Latin America: Financial Inclusion and CashTech Solutions

Financial Inclusion in Latin America

Financial exclusion is high in Latin America (see Chart 1). Many Latin Americans are unbanked (meaning they have no access to financial services) or underbanked (meaning they use very few financial services). Latin American banks tend to service the affluent and, until recently, had few incentives to reach out to other customers.

Chart 1. Latin America and the Caribbean: Selected Financial Inclusion Indicators, 2021 (as a share of the population age 15 and older)

Source: World Bank’s 2021 Global Financial Inclusion dataset.

The Fintech Boom in Latin America

Latin America is undergoing a fintech boom. Fintech solutions are buoyant due to a shift in consumer expectations, adopting fintech-friendly regulation, the Covid-19 pandemic, and efficient real-time payments, according to Andreessen Horowitz, a Silicon Valley venture capital firm.

While Latin America experiences a fintech revolution, most consumers remain conspicuous cash users. Thus, CashTech “could be very successful in Latin America [as] specialists are looking for ways to bridge the gap between the digital economy and the cash economy,” said Bernardo Bátiz Lazo, professor of fintech at Northumbria University and Universidad Anáhuac (Mexico) and member of CashEssentials’ Steering Committee.

Many incumbents and startups have launched CashTech solutions in the region. For example, the Swiss firm Sonect obtained a fintech license to operate in Mexico in August. Below are some examples of how technology improves the efficiency of the cash cycle and meets customers’ preferences for cash.

Banking Apps Offer Cardless Cash Withdrawals

Many banks have implemented cardless cash withdrawals through their apps. After entering the requested amount in their banking apps, customers receive a code or a QR to withdraw cash from ATMs without using cards (see Illustration 1). The Spanish bank BBVA offers this solution in Colombia and Mexico; the Spanish bank Santander provides this service to customers in Mexico.

Illustration 1. BBVA: Cardless Cash Withdrawals through App

Amazon: Your Cash is Welcome

The giant e-commerce platform Amazon allows users in the region to pay for goods with cash through solutions such as Amazon PayCode and Amazon Cash. In Mexico, Amazon has implemented cash payment solutions for users unwilling to pay with debit and credit cards (see Illustration 2).

Illustration 2. Amazon Mexico: “At Amazon, I pay how I want.”

OXXO: Retail and Cash Services

Retail chain OXXO provides cash and correspondent banking services in its more than 19,000 stores in Mexico. The chain has partnered with BBVA and Santander to offer cash-withdrawal services; it delivers cash remittances with Ria Money Transfer and allows customers to recharge their TeleVía road toll tags in cash.

OXXO also launched OXXO Pay in 2017. Users can pay Spotify Premium subscriptions and Amazon purchases in cash through the app. In November 2021, OXXO and the Mexican fintech startup ComproPago launched Spin by OXXO, a Visa debit card, and mobile app. Spin leverages OXXO’s retail infrastructure to expand into financial services.

The First Mobile ATM Network: Blink in Bolivia

“In a country with over 11 million inhabitants and 7 million smartphones, an innovation like this will change the lives of many people through massive financial inclusion.” – Marcelo Trigo, President of the Bolivian Banking Association.

Access to cash in Bolivia is difficult. There are few ATMs, and many consumers live far away from ATMs. In 2019, Blink partnered with the ad agency Ogilvy to convert taxis into roaming ATMs.

Users needing cash enter the amount in the Blink app. Cab drivers deliver cash using their funds. After each delivery, the driver receives a code to withdraw funds (plus a commission) from ATMs. Since its launch, Blink has earned many fintech awards.

Rappi: Cash Guarantees Access to E-Commerce

“We deliver everything from groceries, even cash. […] The idea was, how can we use technology to move things faster, how can we use technology to make the delivery or convenience store in 15 minutes? And that is how we started.” – Juan Pablo Ortega, co-founder of Rappi.

Since its foundation in Bogota in 2015, the digital platform Rappi has allowed users to pay using cash, giving “access to hundreds of thousands of people who had never partaken in ecommerce,” said Simón Borrero, CEO and founder of Rappi.

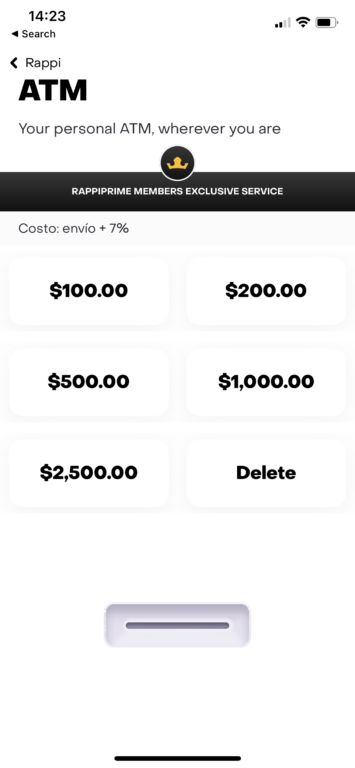

Early on, Rappi launched Rappi Cash, a cash delivery solution. Users with registered credit cards can request cash through the app’s ATM service (see Illustration 3). Rappi Cash is available in Argentina, Brazil, Chile, Colombia, Mexico, and Peru. HSBC offers free cash delivery services to clients in Mexico through Rappi.

Illustration 3. Rappi: Cash Delivery Service

Paying Online Purchases with Cash through Paysafe

In 2021, Paysafe acquired PagoEfectivo and SafetyPay, two solutions allowing underbanked consumers to make online purchases.

- Launched in Lima in 2009, PagoEfectivo provides users codes to pay using a digital wallet, internet/mobile banking, bank agents, and over 140,000 points of sale in Peru and Ecuador.

- Founded in Mexico City in 2007, SafetyPay is a non-card payment network of 380 banks and over 180,000 cash collection points in 16 countries across Latin America.