U.S. Credit Card Balances and the Cost-of-Living Crisis

U.S. Credit Card Balances Reach Historical Peak

“It’s easy to become overwhelmed by credit card debt, and $1 trillion tells us that many Americans are making purchases with moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More they don’t necessarily have.” – Ben Alvarado, executive vice president at California Bank & Trust.

U.S. credit card balances have been growing since the beginning of 2022, as inflation increased due to post-pandemic supply shocks and Russia’s war on Ukraine. Many consumers use their credit cards to cover expenses during the cost-of-living crisis. “Everybody is using credit a bitIn computers, the basic unit of digital information; contraction of BInary digiT. More more to help make ends meet,” said Michele Raneri, vice president of U.S. research and consulting at TransUnion.

- Total U.S. household debt rose by $16 billion in the second quarter of 2023, standing at $17.06 trillion (FRBNY 2023: 2). Credit card balances increased the most ($45 billion, a 16.2% year-over-year growth rate) and stand at $1.03 trillion, reaching 6% of total household debt. Retail credit cards and other consumer loans increased by $15 billion.

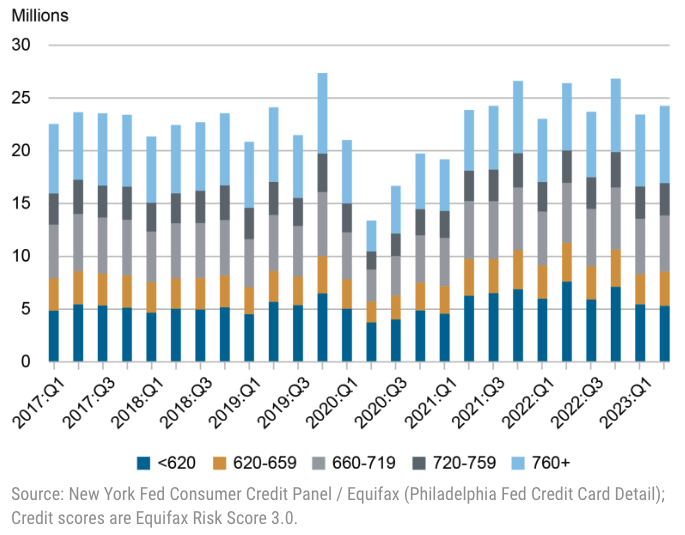

- Close to 69%of U.S. consumers had a credit card in 2023Q2, up from 65% in December 2019. Card issuance has tightened among subprime borrowers and expanded among borrowers with high credit scores (see Graph 1). Average U.S. credit card rates are 21.04% as of August 17, up from 16% in March 2022.

- Delinquency rates for credit card balances have worsened the most. Mature adults (50-59 years), seniors (60 years and older), and younger consumers (18-29 years) have the highest credit card balances. Serious delinquencies have risen markedly among younger consumers and those aged 30-39 (FRBNY 2023: 2, 21, 27).

Graph 1. United States: Credit Card Issuance by Credit Score, 2017Q1-2023Q2

Source: FRBNY (2023).

Restaurants Increase Credit Card Fees

“It’s a perfect storm affecting an industry that’s barely profitable on a good day. At the end of the day, these surcharges are not about greed, they’re about survival for restaurant owners.” – Sean Kennedy, executive vice president of public affairs of the National Restaurant Association.

The Visa and Mastercard duopoly controls 576 million cards or 83% of all credit cards in the United States. In 2022, U.S. merchants paid $93 billion in credit card fees to Visa and Mastercard, including interchange or swipe fees that merchants pay to banks and network fees that retailers pay to the duopoly. Swipe fees account for 2-3% of transaction costs.

Rising credit card fees have made many restaurants add convenience charges for customers paying with credit cards. Credit card fees are the third-highest expense for restaurants, behind food and labor costs, according to the National Restaurant Association (NRA), an industry group.

- Credit card processing companies “pile fees on top of fees, on top of fees,” said José Theoktisto, owner of a Venezuelan restaurant in Troy, New York. Theoktisto added a 4% convenience fee after finding out that he paid $2,000 monthly in credit card fees.

- “No onsing cashMoney in physical form such as banknotes and coins. More. It is increasing the cost of doing business in every industry. And the consumer doesn’t realize it,” said John Horne, owner of six restaurants in Sarasota, Florida. Horne paid about $279,000 in credit card fees this year.

- “I could have a full member on salary with insurance benefits on staff with what I’m paying in these fees. It kills you,” said Amy Warner, a restaurant owner in Trempelau, Wisconsin, who paid over $6,000 in credit card fees in July.

The Credit Card Competition Act (CCCA) of 2023

On June 7, the U.S. Senate Judiciary Chairman and Majority Whip Richard J. Durbin (Democrat of Illinois) introduced a bipartisan, bicameral bill to promote competition in credit card transactions, preventing banks from working with exclusive networks (such as Visa and Mastercard).

- “Credit card swipe fees inflate the prices consumers pay for everyday purchases like groceries and gas. It’s time to inject real competition into the credit card network market, dominated by the Visa-Mastercard duopoly. […] Bringing real competition to credit card networks will help reduce swipe fees and hold down costs for Main Street merchants and their customers,” said Senator Durbin.

- “At a time of economic uncertainty and skyrocketing inflation, these credit card companies are increasing their hidden swipe fees and price gouging small businesses and consumers. Our legislation would rein in the big banks and the credit card industry, drive down costs for convenience stores, gas stations, and other small businesses, and ultimately pass those savings down to consumers,” said Senator Roger Marshall, M.D., Republican from Kansas.

- “Large credit card firms have consistently demonstrated prioritizing self-interest over our constituents,” stated Rep. Lance Gooden, a Republican from Texas.

- “Right now, our country’s credit card landscape does not reflect a competitive market, with just two major credit card companies setting prices for the nation’s largest banks. The current system harms consumers and small businesses,” said Rep. Zoe Lofgren, Democrat from California.

Breaking the Duopoly’s Hold on Credit Card Payments

If the CCCA is enacted, the Board of Governors of the Federal Reserve System would have to prescribe regulations to prevent card-issuing banks and networks from “restricting the number of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More card networks on which an electronic credit transaction may be processed.”

The Board’s regulations would prevent banks and payment networks from

- Impeding retailers to “direct the routing of electronic credit transactions (…) over any payment card network.”

- Requiring retailers to use exclusive security technology for authenticationThe process of proving that a banknote or security document is genuine. More.

- Imposing penalties on retailers for choosing different payment networks.

By forcing banks to allow merchants to choose smaller networks to process card payments, merchants could choose networks at lower costs, driving competition and reducing credit processing fees.

The bill was referred to the Senate Committee on Banking, Housing, and Urban Affairs. CCCA’s supporters include the National Association of Convenience Stores, the National Grocers Association, the National Restaurant Association, the National Retail Federation, and many other national, state, and regional associations.