Cash Demand in Canada and Sweden: What’s the Difference?

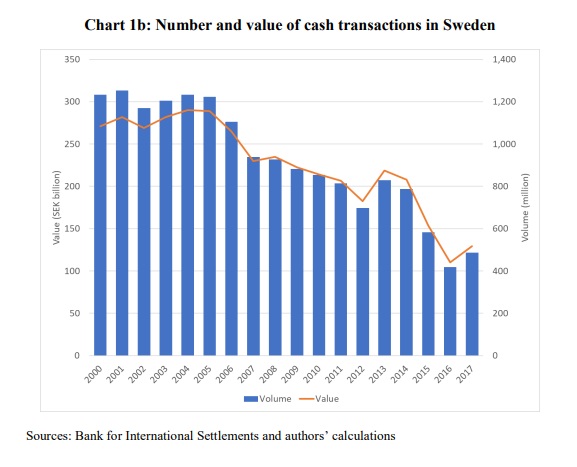

The use of cashMoney in physical form such as banknotes and coins. More as a payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More has been experiencing a steady decrease in some countries such as Sweden, while Canadians have also been enthusiastic about adopting new payment technologies. The Bank of Canada recently published a discussion paperSee Banknote paper. More, A Tale of Two Countries: Cash Demand in Canada and Sweden, which studies the use and the demand for cash.

First, let’s have a look at why Canada and Sweden were used as the point of comparison. Although thousands of miles apart, these countries are similar in more ways than one would think:

- Canada and Sweden are considered to be small, open economies that neighbour much larger economies such as the United States and the European Union.

- While both carry their own national currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More, they can easily access an international reserve currency – the US dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More and the euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More, respectively.

- Both carry monetary policy frameworks that target inflation, and both have pursued the same inflation-control objective (2%) since the beginning of 1990s.

- Each country is dominated by a handful of large, global banks while still having many smaller domestic institutions.

- Their digital infrastructure for digital payments ranks high and both countries are among the most significant adopters of digital paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods, driving a range of payment innovations (e.g. Swish in Sweden and Interac e-Transfer in Canada).

Throughout the paper’s in-depth analysis, researchers Walter Engert, Ben Fung and Björn Segendorf explain the differences between each country’s transactional demand for cash (for payments) and the store-of-value demand (for times of economic uncertainty and negative interest rates) that portray interesting results:

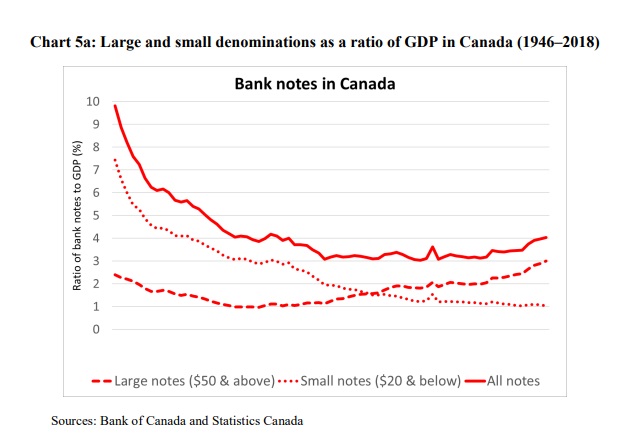

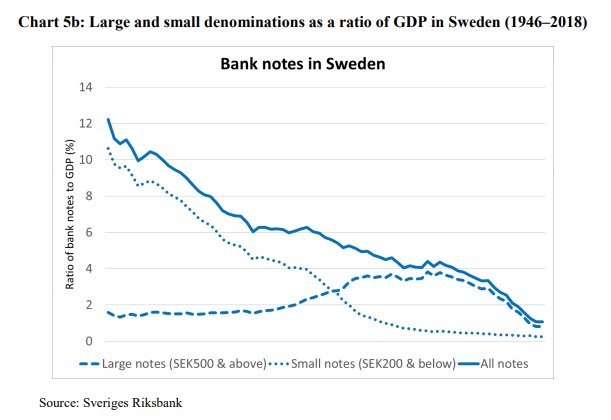

Both Canada and Sweden have experienced a long-term decline in the demand for small-denomination notes, as illustrated in charts 5a and 5b above, reflecting declining transactional demand for cash in both countries. This evolution is related to both consumer behaviour as well as merchant policies towards both cash and non-cash payments. However, in Canada, demand for large-denomination notes has continued to grow while this has not been the case in Sweden.

It is worth noting, nonetheless, that the situation has evolved recently in Sweden, as

The paper points to three broad lessons:

- Policy interventions and bank resolution frameworks (such as “) that protect depositors during a financial crisis reduce the incentive to hold larger bank notes as a hedge against crises.

- Cashless bank branches can inhibit access to cash particularly when ATM networks are unable to satisfy consumer demand for banknotes across a range of denominations.

- Legal tenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More rules that declare old banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More series invalid can inhibit the demand for cash.

Read the full report here: