Cash and the Covid-19 Pandemic in South Africa

The Economic Impact of the Covid-19 Pandemic in South Africa

According to the Financial Times Coronavirus Tracked page, as of July 28 of this year, there have been 2.39 million confirmed cases of SARS-CoV-2 in South Africa, and 70,338 people with Covid-19 have died. As of July 27, the country had administered 6.9 million vaccine doses, equivalent to 11.7 vaccine doses per 100 inhabitants; 9.5% of the population had received at least one dose, and only 4.4% of the country’s population were fully vaccinated.

Lockdown measures imposed by the Ramaphosa government during the Covid-19 pandemic have been rather harsh, including a ban on alcohol and tobacco sales, a nightly curfew, and the closing of borders. As a result, South Africa’s gross domestic product contracted 7%, its worst fall since 1920. The share of jobless people and those discouraged from looking for work reached 43% by the end of 2020.

Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More Grew 8.23% in Value During the First Year of the Pandemic

According to South African Reserve BankSee Central bank. More (SARB) data, cashMoney in physical form such as banknotes and coins. More in circulation grew 8.23% in value between March 2020 and March 2021, as it rose from ZAR155.544 billion (US$10.567 billion) to ZAR168.339 billion (US$11.44 billion). As detailed in the SARB Annual Report 2020/21, most of this increase arose from the growth in notes rather than coins in circulation (SARB 2021: 120). Notes in circulation grew 8.34%, going from ZAR149.079 billion (US$10.13 billion) in March 2020 to ZAR161.514 billion (US$10.97 billion) in March 2021. Coins in circulation grew 5.56%, as they went from ZAR6.465 (US$0.44 billion) to ZAR 6.825 billion (US$0.46 billion) between March 2020 and 2021.

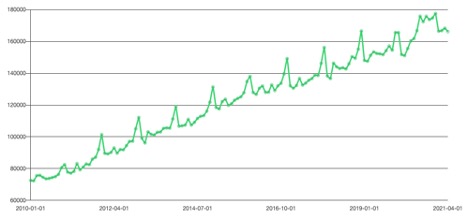

Graph 1. South Africa: Cash in Circulation, January 2010-April 2021 (millions of South African rands)

Source: SARB Online Statistical Query, series KBP1000M.

CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation in South Africa increased 2.95% in value in March 2020, the month when the World Health Organization declared Covid-19 a global pandemic. Cash in circulation grew most rapidly in July 2020, at a rate of 5.41%.

Graph 2. South Africa: Cash in Circulation, January 2021-April 2021 (millions of South African rands)

Source: SARB Online Statistical Query, series KBP1000M.

Covid-19 and Responses from the Cash CycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More in South Africa

With the onset of the Covid-19 pandemic, the SARB established an industry-wide forum to secure the continuity of the cash supply and monitor its performance (SARB 2021: 150).

The pandemic impacted production costs in the MintAn industrial facility manufacturing coins. More and the South African Bank Note Company, both SARB subsidiaries. In 2020-2021, the Mint produced and delivered the SARB’s entire order of 811 million coins despite workforce capacity constraints. (SARB 2021: 80). In addition, the Bank Note Company printed 974 million banknotes and delivered 892 million notes in 2020-2021 (SARB 2021: 81).

According to the SARB, the incidence of counterfeiting diminished during the Covid-19 pandemic, going from 10.76 parts per million (ppm) in the March 2019-March 2020 period to 5.68 ppm in the March 2020-March 2021 period (SARB 2021: 27).

Beyond Covid-19: the SARB and the Payments System

“Macro forces shaping the digital revolution make for an incredible melting pot for innovation, with central bank moneyA liability of a central bank, including banknotes in circulation and banks’ deposits with the central bank. More, commercial bank moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More and private money competing for a share of consumers’ wallets.” – Dr. Arif Ismail, Divisional Head – Fintech, Executive Management Department, South African Reserve Bank, quoted in PricewaterhouseCoopers, Payments 2025 & Beyond. Navigating the Payments Matrix: Charting a Course Amid Evolution and Revolution, May 2021, 10.

In 2020, the SARB completed the discontinuation of cheques as paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More instruments in South Africa. The Bank also published a paper on the technical feasibility of establishing a domestic card scheme. This question has become even more critical given the accelerated adoption of digital payments during the Covid-19 pandemic. Currently, Visa, MasterCard, Diners Club, and American Express are the only card schemes operating in the country.

In 2018, the Bank launched Project Khokha as proof of a wholesale payment system for interbank settlementThe discharge of an obligation in accordance with the terms of the underlying contract. In e-transfers the settlement may take days, whereas cash settlements are instantaneous and irreversible. More employing a tokenized South African rand on distributed ledger technology. Last year, the Bank launched Project Khokha 2 to assess the feasibility of a retail central bank digital currency (CBDC)A digital payment instrument, denominated in the national unit of account, and a direct liability of the central bank, like banknotes. A general purpose CBDC can be used by the public for day-to-day payments like cash. More for domestic use (SARB 2021: 61).