Moroccans Prefer Cash

Cash in Circulation grew by 7.2% in 2019

The report, which includes data for 2019, shows that cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More grew by 7.2 % in value in 2019 and 4.4% in value, a comparable figure to the previous year. In 2019 there were 1.8 billion banknotes and 2.8 billion coins in circulation.

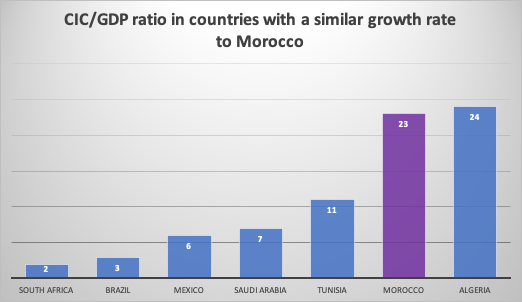

CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation represents 29% of M1 and 23% of GDP. The latter figure is high by international standards and is comparable to Japan (21% in 2018) and significantly higher than in the EuroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More area (11% in 2018) or India (15% in 2020). Bank al Maghrib compares the ratio in countries with a similar growth rate and finds that Morocco is only surpassed by Algeria.

Source: Bank Al Maghrib

The banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More denominationEach individual value in a series of banknotes or coins. More mix is dominated by the two highest denominations. The DH 200 banknotes represents 52% and the DH 100 36% of the total volume. In value, the DH 200, represents 73% of the total circulation.

Counterfeits continue to decline

The number of counterfeitThe reproduction or alteration of a document or security element with the intent to deceive the public. A counterfeit banknote looks authentic and has been manufactured or altered fraudulently. In most countries, currency counterfeiting is a criminal offence under the criminal code. More notes increased by 5.5% in 2019 to reach 9,575 pieces, with a value of 1.5 million dirhams versus 1.4 million dirhams in 2018. The counterfeit rate has continued to decline in 2019 and represents 5.2 counterfeits per million notes in circulation. The DH 200 is the most targeted denomination and represents 69% of detected counterfeits.

Digital Payments Grew by 4.8%

The overall number of digital payments increased by 4.8% compared to 2018 and amounted to nearly 272 million transactions, corresponding to a cumulative value of nearly 3,597 billion dirhams. This represents around 7.6 transactions per year and per person.

The report also highlights important progress in terms of financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More, measured by access to financial services and the number of bank accounts. Regarding access, the central bank estimates that the number of financial services access points increased by 15% in 2019. This includes bank branches, bank agents, financial services providers as well as cash-in/cash-out ATMs. The number of cash-in/cash-out ATMs more than doubled in 2019. The total number of access points increased by 78% since 2013. In spite of overall progress, a significant gap persists between urban areas with one access point for 1,023 adults and rural areas with one access point for 9,245 adults. The number of bank accounts exceeded 24 million, recording a 4.4% growth in 2019 (for a population of 37 million).