Nigeria: Notes Redesign and a Cash Crunch

On October 26, 2022, the Central Bank of Nigeria (CBN) announced it would replace its three highest denominationEach individual value in a series of banknotes or coins. More notes within four months. The redesign of the 200 Nairas (NGN, equivalent to USD0.43), NGN500 (USD 1.08), and NGN1,000 (USD 2.17) notes would “check counterfeiting, strengthen the economy, reduce the expenditure on cash managementManagement and control of cash in circulation. More, promote financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More, and enhance the CBN’s visibility of the moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More supply,” according to a CBN brochure.

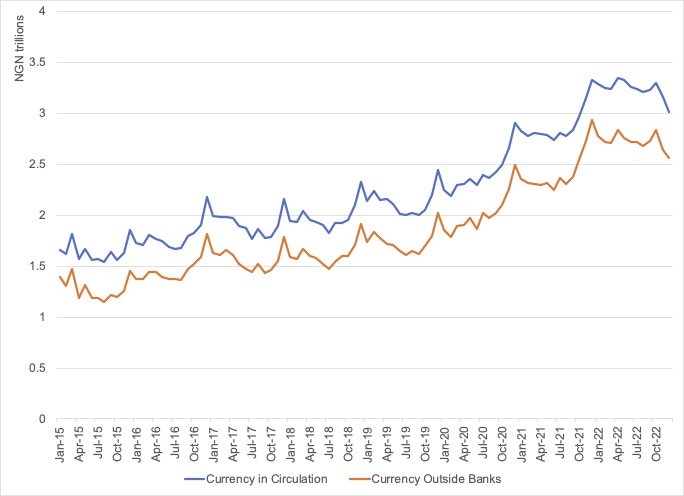

The CBN sought to reduce the cashMoney in physical form such as banknotes and coins. More reserves hoarded by the public outside the financial system. CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation has more than doubled in Nigeria since 2015 (see Graph 1). Currency outside Nigerian banks rose from NGN1.46 trillion in December 2015 to NGN 2.83 trillion in October 2022.

Graph 1. Nigeria: Currency in Circulation, January 2015-December 2022 (NGN trillions)

Source: CBN Money and Credit Statistics (2023).

Digital Payments and Financial Inclusion

The new notes would help “entrench the cashless economy,” said Godwin Emefiele, the CBN governor. During the cash swap,

- The CBN encouraged Nigerians “to explore other paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More channels such as eNaira, POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More, electronic transfer, USSD, internet banking, and mobile money operators.”

- CBN branches advised Nigerians in “unbanked, underserved, and rural areas” to exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More their old notes by opening banking accounts and digital wallets with 30,000 “Super Agents.”

Most Nigerians use cash and have not adopted digital payments.

- Less than 5% of Nigerians use the eNaira, the country’s CBDC launched in 2021.

- According to the World Bank’s Global Financial Inclusion Database, in 2021,

- 45.3% of Nigerians (age 15 and older) had a financial institution account.

- 35.3% owned a debit card, and just 1.6% had a credit card,

- 33.7% had made or received a digital payment,

- 32.4% used a mobile phone or the internet to make payments, buy things, or send or receive money using a financial institution account.

The Cash Swap Program

On January 23, 2023, citizens would get “newly redesigned notes and notes of lower denominations” by depositing their old banknotes at commercial banks without charges. The CBN instructed banks to “load new notes into their ATMs nationwide” of “denominations of “NGN200 and below only” and set up cash withdrawal limits (see Table 1). As of January 29, the CBN had collected about NGN1.9 trillion in old notes.

Table 1. Nigeria: Limits to Cash Withdrawals for Cash Swap (NGN)

A Cash Crunch

The old Naira notes would lose legal tenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More status on January 31. However, the CBN began supplying the new notes to banks only in December, leading to a cash shortage.

Some businesses have stopped accepting old notes. Nigerians make long lines to get new notes at ATMs, bank branches, and point-of-sale (POS) operators. Banks in Lagos and Abuja limit cash withdrawals to NGN10,000 (USD 21.71) per customer. Uber drivers cancel trips if passengers don’t pay in cash.

- A bank chief told the Financial Times that the CBN did not supply banks with enough new notes. Nigeria’s Economic and Financial Crimes Commission accused bank officials of “sabotage of the government’s monetary policy.” President Buhari has said the banks were “inefficient [and] only concerned about themselves.” CBN Governor Godwin Emefiele blamed banks for the scarcity of new naira notes.

- “Banks are not doing a good job distributing the money. Bank managers have been keeping a lot of the money aside for people with connections and for the rich, misusing the central bank’s policy,” said Yemi Makinde, a policy analyst.

- “I’m angry — it’s my own money I came to collect, not a loan,” said Japhet Joshua Babatunde, a Lagos resident.

- “They made us put all our money into our accounts, and now we can’t access it. It’s unbearable. […] The banks won’t let me get my money,” said Osarenoma Kolawole, 40.

- “We urge [Nigerians] to exercise patience as the CBN is working assiduously to address the challenge of queues at ATMs,” said Osita Nwanisobi, corporate communications director at the CBN.

The cash crunch is causing widespread anger and social unrest, with rioters blocking roads in Ibadan, Benin City, and Warri.

- “I can’t go to the market, because they want cash. Buses want cash – now I have to treck everywhere. There’s no money to buy stock, so I have less products to sell. There are even less customers,” said Lilia Ineh, 26, a hairdresser.

- “I do not know how I will get home tonight because I do not have cash,” said David Aghamelum, a 25-year-old computer technician.

- “The two critical sectors of the economy — trade and commerce as well as agriculture — have been very badly affected because they do a lot of transactions in cash, especially in rural areas. […] Economic activities have been practically crippled as some people have locked their shops,” said Muda Yusuf, head of the Nigeria Center for Promotion of Private Enterprise.

The International Monetary Fund (IMF) advised Nigeria “to consider extending the deadline [to replace old notes], should problems persist.” On January 29, the CBN extended it until February 10, and Nigeria’s Supreme Court extended it until February 22.

A Digital Payments Fiasco

The CBN insisted it is working “assiduously to increase the circulation of the new notes” and denied a shortage of printing materials caused the delay. While the CBN encourages Nigerians “to embrace and adopt other payment channels,” digital payments have been unable to mitigate the cash crunch:

- “Someone might want to transfer funds to you, but it can’t be processed and they don’t have cash because of this issue,” said Chima Ekwueme, a car-parts seller in Abuja.

- “All my customers are saying they don’t have cash, they will pay using a bank transfer, but I go to the bank and there’s no cash for me to collect. So what do I do?” said Iya Ruka, 52, a plantain seller in Lagos.

- “Nigerian banks don’t have the capacity or structure to make digital payments work seamlessly,” said Paul Alaje, a senior economist at management consulting firm SPM Professionals. Several bank servers are failing, per CNN.

- “[The CBN] doesn’t want us to be spending cash; they want us to be doing transactions electronically, but you can’t legislate a changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More in behavior. You have to make people see reasons and ensure those channels are reliable,” said Ayokunle Olubunmi, an analyst with Agusto and Co., a rating agency.

A Political Rationale?

The cash shortage has raised withdrawal commissions and created a black market for the new Naira notes at inflated prices. The CBN said the Police, tax, and financial authorities would prosecute those who “hawk, sell or otherwise trade in” the newly redesigned banknotes.

The cash shortage happened shortly before the presidential and parliamentary elections on February 25. “The new currency voids old banknotes stored by politicians to buy votes in the upcoming general elections,” said Rafiq Raji, a senior associate with the Africa program at the Center for Strategic and International Studies.