation may be open to debate, but it has undoubtedly been a successful one.

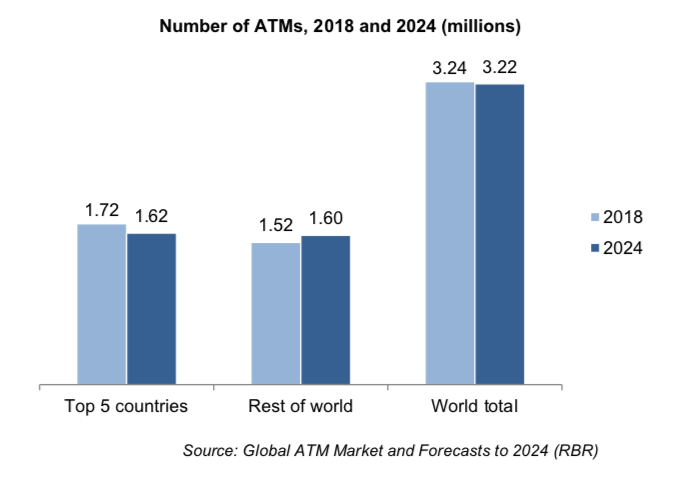

Since the first ATM appeared in 1967, the number of installed units has grown to 3.24 million in 2018. In 2017, market research company Global Insights forecasted that the installed base would exceed 4 million units in 2024. However, in May 2019, Retail Banking Research announced that the number of ATMs fell by 1% in 2018 and forecasted that the numbers will continue to fall to 3.22 million in 2024.

This modest decline should not be interpreted as a sign of slackening demand for banknotes. The evolution is not homogeneous and while some countries may have seen numbers fall, others are experiencing growth. China is the country which apparently experienced the strongest decline with a drop of 50,000 units, though other sources report that there are over 1 million ATMs in the country.

In any event, excluding China, the number of ATMs would be growing globally. And according to Retail Banking Research, in the 110 largest markets, only 37 saw a fall in the number of ATMs; in the majority of countries, the number of ATMs continues to increase.

There are also structural reasons why ATM numbers are decreasing, which are totally disconnected from cashMoney in physical form such as banknotes and coins. More demand.

The first is the rationalization of ATM networks through interoperability. If users have access – at a reasonable cost – to all ATMs regardless of their bank, then there is no longer a need for each bank to install machines in the same location. The next steps in this rationalization process has been the pooling of networks and in some countries the establishment of ATM utilities. The jury is still out on whether such developments will have a long-term negative impact on access to cash, should, for example, rationalisation result in busy ATMs being removed simply to reduce estate operating costs.

The second factor is the downward pressure of ATM interchange fees. Each time a consumer uses an ATM that does not belong to the bank that issued their card ,a fee is paid by the bank to the ATM operator – another bank or non-bank operator. In the case where the ATM is operated by the issuing bank, no fee is paid – this is an ‘on-us’ transaction. As ATM estates have grown, the share of ‘on-us’ transactions has declined and overall interchange fees paid by issuing banks have increased. In several cases, this has led to issuing banks forcing reductions in the value of interchange fees per transaction, which inevitably threatens the viability of ATMs. Over 1,700 ATMs across India were shut down between May and November 2017, due to declining interchange fees as well as revised security-related regulations which increase the cost of operating ATMs. A similar situation has developed in the UK, where reduction in interchange payments has been a factor in an almost 10% decline in the size of the national ATM estate over the last 18 months or so.

A third reason which is more specific to mature markets is the closure of bank branches, driven by substantial investments in digital banking as well as increasing real estate and staffing costs. In the UK, rampant bank closures during the past 30 years saw half the branches close, from 20,583 in 1988 to 9,690 in 2017, according to the Parliament Treasury Select Committee, leaving many towns without banks. As the branches, close, so do the ATMs.

If the drop in ATM numbers is not driven by less demand for cash, it does not mean that it doesn’t matter. It does, as less ATMs means less access to cash and this has been highlighted in several countries where there have been reviews of the public’s access to cash: notably, Sweden, the UK, France, Spain and the Netherlands.

One timely initiative that may contribute to giving new momentum to the ATM is the ATM Industry Association (ATMIA) Initiative for the NextGeneration API model for ATMs. A consortium, including more than 250 companies from around the globe, is participating in the development of the next-gen model, according to a press release by the ATM Industry Association. “The Consortium for Next-Generation ATMs has carried out and completed the largest future-proofing exercise undertaken by the ATM industry in living memory,” says Mike Lee, ATMIA CEO

The Next Gen Project should see, over the next few years, the introduction of Smart ATMs around the planet, with enhanced transaction sets which allow the machines to replace the services previously offered by now lost bank branches. The Next Generation of ATMs can become community financial services touch-points, serving the local needs of the public and businesses everywhere, helping to ensure that universal financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More becomes a reality.