New Zealand: Cash after the Cyclone

Cyclone Gabrielle Hits New Zealand’s Payments Infrastructure

“When people lose the ability to transact, when they don’t have a means of exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More, then social cohesion is very quickly challenged. There’s nothing more distressing than seeing a café serving hot coffee beside a bank whose ATM doesn’t work – one had a generator.” – Adrian Orr, RBNZ’s governor.

On February 13 and 14, Cyclone Gabrielle hit New Zealand, leaving at least 11 people dead, displacing thousands, and cutting power to 225,000 residents. ATMs in many towns went down.

- The National Emergency Management Agency (NEMA) advised residents to keep cash if electronic funds transfer at point-of-sale (EFTPOS) and ATMs went down.

- After a five-hour trip to collect supplies and cashMoney in physical form such as banknotes and coins. More in Tauranga, a man distributed more than 3,000 New Zealand dollars (NZD) in Ruatoria. This town lost its last bank branch in 2015. “I’ve been the Ruatoria ATM. […] I suggest we should all have a little amount of cash set aside at home if possible,” said the Ruatoria man.

Cash industry incumbents, including the Reserve BankSee Central bank. More of New Zealand – Te Pūtea Matua (RBNZ), commercial banks, cash service and security companies, ATM providers, and maintenance firms, worked to restore cash services.

- The RBNZ published a list of bank branches and ATMs in operation after the cyclone. “We are doing everything possible with industry and emergency response to support across the cash system. […] Keeping working machines full is a priority,” said Ian Woolford, RBNZ’s director of MoneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More and Cash.

- Banks were “quick to offer customer support including cash payments, reduced loan repayments, waived fees, access to term deposits, and donations to flood relief funds,” said Roger Beaumont, CEO of the New Zealand Banking Association – Te Rangapū Pēke.

Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More and Te moni anamata (the Future of Money)

In 2020, the RBNZ established a new department to protect the role of cash in payments and plan for the future of money in New Zealand. The Money and Cash Department (Tari Moni Whai Take) develops guidelines for the RBNZ’s work in money and cash, investigates the role of a central bank digital currency (CBDC)A digital payment instrument, denominated in the national unit of account, and a direct liability of the central bank, like banknotes. A general purpose CBDC can be used by the public for day-to-day payments like cash. More and digital private currencies, and improves the efficiency and sustainability of the cash system.

According to the RBNZ’s Future of Money – Cash System Redesign issues paperSee Banknote paper. More (2022: 25, 55),

- Cash in the hands of the public has increased nearly five-fold since 1995 and more than doubled since 2010.

- Adjusting for population growth and inflation, cash in the hands of the public has increased by 155% since 1995 and 59% since 2010 (see Graph 1). That increase represents a 3.7% average annual growth rate since 1995 and 4.3% since 2010.

- By volume, the number of banknotes has grown 65% between 2010 and 2022, from 149 to 246 million pieces.

Graph 1. New Zealand: Cash in the Hands of the Public, 1995-2021 (2017 prices, NZD per person).

Source: RBNZ (2022: 55).

PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Habits

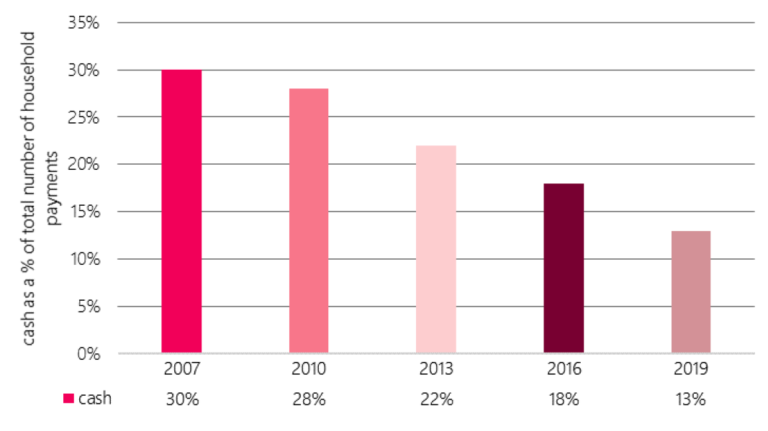

The use of cash in retail payments has declined steadily since 2007, per N.Z.’s Household Economic Surveys (see Graph 2). The share of cash in household payments declined 56% between 2007 and 2019 (RBNZ 2022: 23).

Graph 2. New Zealand: Use of Cash in Household Payments, 2022

Source: RBNZ (2022: 23).

