Consumer Surplus of Alternative Payment Methods: Paying Uber with Cash

This article was first published on the website of the Becker Friedman Institute at the Universitry of Chicago. It is republished here with permission from the publishers. It is based on BFI Working PaperSee Banknote paper. More No. 2019-96, “Consumer Surplus of Alternative PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Methods: Paying Uber with CashMoney in physical form such as banknotes and coins. More,” by Fernando Alvarez, professor, University of Chicago; and David Argente, assistant professor, Penn State University

However, for millions of other people who do not have credit cards or who are disinclined to use them, those benefits have gone missing. These people, many of them lower-income, rely on cash as their primary mode of payment, which necessarily limits their ability to benefit from ridesharing services. And this is no trivial loss. Research by UChicago’s Fernando Alvarez and David Argente of Penn State reveals that riders would suffer an average cost of about 50 percent of the value of the rides paid with cash if they are not allowed to use cash as a payment methodSee Payment instrument. More.

In “Consumer Surplus of Alternative Payment Methods: Paying Uber with Cash,” Argente and Alvarez employ large field experiments and other tests to determine this consumer cost. For policymakers considering the impact of app-based services on lower-income consumers, especially those in countries that are trying to steer consumers away from cash payments, these findings are particularly relevant.

“Will that be cash … or cash?”

For a number of economists and policymakers, the persistence of cash as a form of payment is potentially problematic. Some researchers have called for the elimination of large-denomination bills, in part because such currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More is often the primary transaction method for organized crime and tax evasion. Policymakers around the world have also advocated for a cashless economy not only to address criminal intent or tax avoidance, but also to improve payment efficiency. For example, until a November 2018 ruling by the Mexican Supreme Court disallowing cash bans, some cities in Mexico—including Mexico City—banned cash payments for app-based ridesharing firms like Uber.1 In India, a 2016 demonetization plan was enacted to, in part, remove certain large-denomination bills from circulation.

These efforts have brought renewed attention to the role of cash in an economy and, more broadly, to the study of optimal payment choices, a field of research to which the authors’ paper contributes. To investigate the role and benefits of cash payments for Uber rides, Alvarez and Argente estimate the effect on riders (or consumer surplus) in cases where cash was introduced into previously cashless areas, as well as in places where cash was banned.

To arrive at their estimates, the authors employ two types of evidence: quasi-natural experiments, where the researchers examine data from the effects of either cash bans or cash introductions into a particular market; and field experiments (or randomized control trials), where riders face different prices for alternative payment methods. Their paper contains detailed analysis and review of each experiment and describes the authors’ many results. Here are some key findings:

- In 15 cities in Mexico, cash was introduced as a form of payment for Uber some time after the entry of Uber in the city.After the introduction of cash, there was a large increase in the number of trips and total fares in these cities. On the supply side, while the number of drivers did not increase at the same relative pace as riders, total weekly hours did increase by the same approximate percentage as total fares.

