U.K.: Payment Instruments and Inflation

Credit Card Debt Grew in July at Fastest Rate in 17 Years

As recession looms and inflation reaches 10%, British consumers borrow more on credit cards to maintain their living standards.

- According to the Bank of England, Brits borrowed an additional ₤4 billion in consumer credit in July, of which ₤700 million was new lending on credit cards (see Graph 1).

- Credit card borrowing grew 13% year-on-year, the fastest rate since October 2005. The effective interest rate of credit cards was 57% in July, two basis points above its February 2020 level.

Graph 1. United Kingdom: Consumer Credit (Credit Card Debt; Other Loans and Advances), July 2017-July 2021

Source: Bank of England (2022).

The data “suggests that consumers are already battening down the hatches against what will almost certainly be an exceptionally tough winter,” said Thomas Pugh, an economist at the consulting firm RSM U.K. The situation is expected to deteriorate further with the increase in gas and electricity bills.

While banks earn revenue whenever customers use their credit cards, most fees go to Visa and Mastercard. Credit card issuers’ revenue comes mainly from cardholders paying lots of interest.

The Credit Debt Trap

According to the debt charity StepChange, the share of new clients citing the cost-of-living crisis as their reason for debt rose to 20% in July 2022, 2% higher than in June. More than two-thirds reported having substantial credit card debts.

In a 2020 study, Merle van den Akker, Neil Stewart, and Andrea Isoni (Warwick Business School) found that people with contactless cards spent “significantly more” than those without, drawing on a dataset of over 300 million transactions of 260,000 customers. The authors found that contactless spenders were likelier to make more purchases overall and be charged overdraft fees. Contactless payments promote “increased spending; decreased cashMoney in physical form such as banknotes and coins. More usage and increased use of debt,” they wrote.

BNPL and Pawnbroking on the Rise

Some consumers are resorting to “buy now, pay later” (BNPL) financing schemes such as Zilch to spread payments on electricity and gas bills. Britons spent at least ₤2.7 billion in BNPL debt in 2020, according to the Financial Conduct Authority (FCA).

Many customers are unsure whether BNPL is debt and have difficulties tracking their balances across providers. Borrowing to pay for essentials through BNPL “can be like quicksand – easy to slip into and very difficult to get out of,” said Matthew Upton, director of policy at Citizens Advice.

Brits are also pawning valuables. “With everyday costs soaring, it’s no surprise to hear more people are using pawnbrokers. But you shouldn’t need to put your wedding ring or a family heirloom at risk to pay an unexpected expense,” said Theodora Hadjimichael, CEO of Responsible Finance.

Cash (and #CashStuffing) to the Rescue

Many U.K. consumers have stopped using cards and contactless payments and switched to cash for controling expenses.

- “We’re seeing more and more people increasingly reliant on cash as the tried-and-tested way to manage a budget,” said Martin Kearsley, banking director at the U.K. Post Office.

- “The main reason people will tell you they use cash is for budgeting: you can see it, you can feel it. With the cost of living crisis, more people are strapped for cash so it shouldn’t be a surprise that people are going back to using cash, withdrawing moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More to get through the week safely without getting overdrawn. […] Consumers can’t afford to go overdrawn – this is about necessity,” said Natalie Ceeney, chair of the Cash Action Group.

The Budget Mum UK

A year ago, buying Starbucks coffee with contactless cards was “just tapping. It didn’t feel like real money, it was just my card. When you’re physically handing over solid money, it just makes you think twice,” said Samantha Thomas, a 41-year-old private tutor from Wigan.

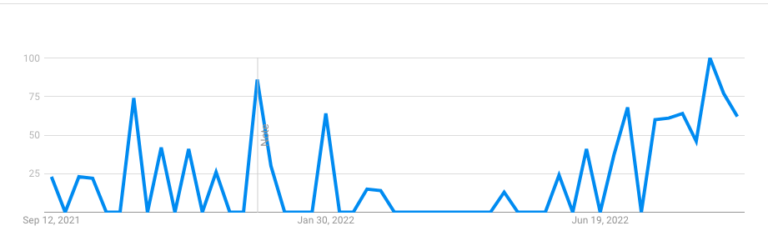

On her YouTube channel, Thomas shows how to budget with “cash stuffing,” a budgeting technique that has drawn increasing attention online (see Graph 2). She separates funds in labeled envelopes for groceries, travel, credit card debt, and emergencies. Ms. Thomas withdraws her wage at the start of the month.

Graph 2. United Kingdom: Google Searches for Cash Stuffing, September 2021-September 2022

Source: Google Trends (2022).

Leaving debit and credit cards at home has helped Ms. Thomas prepare for rising costs. “I feel like I’m ahead of the game, I feel like I’ve got an advantage. It’s definitely going to be tricky, but I feel like I’ve already got lots of tools in place to help me. I feel like it’s going to be a big hurdle,” said Ms. Thomas.

OxMail Studios

Jade Edmonson sells cash-stuffing materials on her Etsy page. Edmondson, a 29-year-old teaching assistant from Coventry, uses 30 envelopes for gas, Christmas savings, and club memberships.

Cash stuffing helped Ms. Edmondson save money for her children’s return to school. “If this was me last year, I would be panicking: ‘How am I going to pay for all of this? Whereas actually, now, I don’t worry about money. [But inflation is] still very nerve-racking. It’s like: ‘Where are we going to find this extra money from?’” said, Ms. Edmonson.