Cash Infrastructure

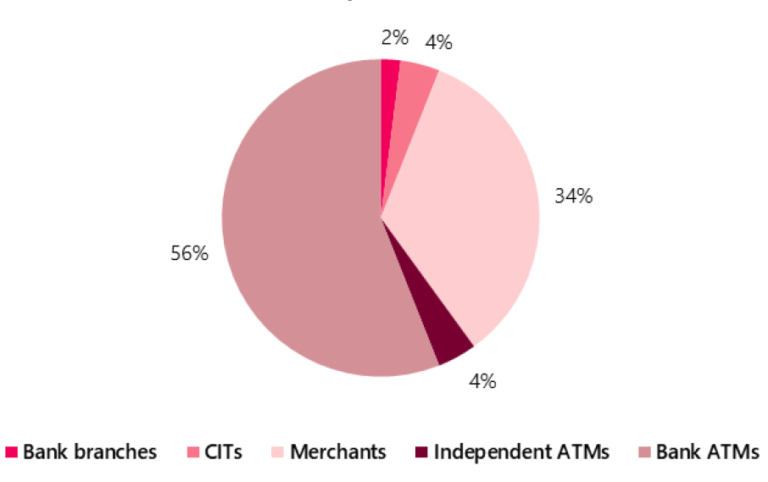

Per the RNBZ (2022: 11-12), there is a significant mismatch between sources and recipients of cash in New Zealand (see Graph 3, panels A and B). Bank ATMs and merchants are the primary sources of cash, with 56% and 34% of cash withdrawals respectively; bank branches are the leading recipients of cash, with 50% of all cash deposits.

Graph 3. New Zealand: Sources and Recipients of Cash, 2022

A. Sources

B. Recipients

Source: RBNZ (2022: 11, 12).

New Zealand’s banking and cash infrastructure has declined since the mid-2010s. ATMs and branches for the five major banks have reduced markedly since 2017 (see Graph 4). These banks have closed 42.3% of branches and 9.6% of ATMs since 2017 (RBNZ 2022: 13, 24).

Independent ATMs have increased in rural communities lacking back branches. In 2020, six banks launched regional banking hub pilots in four towns: Opunake, Twizel, Martinborough, and Stoke.

Graph 4. New Zealand: Top Five Banks’ Branches and ATMs, 2011-2022

Source: RBNZ (2022: 13).

In a November 2022 speech, Karen Silk, RBNZ’s assistant governor, stressed the importance of “exploring policies that support merchants having an expanded role in cash distribution to augment the current and shrinking commercial bank-centric cash system.” Silk added:

“This could include supporting merchants:

- to recycle cash at point-of-sale,

- by remunerating them for cash out services,

- by facilitating frequent, affordable cash delivery and collection for merchants,

- through consolidation within the cash system with the creation of utility entities.”

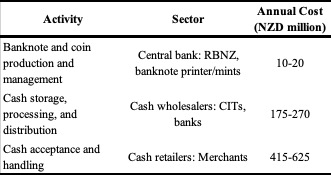

Cash System Costs

The RBNZ estimates New Zealand’s cash system annual costs at NZD600-900 million (see Table 1 and Graph 5). Most charges accrue to merchants accepting and dispensing cash (NZD415-625 million), followed by banks, cash-in-transit companies (CIT), and the Reserve Bank storing, processing, and distributing cash (NZD165-255 million).

Table 1. New Zealand: Cash System Costs, 2022

Source: RBNZ (2022: 70-71).

Cuadro 1. Nueva Zelandia: Costos del sistema de efectivo, 2022

Fuente: RBNZ (2022: 70-71).

Graph 5. New Zealand: Cash System’s Costs Allocation, 2022

Source: RBNZ (2022: 26).

Cash and Financial InclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More

“Any reduction in the availability of cash and branch closures will impact certain pockets of society more than others. It is important that financial institutions maintain a strong focus on financial inclusion, finding ways to service and support those less able to access the electronic channels.” – Geoff Bascand, RBNZ’s deputy governor.

While New Zealand has achieved high levels of financial inclusion, cash remains critical for people living with illness, those going through stressful life events (“including but not limited to natural disaster and pandemics, and family breakdowns”), seniors, people recently released from prison, and those requiring transitional housing (RBNZ 2022: 60-62).

Low-income households, those receiving government support, or those identifying as Pacific people or as Māori tend to rely heavily on cash (RBNZ 2022: 26-27, 66-68):

- By income level, households in the lowest three income deciles (making less than NZD26,089) used cash in over 20% of their payments.

- By income source, households receiving government benefits and N.Z.’s supper annuations used more cash in payments (31% and 22%, respectively).

- By household composition, one-person households (23%), other one-family households, and single parents with dependent children (16% each) used the most cash.

- By ethnicity, Pacific and Māori households used cash most intensively in payments (21% and 16%, respectively).

Cash and the Resilience of Payments

While a reliable cash system increases the resilience of New Zealand to climate changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More, a shrinking cash infrastructure increases its vulnerability:

- “Disruption caused by climate-related events can create spikes in demand for cash that are difficult to manage. Moreover, the cash system itself has a significant carbon footprint due to the need to transport cash around New Zealand” (RBNZ 2022: 25).

- “[During natural disasters] cash becomes incredibly important as the primary form of payment. Having resilient distribution is important,” said Karen Silk, RBNZ’s assistant governor.