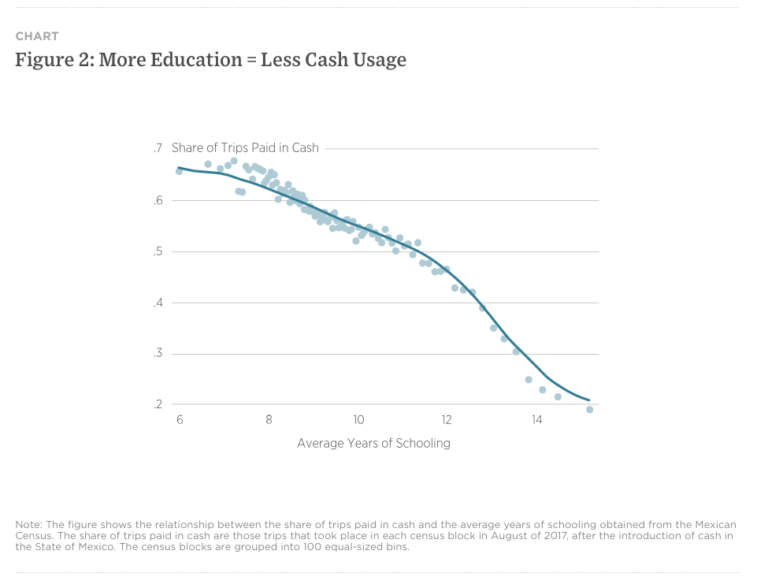

- Mexico City, with a metro area population of more than 20 million and one of the top ten metropolitan areas in the world in terms of Uber rides, offers a rich experiment for the authors to examine. Cash was introduced in 2016, but only riders who originated their rides in the greater metro area were allowed to use cash; if they began their ride in the city proper, cash was not an option (at least until November 2018, after the Mexican Supreme Court ruling on cash payments). Following an analysis of rides originating in each census block in August 2016, 2017, and 2018, they find that neighborhoods with higher discernible income (denoted by higher education, internet connections, etc.) took a smaller share of trips with cash. Among many other results, they also find a substantially larger increase in trips that began outside the city proper, where cash was permitted and lower-income residents generally reside.

- Following a crime, allegedly committed by a driver of a competing ride-service to Uber, the city of Puebla in Mexico banned cash for all app-based riding services in December 2017. Using data from other cities as a counterfactual, Alvarez and Argente estimate a 50 percent reduction in trips by cash users after the ban. Over time, about one-third of cash users registered a credit card with Uber and the drop-off in ridership improved to 40 percent.

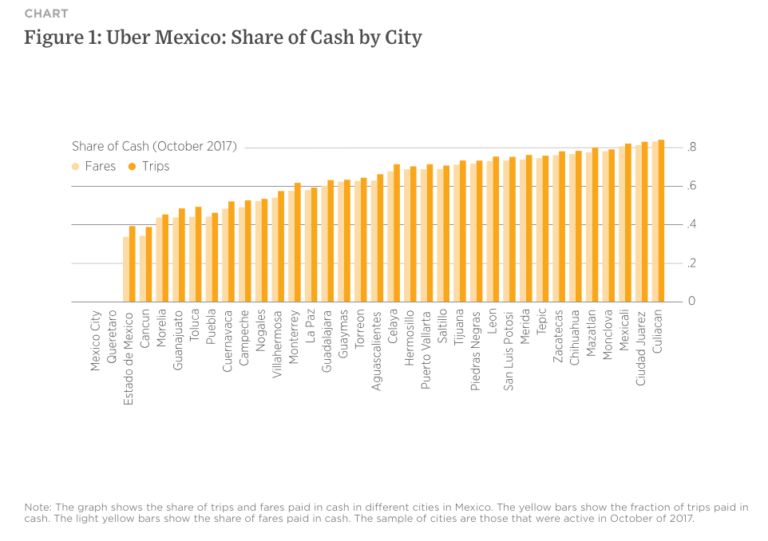

- Regarding Mexico City and Puebla, it is worth noting that these two cities have the lowest share of trips paid in cash in Mexico, about 40 percent. Other Mexican cities have cash-payment rates at twice that rate, reflecting the cash dependence of many Mexicans.

- Along with these quasi-natural experiments, the authors conducted three large field experiments that each involved over 100,000 Uber riders within the State of Mexico. Using price discounts and credits, the authors measure the riders’ responsiveness to incentives, finding that riders do changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More their payment methods according to the incentives, but their response is rather limited. The authors translate the (small) size of the riders’ response into a large benefit attached by consumers to the use of their preferred means of payment, which for many riders is cash.

- Two of the experiments involved incentives to cash riders. In one, discounts of 10, 15, 20, and 25 percent were offered to four groups of 23,000 riders, with a control group of 56,000 for whom prices remained stable. Another experiment involved six control groups of about 20,000 cash users, who received rewards equal to three, six, or nine times their average weekly expenditures if they registered a credit card within a certain time frame. In both cases, riders were responsive to the incentives, but the responses were moderate.

