U.K. Sees Cash Transactions Rebound

The Cost-of-Living Crisis is Driving a Return to CashMoney in physical form such as banknotes and coins. More

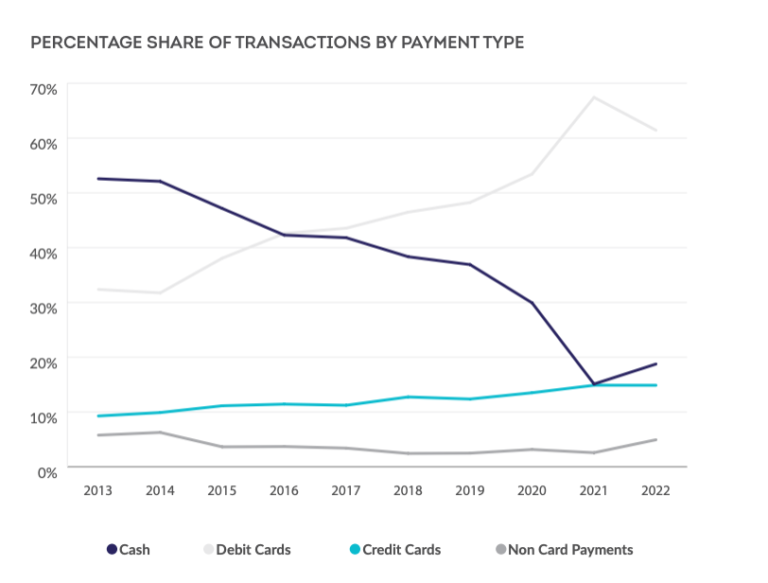

The British Retail Consortium’s (BRC) Payments Survey 2023 shows that cash transactions grew in 2023 for the first time in a decade, both by volume and value. In 2022, 19% of all transactions were made in cash, compared to 15% in 2022. In value, 11% of sales were made in cash, up from 8% in 2021 (see Graph 1). Nonetheless, the figures remain significantly lower than pre-pandemic levels, as shown by the chart below. Retailers participating in the survey accounted for 35% of all U.K. retail annual sales turnover.

Graph 1. U.K.: Percentage Share of Transactions by PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Type, 2013-2022

Source: British Retail Consortium

“This reflects a choice by many households to use cash to budget more carefully during the onset of the cost of living crisis, as well as a natural return to cash usage following the move to contactless during Covid.” – BRC.

According to Bank of England figures, cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More declined very slightly (-0.45%) in 2023; however, the value of the £20 denominationEach individual value in a series of banknotes or coins. More, the most widely used transactional note, increased by 3.6%.

Graph 2. United Kingdom: Value of Notes in Circulation, 2013-2023.

Merchants Commit to Accepting Cash

The increase in cash usage – both by spending and transaction numbers – is welcome, says the BRC. Its members are committed to accepting cash payments and supporting vulnerable groups and those using cash to budget. The BRC calls for the Government to consider further interventions to support a sustainable future for cash; these should focus on ensuring cash acceptance is a viable option for merchants across the ecosystem.

The dominance of card payments has come at a significant cost to retailers. Retailers spent £1.26 billion on card processing fees; this includes a 27% increase in scheme fees and a 7% increase in interchange fees (as percentages of turnover) in 2022.

Nationwide Reports Higher ATM Withdrawals

New data from Nationwide, Britain’s biggest building society, confirms that cash usage continued to rise as many households responded to the cost-of-living crisis by budgeting with cash. That data also shows where the building society is the last remaining branch in town, the growth in usage is at its most pronounced.

Unlike many banks that have closed significant numbers of branches in recent years, Nationwide has reaffirmed its commitment to communities by continuing to offer face-to-face service. Nationwide’s Branch Promise means everywhere it has a branch, it will remain until at least 2026.

Data reveals around 31.4 million cash withdrawals were made from its network of more than 1,200 ATMs last year – a 4% increase in 2022. The average amount of cash taken out on each withdrawal from Nationwide ATMs was around £105 last year, an increase on the previous year (+1%) below the current inflation level. However, it is still up 28 percent in 2019 (pre-pandemic).

It marks the second consecutive annual rise as 2022 saw the first rise in cash withdrawals for 13 years. Before 2022, the number of cash withdrawals had been steadily declining, most sharply at the start of the pandemic, when the number of withdrawals at Nationwide ATMs dropped more than 40 percent in a year (26.4m in 2020 v 44.5m in 2019).

“ATMs play a vital role in society, enabling people to easily access and manage their moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More flow. We now have the largest branch network in the U.K., which allows us to support customers who want access to cash, whether from our ATMs or over the counterAutomatic device for the counting of banknotes or coins. More. Unfortunately, the large banks have closed, and in some cases are still closing large numbers of branches, meaning far fewer free-to-use ATMs are available. ATMs do more than just dispense cash – nearly half of transactions are from people paying money in, checking their balance or paying a household bill. This goes to show this is far from the end for cash and we will continue to offer our customers the ability to access their money on their terms whether that be digitally or in branch.” – Otto Benz, Director of Payments at Nationwide Building Society.