Netherlands: DNB calls on Stakeholders to Ensure Access to Cash

Trust in Cash is High

Cash payments have been declining steadily in the Netherlands over the past decade, and the pandemic has further accelerated the decline. According to a study by De Nederlandsche Bank (DNB) and the Dutch Payments Association, the share of cash payments in total POS payments fell from 65% in 2010 to 21% in 2020. In 2020 alone, the number fell by 11 percentage points.

Graph 1. Transactions (2a) and transactions value (2b) by payment method, 2010-2020. Source: DNB.

Source: DNB.

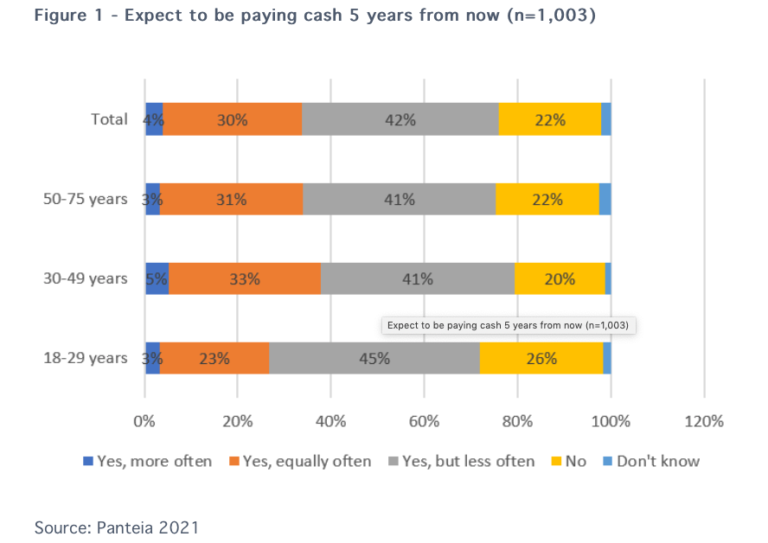

However, despite the declining use of cash for payments, the Dutch have retained their confidence in cash. According to a recent survey commissioned by the DNB, 76% of the population expect to pay in cash in five years. The figure varies only marginally across age groups, as illustrated by Graph 2.

Graph 2. Survey respondents expecting to be paying cash 5 years from now, by age group (18-29 years, 30-49 years, 50-75 years, total: 1,003).

An Industry Agreement to Ensure Access to Cash

DNB aims for agreements between the relevant stakeholders, since these offer more flexibility compared with regulation. DNB hopes that all parties concerned will be prepared to participate and honour the commitments they make – even though their interests in the cash payment system differ. After all, they have a shared interest: an efficient, accessible and secure payment system.

The number of ATMS in the Netherlands has peaked in 2008 and has since declined by over 40%. This is one the most important declines in the European Union, as illustrated by Chart 3.

Cash is the Only Fall-back Option

The DNB commissioned a study on the future of the cash infrastructure from McKinsey. The report distinguishes three distinct functions of cash:

- Fall-back. For the time being, cash is the only fall-back option in the event of failure in the electronic POS payment system – albeit only partly, due to the fact that the cash infrastructure is already shrinking.

- Inclusiveness. People in vulnerable groups are relatively often dependent on cash as a means of payment.

- Public money. Cash is a claim on the central bank and can be used by anyone wishing to do so.

The report foresees a further decline in the use of cash. This may become a problem in the event of disruptions in electronic payments, since cash functions as a fall-back option in such cases. In addition, it could be problematic for those who are dependent on cash as their main means of payment. Cash, moreover, is public money, which means everyone should be able to use it. The report explores ways to improve the efficiency of the cash infrastructure and addresses its costs and funding. It also highlights various measures that could be used to guide its future development in the right direction. McKinsey recommends that alternative, digital means of payments are developed to function as fall-back options.

DNB endorsed this recommendation and has submitted the conclusions to the House of Representatives. However, before cash as a fall-back instrument can be replaced by digital means of payment, the latter need to be widely available and accessible to everyone (inclusiveness). DNB advises the cabinet to think about what this will mean for the role of the government with regard to the cash infrastructure once this point is reached. While it is understandable that banks pass on the cost of payments to their customers, they should take care not to place the burden on the users of cash. DNB is of the opinion that banks’ efforts to combat money laundering and fraud should not hamper the legitimate use of cash or obstruct the accessibility of the cash payment system. Many retailers continue to accept cash, and DNB considers it important that this remains the case. Security therefore deserves continued attention from all parties in the cash chain.

Access to cash is a core element of the European Commission’s 2020 Retail Payment Strategy and Member States are expected to ensure that citizens have access to cash services. One approach, according to the report, is to provide minimum ATM coverage or equivalent means of access throughout the territory.

Some countries – as the Netherlands – have been following a collaborative approach between the industry and regulators. In Lithuania, the central bank and financial actors signed a Memorandum of Understanding in the summer of 2021 to ensure the availability of cash services.

Others are following a regulatory approach. In Sweden, for example, a law came into force at the beginning of 2021 that obliges the largest Swedish banks to ensure adequate access to cash services throughout the country .