Cash: most comfortable payment method

33% of females and 35% of males worldwide consider cashMoney in physical form such as banknotes and coins. More the most comfortable payment methodSee Payment instrument. More. In fact, 89% of them admitted to using it up to 25 times a month for in-store payments.

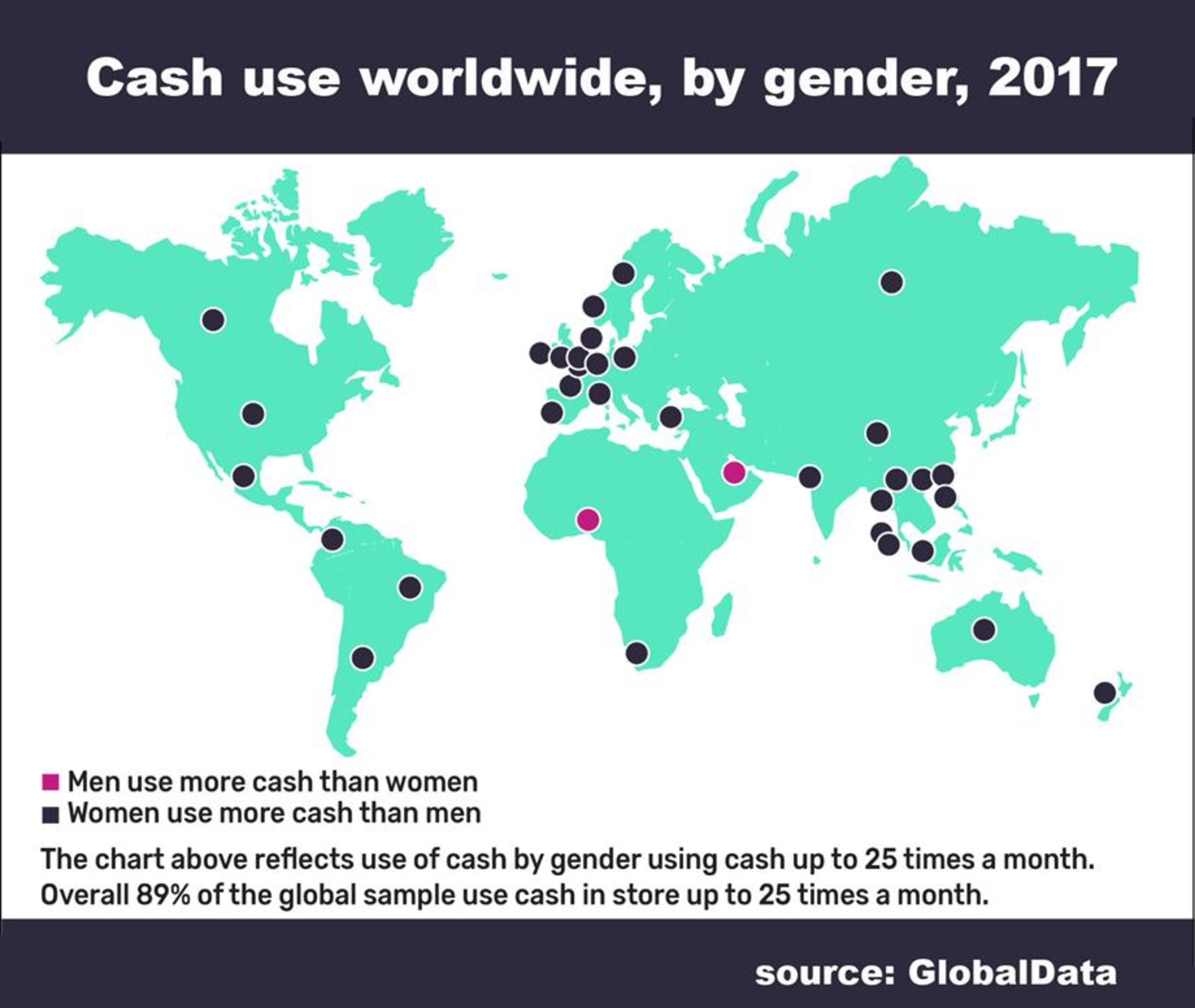

The survey, carried out by GlobalData* in 35 countries on 30,000 adults, also found that women are more prone to using cash, exceeding men by 6% on average. The surveyed population was mostly middle-to-upper class, which could indicate that cash usage is even higher for middle-to-lower class segments.

These findings are not particularly surprising considering women’s generally more traditional role of running the household and caring for children in many societies. Aside from considering cash comfortable, other reasons for choosing it over other paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods include “convenience, low risk and the unavailability of alternative payment methods”.

But other reasons can be factored into this preference for cash, says Senior Financial Analyst at GlobalData Arnie Cho: “For example, the Gen X and Y segments use cash more often than the other age groups — partly as a result of being out at work, which increases their opportunities for in-store purchases.”

From GlobalData’s map here below, it is clear that women are those that make use of cash most of the time, except for Nigeria and the UAE. Reasons for this difference could be many, but might also be linked to the fact that in the UAE, for example, it is generally the helper that makes smaller in-store purchases for the household. In Nigeria, one explanation could be fear of petty crimes, but a more in-depth investigation is necessary to understand these fundamental differences.

The countries where the discrepancy between men and women is highest is in Poland, New Zealand, Russia, the UK and in Singapore where women use cash 11% to 13% more frequently than men. In contrast, countries where men and women have similar cash usage habits are China, Thailand, Sweden and Indonesia (between 2% and 0% difference).

*Special thanks to GlobalData for providing additional data related to the survey.