For the Swiss, cash is a symbol of confidence

During his opening speech at the first World Banknote Summit, Deputy Chairman of the Swiss National Bank (SNB) Governing Board, Fritz Zurbrügg, presented cash’s lasting positive attributes and explained why it cannot be fully substituted by other paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods, The conference is being held in Basel 27 February through 1 March, 2017.

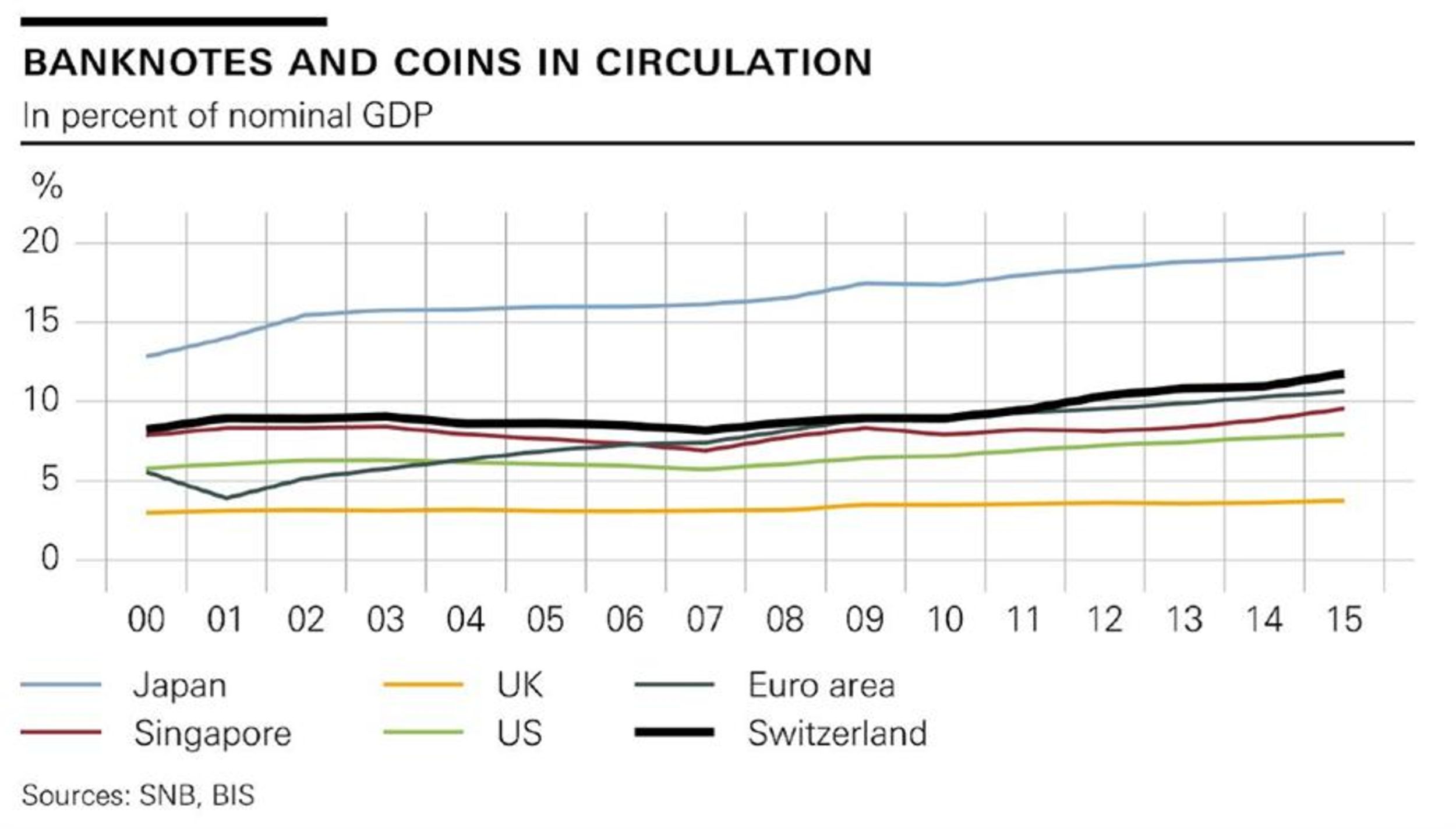

CashMoney in physical form such as banknotes and coins. More demand is growing globally, particularly since the financial crises of 2008, as the data in the table here below demonstrates.

