Nigeria Sees Double-Digit Growth in Cash in Circulation

Early in the Covid-19 Pandemic, the Central Bank of Nigeria and the Banking Community Encouraged the Use of CashMoney in physical form such as banknotes and coins. More Alternatives

The Central Bank of Nigeria (CBN) urged the public to limit their use of cash and employ digital alternatives in March 2020, as the Covid-19 pandemic reached Nigeria. The measures seemed to strengthen the CBN’s bias towards cashless payments, manifest since at least 2012.

Isaak Orafor, the CBN spokesperson, said it was “advisable for Nigerians to adopt alternative paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods and be wary of cash or Automated Teller Machines” as Nigerian naira (NGN) banknotes were “one surface that people touch every day. It will be wise for us to wash hands after handling moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More, especially if you are eating or touching food.”

The Chartered Institute of Bankers of Nigeria added that “individuals should explore online means of payment […] as it is possible for respiratory droplets to fall on cash held as well as ATM Machines.” The Institute said that further efforts were needed to sensitize “small businesses and petty traders in particular on the use of electronic/virtual means of payment [as] crucial [efforts] to prevent the spread of the virus.”

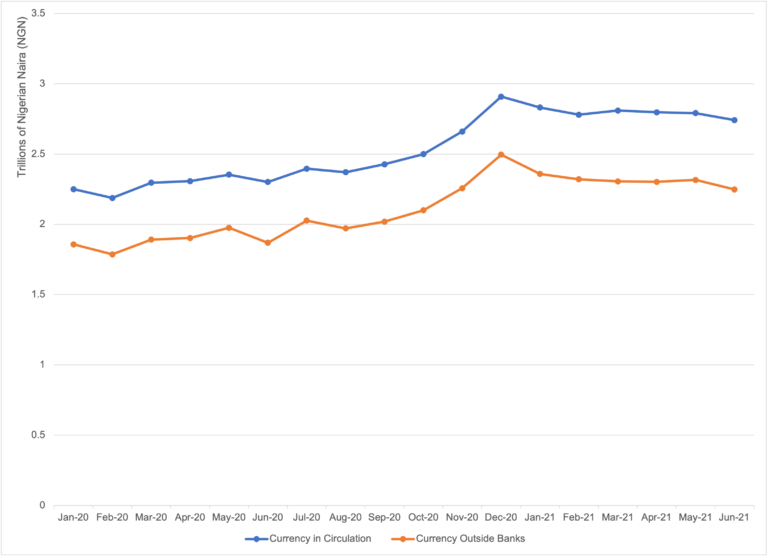

CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in Circulation Grew by 22.32% between March 2020 and March 2021

Despite the CBN’s advice, currency in circulation increased by 22.32% during the first year of the pandemic (March 2020-March 2021). Currency outside banks grew by 21.93% in the same period, according to CBN data.

Graph 1. Nigeria: Currency in Circulation, January 2020-June 2021

Source: CBN Money and Credit Statistics (2021); CashEssentials.

The Contours of Financial Exclusion in Nigeria

According to a 2020 survey by NGO Enhancing Financial Innovation & Access (EFInA),

- Nearly 38.1 million Nigerian adults –35.9% of the country’s population– are financially excluded. Half of the adults (50.5% or 106 million people) use formal financial services, while informal financial services cover about 14.4 million (13.6 %).

- Men tend to be more banked (51%) and financially included (69%) than women (39% and 60%, respectively).

- Urban Nigerians are more banked (66%) and financially included (80%) than rural Nigerians (34% and 56%, respectively). Only 38% of adults in rural areas live near a financial access point.

Digital Payments Growth During the Pandemic

The press has reported a decline in ATM transactions, although official data is lacking to verify these assertions. According to Uju Ogubunka, president of the Bank Customers Association of Nigeria (BCAN), this might have resulted from “the impact of Covid-19 on the economy, which has impaired income and created loss of jobs leading to a high unemployment rate; […] the economic recession; […] ATM dispense error; fraud.” The Association of Mobile Money and Bank Agents (AMMBAN) attributed the decline to an expansion in “alternative channels for payment asides cash” and “the state of the economy.”

New Payment Instruments Bring New Risks

According to Mastercard’s New Payments Index survey of May 2021, 96% of Nigerian consumers were likely to consider an emerging payment methodSee Payment instrument. More in 2022, including contactless payments, wearables, biometrics, digital wallets, digital currencies, and QR Codes. The survey also found that 86% of consumers reported having access to more ways to pay than the first quarter of 2020.

However, the acceleration in digital payments has also brought an increase in digital criminality. In April 2020, the CBN alerted the public that cyber-criminals were employing phishing campaigns, relief package scams, and impersonation to “defraud citizens, steal sensitive information, or gain unauthorized access to computers or mobile devices using various techniques.”

“Only through concerted efforts […] can we then eliminate, reduce or ensure adequate measures are taken to combat cybersecurity challenges.” said Abumere Igboa, chairman of the Committee of Chief Information Security Officers of Nigerian Financial Institutions.

The Fintech Space in Nigeria: Dangers Lurking?

According to a recent McKinsey report, the Covid-19 pandemic and the acceleration in digital payments represents “an untapped opportunity to convert the underbanked and unbanked to fintech solutions and unlock the economic and social benefits that this promises.” However, the consultancy says little or nothing about the potential for incumbents to capture larger market shares through partnerships and investments from global digital payment giants.

- In November 2019, Visa acquired a minority stake in Interswitch, which valued the Nigerian fintech at over USD1 billion. Interswitch owns Verve, the main card scheme in Nigeria and the Quickteller app. The payments firm has expanded to Uganda, Gambia, and Kenya.

- In January 2020, FIS and Visa were part of a consortium investing in business-to-business (B2B) payments firm Flutterwave. Flutterwave also signed commercial agreements with Visa and FIS, allowing it to use various products to grow its consumer payment service (Barter) and merchant acquiring service (Rave).

- In March 2020, Paga signed a deal with Visa to offer near-field communication (NFC) payments and QR codes. At the time, the firm had over 14 million users and a network of 24,840 agents. On the deal, Otto Williams, Visa’s head of Strategic Partnerships, Fintech, and Ventures for Africa, said, “We want to digitize cash, that’s a strategic priority for us. We want to expand merchant access to payment acceptance and we want to drive financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More.”

- In October 2020, U.S.-based Stripe acquired the payments API firm Paystack for over USD200 million. At the time, Paystack had around 60,000 customers. Paystack had already received funding from Stripe, Visa, and Tencent in its 2018 funding round.

CBN Launches Digital Currency Pilot

The Nigerian central bank plans to launch a digital currency pilot later this year, according to Rakiya Mohammed, director of the Information Technology Department. “The Central Bank digital currency will just be as good as you having cash in your pocket and even as you have the cash in your pocket, you are going to have the cash on your phone,” said Mohammed.

The CBN’s enthusiasm for the pilot contrasts with its stance towards cryptocurrencies. In 2017, the CBN prohibited commercial banks from using cryptocurrencies; in 2020, the CBN mandated commercial banks to close the accounts of clients transacting in crypto exchanges. However, as of 2021, Nigeria is the 6th country in crypto adoption and might have the largest crypto market in the world in terms of retail users doing transactions under USD10,000.