Australia: Electronic Payments Increase Inequality and Costs

The Payments Mix in Australia

“Australians have been following the fashion cycle towards cashless-ness, but there is still this contingent of Australians who use it. The statistics […] don’t actually capture all of the use of cashMoney in physical form such as banknotes and coins. More in our society. Do they capture when a parent gives an allowance to a child […] or when somebody is simply holding cash to feel safer, feel secure? […] It would increase inequality to prohibit cash, to go all the way.” – Gigi Foster, professor of economics at the University of New South Wales (1:36-2:16).

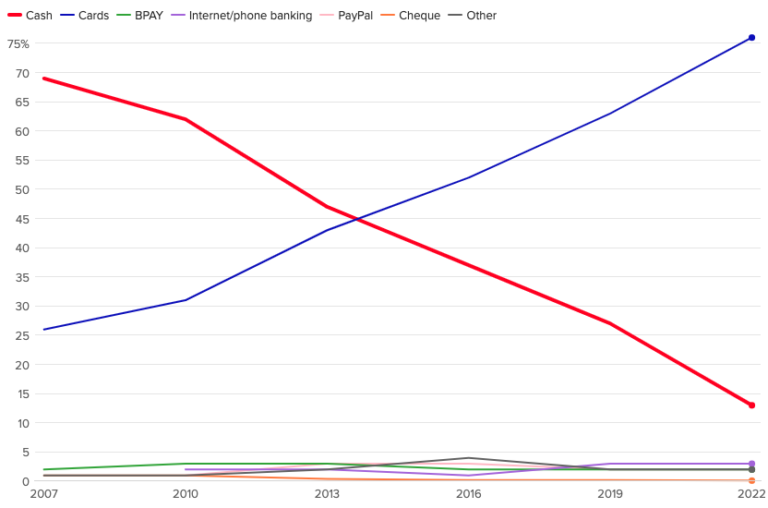

According to the Reserve BankSee Central bank. More of Australia (RBA)’s 2022 Consumer Payments Survey (CPS), Australians use cash less frequently (see Graph 1). The share of cash in retail payments declined from 69% in 2007 to 13% in 2022, while the share of cards increased from 26% to 76% (Nguyen, Watson 2023: 22).

Graph 1. Australia: Consumer PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Methods, 2007-2022.

Source: Nguyen, Watson (2023: 22).

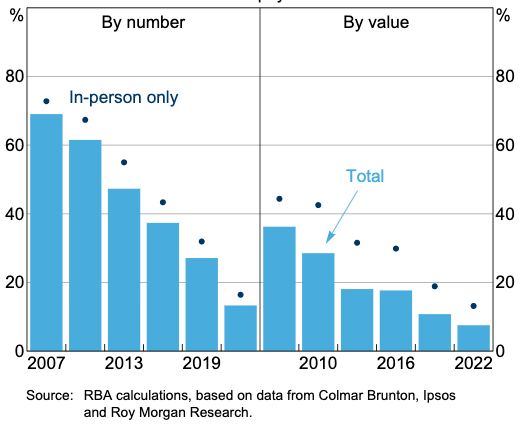

By number, the share of cash in Australian payments halved from 32% in 2019 to 16% in 2022, reflecting the impact of the Covid-19 pandemic on payments behavior (Mulqueeney, Livermore 2023: 30-31). By value, the decline in the cash share was more modest, going from 19% in 2019 to 13% in 2022 (see Graph 2).

Graph 2. Australia: Share of Cash in Payments, 2007-2022

Source: Mulqueeney, Livermore (2023: 31).

Cash Users in Australia

“Any society can embrace changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More but you’ve always got to bring everybody with you, and the concern is we’re leaving a cohort behind by racing towards this digital economy. It would be good to see a number of banks across the country start to really look at their customers that have been customers for 40, 50, 60 years.” – Chris Grice, National Seniors Australia CEO.

While the decline in cash use has crossed demographic groups, seniors, lower-income households, and rural inhabitants are likelier to be high cash users (see Graph 3).

Graph 3. Australia: Cash User Groups, 2022

Source: Mulqueeney, Livermore (2023: 32).

