Euro Area: the Surprising Use of Cash by Young Adults

CashMoney in physical form such as banknotes and coins. More continues to hold a significant place in the financial behaviors of various demographic groups. A new article by Rebecca Clipal and Alejandro Zamora-Pérez, published in the ECB Economic Bulletin explores the nuanced role of cash across different age groups, highlighting how older adults, young adults, and the general population perceive and utilize cash in their daily lives.

Older Adults: The Steadfast Users of Cash

The research confirms the continued preference for cash among older adults. Individuals aged 60 and above maintain the largest share of cash transactions in their everyday purchases. This trend can be attributed to several factors, including habit, trust, and familiarity with cash as a payment methodSee Payment instrument. More.

For older generations, cash represents not just a means of transaction but also a sense of security and control over their finances. Unlike digital payments, which can be subject to technical issues and cybersecurity threats, cash transactions are straightforward and tangible. This demographic often values the simplicity and reliability of cash, which does not require any technological intermediation.

Moreover, older adults may be less inclined to adopt new technologies due to a lack of familiarity or comfort with digital devices. The learning curve associated with digital paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods can be a barrier, making cash a more accessible and convenient option. As a result, older adults continue to rely heavily on cash for their daily transactions, underscoring the importance of maintaining cash infrastructure to support this demographic.

Young Adults: Average Transactional Users with a Preference for Cash Reserves

The most striking finding of the research is that young adults aged 18-27 are not abandoning cash as rapidly as one might expect. While they are adept at using digital payment methods, this age group still engages in cash transactions at roughly the average rate. This finding is particularly interesting when considering the broader context of digitalization and the proliferation of online payment platforms.

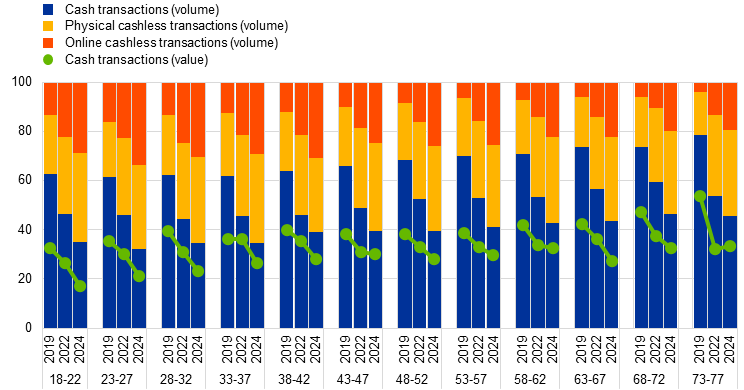

Payment methods in everyday transactions by age group and year (age and period; percentage)

Source: ECB staff calculations using SPACE data (2019-24).

Notes: The chart includes representative survey data from 15 euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More area countries. The “Physical cashless” category includes physical cards, mobile phone payments, bank cheques, credit transfers and direct debits. The “Cash” category refers to transactions made with physical cash, including person-to-person payments.

Young adults are often early adopters of new technologies and are typically more comfortable using digital payment methods. However, their continued use of cash suggests that it still plays a relevant role in their financial behaviors. This could be due to the convenience of cash for small, everyday purchases, or the desire to have a physical form of moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More for budgeting and spending control.

Interestingly, young adults are also the most likely to have cash reserves at home. This behavior spiked notably in 2022, likely influenced by the uncertainties brought about by the global pandemic. Holding cash at home provides a sense of security and preparedness for unexpected events. While this trend has moderated somewhat in 2024, it remains a significant aspect of young adults’ financial habits.

The propensity to keep cash at home among young adults can be attributed to several factors. For one, this demographic may have lower engagement with formal financial institutions, leading them to rely more on physical cash. Additionally, young adults often receive part of their income, gifts, or allowances in cash, further contributing to their cash holdings. The high average age at which people leave their parental homes in many regions also means that young adults may continue to rely on cash for various expenses.

Rising Perceived Importance of Cash Across All Ages

Another notable trend is the increasing perceived importance of cash across all age groups. Between 2019 and 2024, the share of people considering it important to have the option to pay in cash has risen significantly. This shift in perception highlights the enduring value of cash as a payment method and a financial safety net.

Several factors contribute to this growing appreciation for cash. Increased awareness of the vulnerabilities of digital systems and cyber threats has made many individuals more cautious about relying solely on electronic payments. Issues such as data privacy breaches, online fraud, and the potential for digital payment disruptions have reinforced the appeal of cash as a secure and reliable alternative.

Furthermore, recent global crises, including the pandemic and geopolitical tensions, have underscored the importance of having a resilient and accessible form of payment. Cash serves as an analogue backup tool that can be crucial in times of digital infrastructure failures or other emergencies. This recognition of cash’s role in crisis preparedness has likely contributed to its rising perceived importance.

The perceived importance of cash is not limited to any specific age group. Instead, it is a widespread sentiment that transcends generational boundaries. This broad-based appreciation for cash suggests that it continues to fulfill unique and valuable functions in the financial lives of individuals, regardless of their age or technological proficiency.

Policy Implications and Future Outlook

The enduring role of cash in the digital age has significant implications for payment policy frameworks. As digital payment methods continue to evolve and gain prominence, it is essential to ensure that cash remains a viable and accessible option for all demographic groups. Policies that support the coexistence of cash and digital payments can help foster a robust and inclusive financial ecosystem.

One key challenge is maintaining the cost-effectiveness of cash infrastructure, particularly as transaction volumes potentially decrease. However, the continued demand for cash, especially among older adults and in times of crisis, underscores the need to preserve cash accessibility and acceptance. This includes ensuring that cash remains universally accepted and that solutions are in place to support its ease of use.

Additionally, financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More and education initiatives can benefit from covering both physical and digital payment methods. By providing individuals with the knowledge and tools to use various forms of payment, these initiatives can help promote financial literacy and empowerment across all age groups.

Looking ahead, the demand for cash is likely to evolve in response to demographic trends, economic conditions, and technological advancements. While digital payment methods offer benefits and efficiencies, cash continues to play a crucial role in ensuring payment choice, financial inclusion, and systemic resilience. A balanced approach that acknowledges the unique advantages of both cash and digital payments will be essential in shaping the future of the financial landscape.

In conclusion, the persistence of cash in the digital age highlights its enduring value and relevance. Older adults, young adults, and individuals across all age groups continue to find cash useful and important in their financial lives. By understanding and addressing the diverse needs and preferences of different demographic groups, policymakers and financial institutions can help ensure that cash remains a vital and accessible component of the payment ecosystem.

Cash and Gen Z (those born between 1997 ans 2012) will be one of the key topics of the forthcoming Future of Cash Conference. How can we design cash to make it fit for Gen Z? A panel discussion will explore the unique perceptions and preferences of Gen Z, regarding money and finance and discuss how the cash community can encourage the use of cash among Gen Z.