The Hidden Costs of Cards

Payments are a big business. According to the Boston Consulting Group, payments generated $1.1 trillion in revenue in 2015, representing 29% of global banking revenues. By 2025, they are projected to reach nearly $2 trillion. PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More cards are the most important and the fastest growing payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More. According to the World Payments Report, debit cards accounted for 45.7% of electronic transactions globally in 2014 and grew by 12.8%.

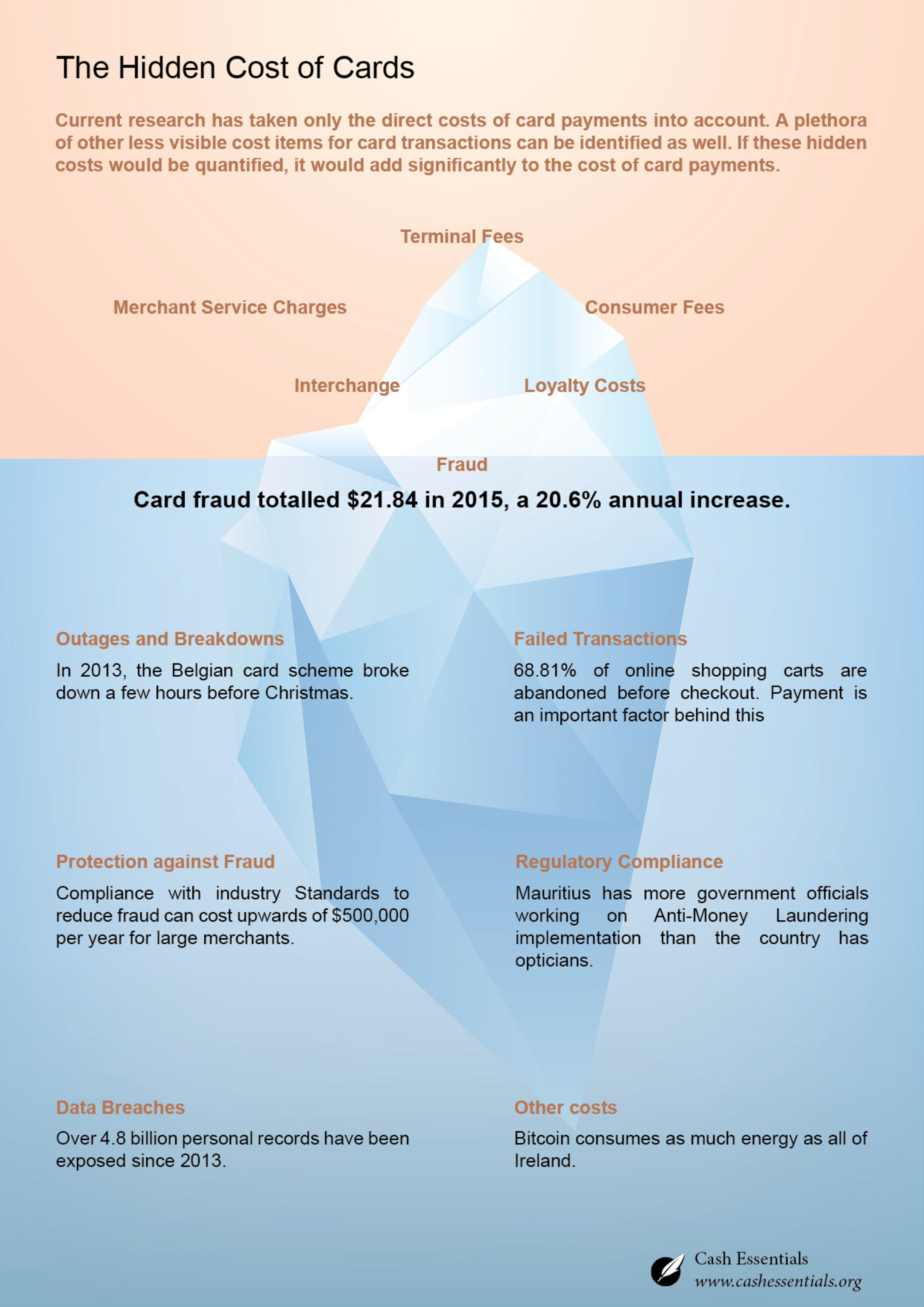

Most of the research focusing on the cost of payments looks at the real, visible and tangible costs and compares them to the cost of cashAlthough banknotes are delivered to the citizens free of charge and their use does not involve a specific fee, costs are generated during their manufacturing, storage and circulation process, which are covered by different social agents (central banks, commercial banks, retailers etc). More. There are, however, more costs associated with payments than those direct costs. In the Hidden Costs of Card Payments, Diederik Bruggink and Guillaume Lepecq analyse and, when possible, quantify these costs. They include costs related to:

- Card Fraud: according to the Nilson Report, card fraud totalled $21.84 billion globally in 2015, a 20.6% annual increase. In the UK alone, over 1 million incidents of financial fraud occurred in the first six months of 2016, according to figures released by Financial Fraud Action UK (FFA UK), a 53% increase over 2015.

- Protection against fraud: considering the growing size of the fraud problem, stakeholders in the payments value chain have been reinforcing measures to protect themselves, known as PCI compliance. And this also comes at a cost. One study found that the largest merchants are paying on average $225,000 for compliance-related work annually and that 10% of the largest ones are paying $500,000 or more.

- Data breaches are more and more common. In the majority of cases they involve theft of credit card details. According to the Gemalto Breach Level Index, over 4.8 billion personal records have been exposed since 2013. The number of breaches grew by 15% in the first six months of 2016.

- Regulatory Compliance: regulators have imposed all kinds of measures upon the payments industry that can be grouped under the header of compliance, and that have been introduced to make life of criminals and terrorists more difficult: CDD, KYC, FATF, AML… All this comes at a price. Anti-Money Laundering (AML)Many jurisdictions have established regulations and set up sophisticated financial and other monitoring systems to enable law enforcement agencies to uncover illegally obtained funds and detect suspicious transactions or activities. International cooperation arrangements have been set up to assist these endeavors. Many anti-money laundering laws combine money laundering (which is concerned with the source of funds) with terrorism financing (which is concerned with the destination of funds) when ... More efforts cost an estimated $7 billion annually in the U.S. alone.

- Failed transactions: as a result of the growing complexity of the payments ecosystem, more and more transactions are declined. Some are fraudulent but some perfectly genuine transactions are also blocked. The Baymard Institute estimates the online shopping cart abandonment rate has reached 68.81%. Almost half of the time, this is due to issues with the payment process.

- Outages and breakdowns: electronic payments rely on multiple parties and infrastructures and failure of one element in the whole transaction chain can block the ability for merchants to accept card payments. On 23 December 2013, just before Christmas, Belgian merchants faced an outage of the domestic debit card scheme Bancontact for two and a half hours, costing them €51 million in sales.