Cash is king in Singapore

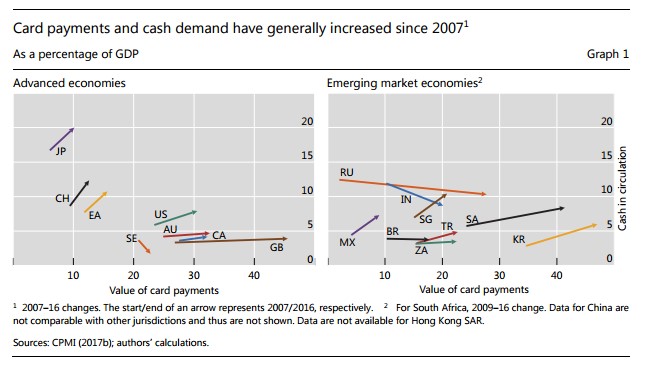

According to the Bank for International Settlements, Singapore is ranked among the countries with the highest level of cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More in relation to GDP – at 9.8% in 2017. More surprisingly, the cashMoney in physical form such as banknotes and coins. More in circulation/GDP ratio has increased steadily over the past decade as has the value of card payments in relation to GDP as illustrated in the chart below.

The government has been promoting the development and adoption of digital payments as one of the pillars of its ‘Smart Nation’ strategy where “people will be more empowered to live meaningful and fulfilled lives, enabled seamlessly by technology, offering exciting opportunities for all” according to the Smart Nation website. The Singapore Payments Roadmap estimates that 60% of consumer payments were settled in cash in 2016 and recommends measures to reduce cash usage. In a 2018 speech to the Association of Banks, Minister for Education Ong Ye Kung said Singapore’s aim is not to be a cashless society, but to use less cash and more e-payments.

The Singapore Business Review reports that three factors explain the high level of cash usage in Singapore in spite of government efforts to reduce dependency on cash.

Resistance to changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More

Singapore is known for having the oldest society among ASEAN’s 10 member nations and making headlines for its ageing population. Majority of the elderly Singaporeans are resistant to change and are happy to continue using cash. Singapore is also home to numerous hawker centres, food courts and wet markets where low value are often settled in cash.

Increasing security concerns

Digital adoption has been rampant, including the banking sector, where the use of mobile banking has overtaken physical branch interactions by 15% during the past 12 months in 2018, according to the J.D. Power 2018 Singapore Retail Banking Satisfaction Study. Nonetheless, security remains a significant roadblock for 41% of customers who have not adopted mobile banking, up from 31% the previous year.

The proliferation of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More option increases confusion and costs

In tech-savvy Singapore, the number of digital payment options has been proliferating leading to confusion among consumers and increasing costs for merchants, who are required to support different terminals and systems due to lack of interoperability. A 2018 study done by UnionPay International and Nielsen reveals how 94% of its respondents used cash in the past three months, while 62% used debit cards and only 43% mobile payments.