Palestine: Card and Digital Payments

The Precarious Palestinian Economy

The Palestinian economy is highly dependent on external support. The Israeli government has restricted the movement of goods and people into and out of Gaza since Hamas came to power in 2007 (World Bank 2023a: 17). The official unemployment rate in Gaza is 46%.

Palestinian GDP fell 11.3% in 2020 due to the economic impact of the Covid-19 pandemic. Before the current Israel-Hamas war, the World Bank (WB) and the International Monetary Fund (IMF) expected Palestinian economic growth to soften this year.

In 2022, the GDP per capita in Gaza was estimated at USD1,257, while the GDP per capita in the West Bank was USD4,458. Nearly half of the Gazan population live below the upper-middle income poverty line, compared to less than 10% in the West Bank (World Bank 2023b: 1).

Financial InclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More in the West Bank and Gaza

The Palestinian economy is well behind others in terms of financial inclusion. According to the World Bank’s Global Financial Inclusion database in 2021,

- 33.6% of Palestinians aged 15 and older had an account at a financial institution,

- 21.4% of the target population had at least one debit card, and 3.6% had a credit card,

- 20.9% had made or received digital payments,

- 2.33% had a mobile moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More account. In 2020, 2.05% used a mobile phone or the internet to access a financial account.

According to the World Bank’s World Development Indicators, in 2021:

- There were 77.6 mobile phone subscriptions per 100 Palestinians.

- 81.8% of the population used the internet. The number increased to 88.6% in 2022.

PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Cards

Per the Palestinian Monetary AuthoritySee Central Bank More (PMA), there were 1,623,963 payment cards in the West Bank and Gaza in 2022 (PMA 2023: 88). Debit cards comprised 80.6% of the total; ATM withdrawal cards were 13.5% and credit cards reached 5.9%. Debit cards grew rapidly in 2017, at a rate of 27.1%; ATM withdrawal cards declined between 2016 and 2018 but have grown at double-digit rates since 2021 (see Graph 1).

Graph 1. Palestinian Territories: Payment Cards (Millions), 2014-2022

Digital Payments

The PMA has sought to increase electronic payments and reduce the use of cashMoney in physical form such as banknotes and coins. More since 2019 (PMA 2020: 63, 2021: xi).

- The PMA launched an electronic clearance system in 2021, and it planned to launch a real-time payment system in 2023 “to reduce reliance on cash by offering interconnected and widely accessible payment channels at lower costs, thereby promoting financial inclusion.” (PMA 2022: 52, 2023: 39).

- The PMA has abandoned plans to issue banknotes and coins to explore the possibility of issuing a digital currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More “to tackle economic issues, reduce reliance on cash, and address Palestine’s political challenges” (PMA 2023: 47).

- Last year, the PMA promoted card payments with ATM withdrawal cards by exempting gas stations from paying merchant fees for a year on point-of-sale (POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More) terminals: as of 2022, 80% of gas stations in the West Bank had POS terminals (PMA 2023: 41, 52).

E-wallets

As part of its digital payments strategy, the PMA has authorized five companies since 2020 to provide electronic payment services, including e-wallets, prepaid cards, POS terminals, and mobile financial services (PMA 2021: 56).

In 2021, e-wallets had 234,083 users with balances of US$2.6 million; last year, there were 418,000 e-wallet users with $2.1 million in funds (PMA 2022: 84, 2023: 70). Gaza has the most e-wallet users (55%), while e-wallets in the West Bank has the most funds (53%, see Graph 2).

Graph 2. Palestinian Territories: Geographic Distribution of E-Wallets, 2022

Source: PMA (2023: 70).

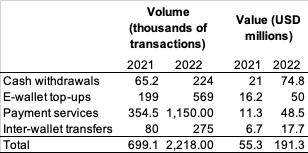

In 2022, cash withdrawals were the most significant component of e-wallet transactions by value, and payment services were the largest by volume (see Chart 1). Cash withdrawals comprised 9.3% by volume of e-wallet transactions and 38% by value in 2021; both shares increased in 2022 to 10.1% by volume and 39.1% by value.

Chart 1. Palestinian Territories: E-Wallet Transactions, 2021-2022

The Case of Palestinian Workers in Israel

“The permit is everything for me, it is my life. If permits stop I will stop.” – Bilal Al-Najar, a Palestinian restaurant worker from Gaza in the southern Israeli city of Lod.

Israel had issued over 18,000 work permits to Palestinians in Gaza, who brought some $2 million a day back to the enclave. Less than half of the monthly earnings of Palestinian workers in Israel (estimated at NIS1 billion) is paid through bank transfers (IMF 2023: 9).

The PMA has promoted a cashless payment system for Palestinian workers in Israel to receive their earnings through Palestinian bank accounts. As of 2022, more than 90 thousand workers had joined the scheme (PMA 2023: 52). Adoption is slow due to delays in verifying workers’ legal status and onboarding them into the system.

Connectivity Outages in Gaza

Israeli airstrikes in response to the Hamas attack of October 7 have damaged or destroyed most of the electricity and communications infrastructure in Gaza, disrupting mobile and internet services.

On Friday, October 27, in the evening, two Palestinian mobile networks, Jawwal and Paltel, reported their services were down. The Gaza strip experienced “a collapse in connectivity,” according to Netblocks, a firm that tracks internet service worldwide.

The blackout lasted throughout the weekend as Israeli forces expanded ground operations in Gaza. Internet service showed “indications of recovery” by Sunday, October 29. “The situation is still very precious: no power, little water. Service could potentially drop out again at any time,” said Doug Madory, director of internet analysis at Kentik.

On November 25, during the temporary truce between Israel and Hamas, Netblocks reported a recovery in internet connectivity in Gaza, “corroborating today’s telco statement that crews have been able to start repair work on damaged segments of the network.”