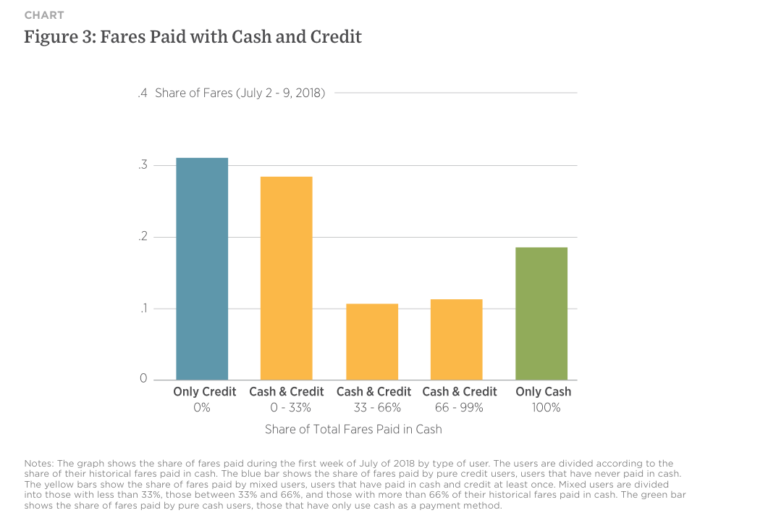

- Surprisingly, about half of the State of Mexico riders alternate the use of cash and credit cards as their means of payment. The authors conducted an experiment where six groups of 20,000 such riders each were offered discounts of different magnitude that applied only if they paid with cash or with credit cards, and a control group of 90,000 riders who were offered the regular price regardless of the means of payment. In this case riders also substitute consistently toward the cheaper means of payment, but the magnitude of the effect was rather small. Again, the authors interpret this finding as a large attachment of the riders to their preferred means of payment.

This new research sheds new light on the use of cash among many Uber riders, especially those with lower income and those without banking relationships.

These rich experiments allow the authors to make estimates of the consumer surplus for Uber riders from the use of cash. As these experiments reveal, not all cash riders are wholly dependent on cash, as some will move to credit cards under certain conditions. However, in the State of Mexico, about 25 percent of riders are dependent on cash, and about 50 percent of riders with a registered credit card are often inclined to use both cash and credit. All told, the authors estimate that a cash ban inflicts a cost equal to about 50 percent of the value of trips paid in cash.

Bans of cash as means of payment for Uber rides have been in place, or announced, in other cities and countries. As recently as mid-July of 2019, cash has been banned in Uber in the Mexican city of San Luis Potosi. Cash is banned in most cities of Uruguay. Cash is banned for Uber in Panama, but it has been used thanks to a temporary suspension of the ban. The authors also estimate a loss of consumer surplus of about 50 percent of the fares paid in cash for Panama if the ban is put in place.

Conclusion

For many low-income people in developing nations, payment options are more than a question of convenience or efficiency—they are often a matter of necessity. For these people, cash is still king. For example, about 95 percent of all transactions in Mexico below $25 are conducted in cash, as well as 87 percent of transactions above $25. For all goods and services, the cash payment rate is 90 percent.

However, these issues are not limited to citizens of developing nations. For example, in early 2019, Philadelphia—with a poverty rate of about 26 percent and a high rate of unbanked consumers—became the first US city to ban retail establishments from accepting only debit or credit cards, ordering that all stores accept cash. In Europe, the move to a cashless society was slowed by a 2018 report from the European Commission that did not recommend legislative action to restrict cash payments.

CLOSING TAKEAWAY

Based on their extensive analysis of the consumer surplus linked to Uber cash rides, Alvarez and Argente conclude that banning cash payments is a costly public policy.

Alvarez and Argente’s research, which incorporates a wealth of experiments and millions of observations, sheds new light on the dependency of cash among many Uber riders, especially those with lower income and those without banking relationships. When cash is introduced to an area, the number of trips, miles, fares, and drivers all increase, with the benefits mainly accruing to low-income riders. The authors estimate a consumer surplus from the use of cash of about 50 percent of the value of trips paid in cash.

However, this research has implications for more than just the consumer surplus derived from Uber cash rides, significant as that may be. As the cash payment rates for all goods and services in Mexico attest, and as the recent cash rulings in Philadelphia and the European Union emphasize, much is at stake when cash is restricted as a form of payment, especially for lower-income people. The authors’ work strongly suggests that policies meant to restrict cash payments should be based on credible estimates on the impact to individuals and society. For their part, based on their extensive analysis of the consumer surplus linked to Uber cash rides, Alvarez and Argente conclude that banning cash payments is a costly public policy.

1 The authors employ data supplied by Uber, which allows cash payments in more than 400 cities worldwide. Riders may select cash as a payment option similar to how other riders select among credit card options. Riders who select cash then pay drivers just as they would otherwise pay a taxi driver, for example.

This post is also available in:

![]()