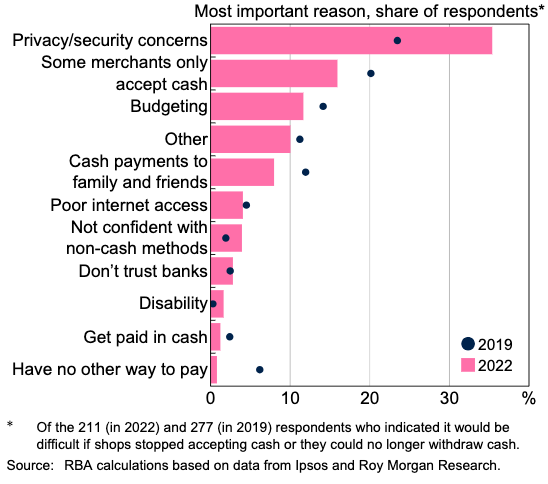

Heavy cash users prefer to use cash due to privacy and security concerns, followed by merchants only accepting cash in payments, and budgeting (see Graph 4).

Graph 4. Australia: Reasons to Use Cash, 2022

Source: Mulqueeney, Livermore (2023: 32).

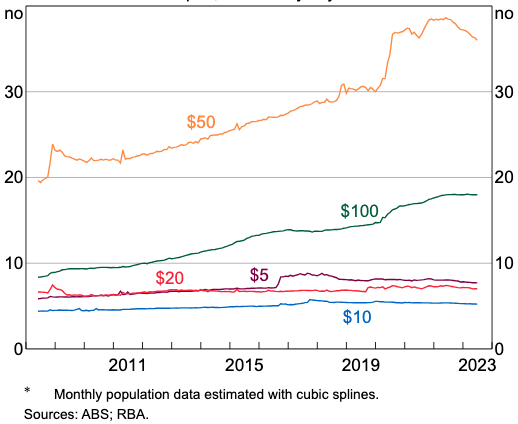

The transactional demand for cash and the cash infrastructure have contracted, but the precautionary demand for cash has grown, as Australians demand cash as a store of wealth. Between 55% and 80% of all banknotes in circulation are hoarded in Australia and abroad (Elkington, Guttman 2024: 2). Since 2007, high-denomination notes ($50 and $100) have grown strongly, while low denominations have grown more slowly (see Graph 5).

Graph 5. Australia: Banknotes in Circulation, 2007-2023

Source: Elkington, Guttman (2024: 2).

Card Payments and Credit Card Surcharges

Debit cards have become the main payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More in Australia: their share in payments went from 15% in 2007 to 51% in 2022 (see Graph 6). The share of credit and change cards in payments increased from 11% in 2007 to 26% in 2022 (Nguyen, Watson 2023: 22).

Graph 6. Australia: Cash and Card Payments, 2007-2022

Source: Nguyen, Watson (2023: 23).

Recent outages have affected card payments in Australia, such as Optus’s failure in November 2023 and the ANZ Worldline outage in February 2024. During the Optus outage, “we lost sales because […] the phones were down, so people couldn’t put through their orders […] and because people couldn’t pay by card,” said Hanede Rabah, manager of a Halal store in Melbourne.

Australian merchants are charging credit card surcharges to make up for the costs passed on by banks and credit card companies, like those in the United States. These costs add about 1-1.5% to the purchase price.

- After paying for lunch with her credit card, Queensland resident Alera noticed a $7.80 surcharge (10% of the bill) after the restaurant emailed her the invoice. “There was still another fee on top of that, a processing fee. I thought it was a mistake and they’d look and give us a refund or a free drink, but the waiter said, ‘Oh no that’s our Eftpos [payments terminal] fee’. Do they want people to pay with cash? It’s just exorbitant,” said Alera.

Australian customers are also paying extra for the “convenience” of using QR menu apps at restaurants.

- “I was directed to a QR code menu on the table. Meanu proceeded to charge a 6.5% venue surcharge, a 2% payment-processing fee, and then had the audacity to ask for a tip. [Technology is] only making everything worse and more inconvenient for everybody,” ranted a diner on social media.

Seniors and Cheques

The share of cheques in payments declined from 1% in 2007 to 0.1% in 2022 (Nguyen, Watson 2023: 22). Last year, Australian TreasurerSee Cashier. More Jim Chalmers said that Australia would phase out cheques by 2030, in a “gradual, coordinated, and inclusive” manner.

However, Australian banks are increasing their cheque processing fees well before that deadline, to the dismay of seniors and others who use cheques to pay for rent and other utilities. The rise in fees has pushed cheque users to use third-party platforms that charge fees for their transactions.

- “Every centFraction of a currency representing the hundredth of the unit of account. More counts, and to all those 33-year-olds out there, one day you will be 53 and 63 and you’ll discover that your income shrinks, the ability to borrow evaporates, and your credit cards will be questioned,” said Michael Coogan, a pensioner in Brisbane’s north.