El Salvador: Bitcoin Illustrates the Value of Cash

In a recent paper, Fernando Álvarez (University of Chicago), David Argente (Pennsylvania State University), and Diana van Patten examined the adoption of bitcoinBitcoin is commonly said to be a cryptocurrency, a digital means of exchange developed by a set of anonymous authors under the pseudonym of Satoshi Nakamoto, which began operating in 2009 as a community project (Wikipedia type), without the relationship or dependency of any government, state, company or body, and whose value (formed by a complicated system of mathematical algorithms and cryptography) is not supported by any central bank or authority. Bitcoins are essentially accounting entries i... More in retail payments in El Salvador. Drawing data from a nationally representative, face-to-face survey of 1,800 households conducted with CID-Gallup, the economists’ conclusion is straightforward: “bitcoin is not being widely used as a medium of exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More” (Álvarez et al. 2022: 19).

CashMoney in physical form such as banknotes and coins. More is Inclusive

Among the reasons to make bitcoin legal tenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More in El Salvador, President Nayib Bukele argued that the crypto-asset would promote financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More in the country. Adult Salvadoreans can claim a Chivo e-wallet preloaded with $30 worth of free bitcoin. Chivo users can hold bitcoin and dollars in their wallets and trade bitcoin without fees.

However, the typical Chivo users are “individuals who own a cell phone with internet, and those who are banked, more educated, younger, and male” (Álvarez et al. 2022: 12, quote in 13). Most Salvadoreans downloaded Chivo to claim the $30 bonus in bitcoin and convert it to physical dollars, per the CID-Gallup survey and sources interviewed by the Financial Times and the Wall Street Journal (Álvarez et al. 2022: 15-16). Chivo downloads peaked during its September 2021 launch (at 40%) and have flattened since.

- “It’s going to be a real challenge for me to figure that stuff [bitcoin] out. Especially because I’m illiterate,” said Louis Robles, a 42-year-old fisherman and boat tour operator in La Union, a port near the planned (and delayed) Bitcoin City.

- “I don’t understand [bitcoin]. I find it very difficult.” said Ana Aracely Flores, a resident of San Salvador.

Although most respondents to the CID-Gallup survey (64.6%) have access to a mobile phone this has not been enough to promote Chivo’s adoption among the country’s population (Álvarez et al. 2022: 10).

“A lot of people don’t have smartphones, and if they do, they don’t have data plans,” said Santiago Pérez, WSJ Deputy Editor, Latin America.

Cash is Trusted

Shopkeepers and customers rarely, if ever, employ bitcoin in retail payments. A Central American University poll indicates that 70% of Salvadoreans have little or no trust in bitcoin as legal tender, and 58% think bitcoin benefits “foreign investors, the wealthy, and businesspeople” (IUOP 2021: 10-11, 20-21).

The surf town of El Zonte, also known as “Bitcoin Beach,” appears to be the only exception. Foreign travellers pay for surf lessons and pupusas in bitcoin. “Most of the merchants accept Bitcoin,” said Carol Souza, a Brazilian influencer and crypto evangelist visiting the town. Adrian Torres, a resident in El Zonte, checks the value of bitcoin on the Chivo wallet whenever he gets paid in the crypto asset.

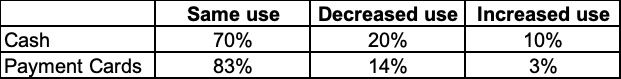

Table 1. El Salvador: Use of Cash and PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Cards among Chivo Users

Note: The sample comprises users who downloaded the Chivo app. Source: Álvarez et al. (2022: 22).

Among those who downloaded the app, most kept using cash (70%), debit and credit cards (83%) at the same rates as before (see Table 1). Most Salvadoreans (60.7%) stopped using Chivo after spending the $30 bonus (Álvarez et al. 2022: 15).

“We believe that this is a relatively strong sign of adoption,” said Felipe Vallejo, chief corporate and regulatory affairs officer at Bitso, a Mexican crypto exchange and technology provider to the Salvadorean government.

Cash is Secure

“We’re a people who like to touch our moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More,” said Danilo Martínez, a cab line operator in San Salvador.

Some Chivo users have reported unauthorized charges, phishing schemes and identity theft. Cristosal, a consumer rights advocacy group, has collected the signatures of more than 1,000 Salvadorans who claim their identities and funds were stolen through Chivo, according to lawyer Ruth López. Even worse, gang members have extorted 2.3% of Salvadorans to transfer their $30 Chivo bonus (IUOP 2021: 8, 27).

According to the CID-Gallup survey, nearly all firms accept cash in payments, slightly over 25% accept debit and credit cards, and just 20% of them take bitcoin. Among the firms accepting bitcoin in payments, 71% convert the crypto funds to dollars and then withdraw them in physical cash; 17% convert bitcoin into dollars and keep the funds in the Chivo wallet; only 12% held bitcoin within the app (Álvarez et al. 2022: 24-25). Most firms accepting bitcoin are large enterprises, such as Starbucks, McDonald’s, and Pizza Hut.