Cash, Gold, and Crypto: Safe Havens in an Age of Uncertainty (2023–2025)

Gold: The Timeless SafeSecure container for storing money and valuables, with high resistance to breaking and entering. More Haven

Gold prices have experienced a pronounced uptrend from October 2023 through October 2025. Starting at approximately $1,924 per troy ounceAnglo-Saxon weight unit, equivalent to 31.10 grams. Used in the precious metals industry. More in October 2023, gold prices rose steadily, reaching a high of $4,371 in October 2025—a cumulative increase of about 56%. Monthly data reveals consistent upward momentum with occasional fluctuations, reflecting responses to geopolitical and economic events.

Why Is Gold Surging?

Gold’s role as a hedge against inflation, currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More debasement, and geopolitical risk has been reinforced over the past two years. Geopolitical tensions, trade tensions, and Middle East conflicts have heightened demand for gold as a safe-haven asset. Central bank purchases, particularly by China and Russia, have also supported prices by increasing demand and reducing market supply. Inflation and dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More weakness have further fueled gold’s appeal.

BitcoinBitcoin is commonly said to be a cryptocurrency, a digital means of exchange developed by a set of anonymous authors under the pseudonym of Satoshi Nakamoto, which began operating in 2009 as a community project (Wikipedia type), without the relationship or dependency of any government, state, company or body, and whose value (formed by a complicated system of mathematical algorithms and cryptography) is not supported by any central bank or authority. Bitcoins are essentially accounting entries i... More: The Digital Safe Haven or FOMO ?

Bitcoin’s price has shown explosive growth from October 2023 to October 2025. Starting at approximately $34,667 in October 2023, Bitcoin surged to a peak of $126,296 in October 2025—an increase of over 260% This dramatic rise reflects Bitcoin’s evolving role as a store of value and hedge against inflation, driven by institutional adoption, ETF approvals, and macroeconomic factors. FOMO (Fear of Missing Out) is accelerating the trend as retail and institutional investors rushed to participate in its record-breaking rally.

Why Is Bitcoin Rising?

Bitcoin is increasingly seen as “digital gold”—a scarce, decentralized asset that thrives in uncertain times. Institutional adoption, including the approval of Bitcoin ETFs and increased institutional investment, has boosted demand and market confidence. Macroeconomic factors, such as inflation hedging and correlation with gold and cashMoney in physical form such as banknotes and coins. More trends, have influenced Bitcoin’s price, especially amid geopolitical tensions and economic uncertainty. Regulatory developments have also supported market growth.

Bitcoin’s price correlation with gold is episodic rather than inherent, driven by specific events such as ETF approvals and central bank gold buying sprees. Bitcoin’s performance has been more volatile historically but is increasingly viewed as a complementary asset to gold and cash in diversified portfolios.

The Rise of Cash: A Store of ValueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More, Not Just a PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Tool

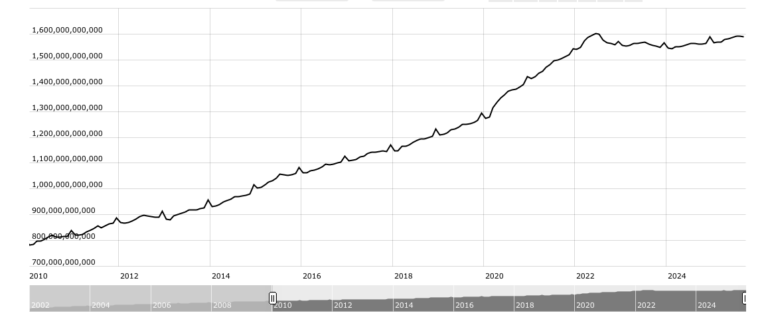

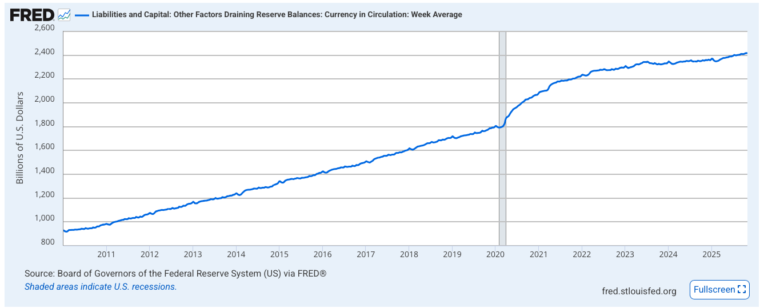

Cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More has grown in both the Eurozone and the U.S., between 2023 and 2025.

In the Eurozone, cash in circulation has grown modestly from €1,563 billion in September 2023 to €1,590 billion in September 2025, a 1.7% increase.

EuroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More Banknotes in Circulation

In the United States, cash in circulation grew from $2,323 billion in September 2023 to $2,414 billion in September 2025, an increase of approximately 3.9%.

US Currency in Circulation

In both cases, this evolution follows a period of exceptional growth during the Covid-19 pandemic.

Why Is Cash Demand Rising?

This phenomenon, known as the “cash paradox,” reflects several key factors. During economic downturns, bank runs, or geopolitical crises, individuals and businesses store cash as a liquid, tangible asset. For example, the 2023 U.S. banking crisis led to a temporary spike in cash withdrawals, and the Eurozone energy crisis saw increased cash demand as households prepared for potential disruptions.

Distrust in digital systems has also played a role. Cybersecurity threats, bank failures, political instability as well as deglobalisation have made cash an attractive offline, censorship-resistant store of value. In countries with capital controls or financial instability, cash demand remains strong as a hedge against currency devaluation. Additionally, cash is seen as a safer option than keeping moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More in banks during crises, especially as the decline in interest rates post-2022 reduced the opportunity cost of holding cash.

The Common Thread: Uncertainty Drives Demand for All Three Assets

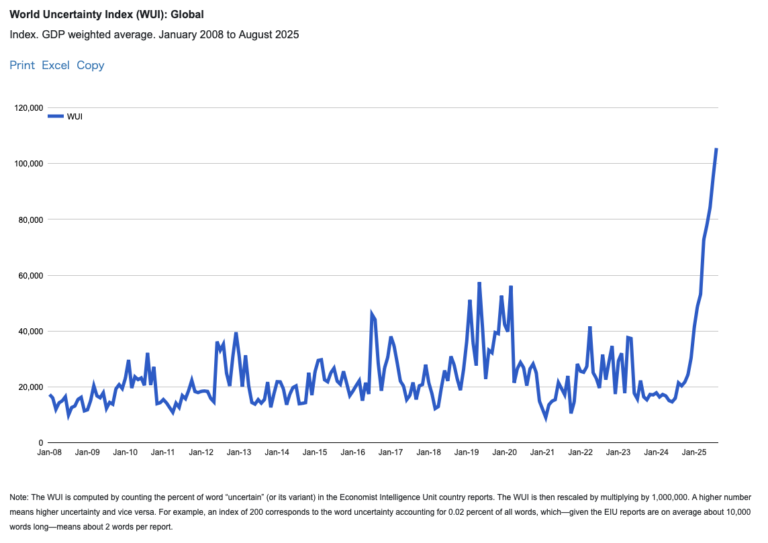

The World Uncertainty Index (WUI) as a Key Indicator

The WUI measures global economic and policy uncertainty by analyzing media and expert reports. Between 2023–2025, it grew exponentially, exceding historic levels reached during the pandemic These spikes in uncertainty have correlated strongly with increased demand for cash, gold, and Bitcoin as safe-haven assets.

How Uncertainty Boosts Cash, Gold, and Crypto

The demand for physical cash, gold, and Bitcoin has grown in uncertain times due to several factors. LiquidityDescribes the extent to which assets or rights can be converted into cash without causing a significant decrease in the asset’s price. Accordingly, liquidity is often inversely proportional to the profitability of the asset and involves the trade-off between the selling price and the time needed to convert it to cash. In finance, cash is considered the most liquid asset and cash is sometimes used as a synonym for liquidity (e.g. cash reserves; cash pooling…). More preference plays a significant role, as people prefer liquid, tangible assets or digital scarcity during crises. Distrust in traditional finance, fueled by bank failures and geopolitical risks, has also driven demand for these assets. Inflation and currency debasement fears have made cash, gold, and Bitcoin attractive options. Finally, the “cash paradox” extends to gold and Bitcoin, as all three assets are bought as long-term hedges rather than for short-term trading.

The Future of Cash Conference in Warsaw: Exploring the Cash Paradox and Beyond

The Future of Cash Conference in Warsaw will explore the evolving role of cash in an uncertain economy and how cash can be contribute to economic resilience and financial stability. This will be a critical forum to explore how these trends will shape the future of money.

Cash, Gold, and Crypto . Are We Entering a New Era of Monetary Diversity?

The past two years have demonstrated that cash, gold, and cryptocurrencies are evolving tools for financial resilience in uncertain times. Cash is more just a payment methodSee Payment instrument. More but a liquidity buffer in crises. Gold remains the ultimate inflation hedge, trusted by institutions and individuals alike. Bitcoin is emerging as “digital gold,” combining scarcity with digital accessibility. As the World Uncertainty Index remains high, the demand for these assets will likely persist.

Perhaps the future is not cash vs. gold vs. crypto, but a multi-asset monetary system where each plays a distinct role. In an uncertain world, diversity in money may be the best hedge of all.