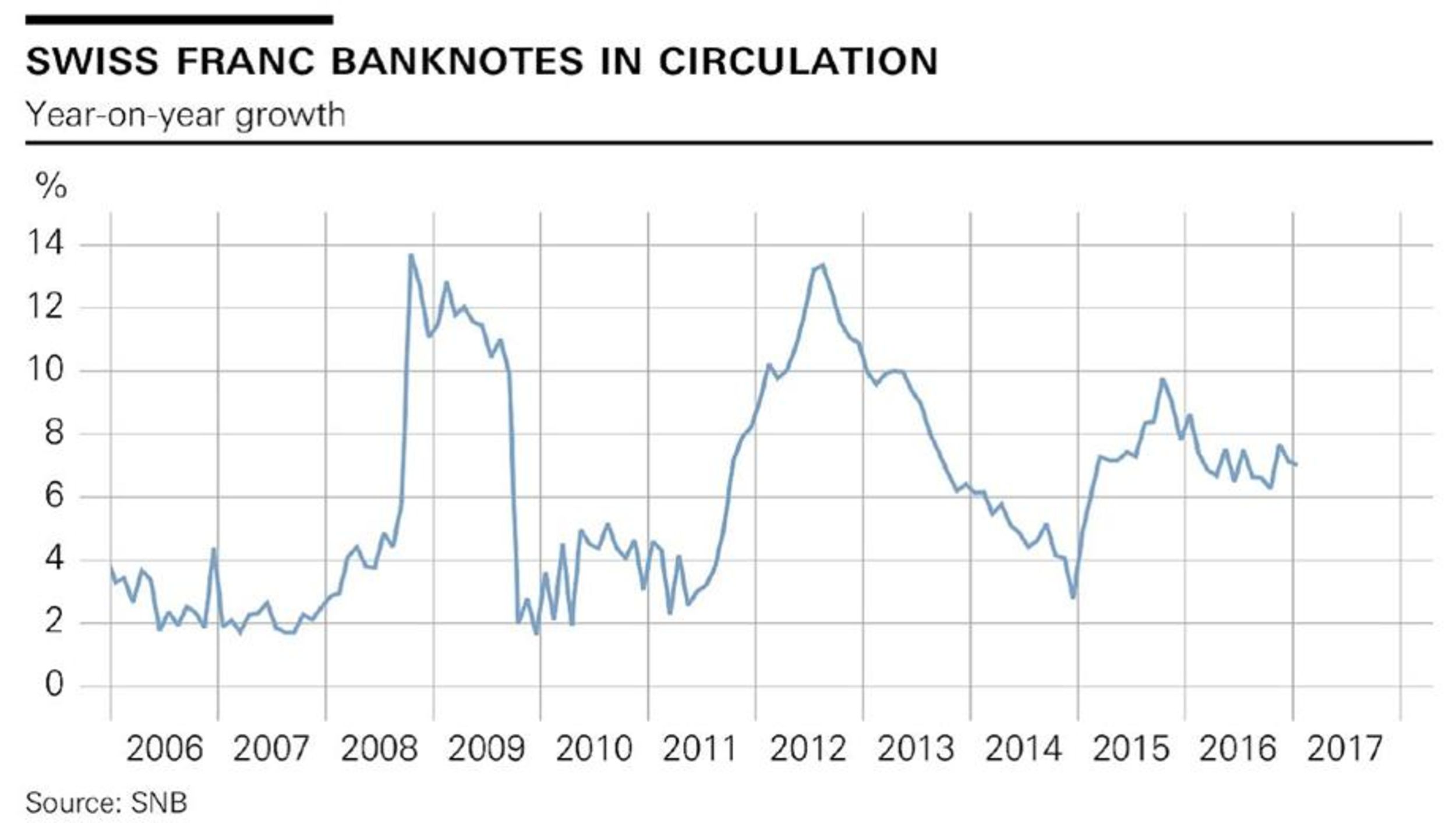

This trend is particularly visible in relation to Swiss data (table here below).

Yet, despite what these numbers show, cash’s strength is not limited to its utility as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More. There are numerous other attributes that no other payment methodSee Payment instrument. More can emulate. For example, cash is often cited as the ideal and most effective tool for household budgetary control. Also, it has an emotional value when for example offering a gift or when presenting the cultural highlights so beautifully illustrated on a banknote’s small surface – as can be seen on Switzerland’s new 50 CHF issued in 2016. Its anonymity, although frequently criticised, is something that no other payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More can provide in the digital age. “It offers the certainty that one’s privacy is protected,” says Zurbrügg. And, although this attribute is most often criticised and used for arguments in favour of cash restrictions, such as in the most recent case of the EU and €500, Zurbrügg retains that when the country’s legislation against fraud and money launderingThe operation of attempting to disguise a set of fraudulently or criminally obtained funds as legal, in operations undeclared to tax authorities, and therefore not subjected to taxation. Money laundering activities are strongly pursued by authorities and in most countries, there are strict rules for credit institutions to cooperate in the fight against money laundering operations, to declare and report any transactions that could be considered suspicious. More is strong as in Switzerland’s case, these issues aren’t even brought to the table.

Zurbrügg believes that the “freedom of choice exists only if the public has confidence in both cashless payments and cash” and that “as the physical embodiment of the quality and stability of a currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More, banknotes also play an important role in maintaining public confidence in the policies of the central bank.” This is also one of the central explanations why cash should not be abolished and why the SNB plans on pursuing its role of cash provider to the Swiss population.