Palestine: Cash and Banking Infrastructure

MoneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More and Banking in Palestine

Established after the Paris Protocol in 1994, the Palestinian Monetary AuthoritySee Central Bank More (PMA) is the primary monetary and banking authority in the West Bank and Gaza. However, the PMA does not issue banknotes or coins, as the Israeli shekel (NIS) is the primary currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation in the cash-based Palestinian economy, as Israel is Palestine’s leading trade partner.

The PMA’s mandate includes ensuring the supply of foreign cashMoney in physical form such as banknotes and coins. More in various currencies and denominations to meet the public’s demand, particularly in emergencies and crises.

- In Gaza in 2021, the PMA provided 20 million Jordanian dinars, USD16 million, and NIS129 million, the latter in denominations of NIS20 and NIS50 (PMA 2022: 62-63).

- In 2022, it provided NIS200 million in cash to the Gaza Strip “to replace damaged cash and meet the needs of citizens for specific denominations” (PMA 2023: 37).

The Cash and Banking Infrastructure

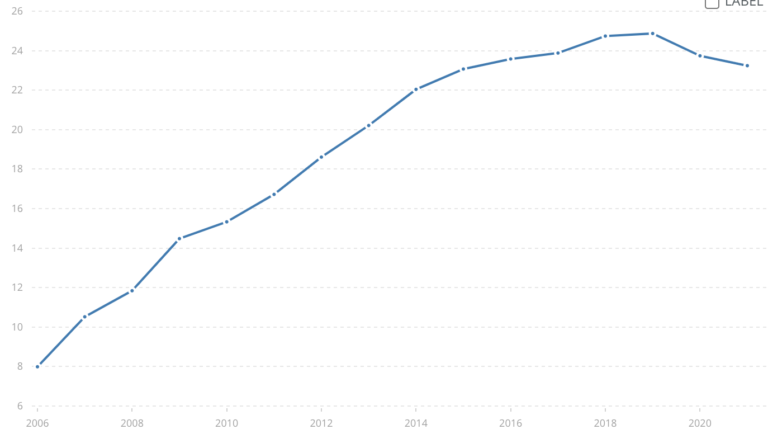

Per the PMA, there were 13 banks, 378 bank branches, 724 ATMs, and 14,192 POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More terminals as of 2022 (PMA 2023: 88). The number of ATMs in the Palestinian territories increased from 2014 to 2019; they declined in 2020 and have increased slightly since then (see Graph 1). The number of bank branches grew from 2014 to 2020 and decreased by 0.3% in 2022. POS terminals declined by 10.8% in 2017 but increased by 77.3% in 2022.

Graph 1. Palestinian Territories: ATMs, Bank Branches, and POS Terminals, 2014-2022.

Note: Left vertical axis: ATMs and bank branches (hundreds). Right vertical axis: POS terminals (thousands). Source: PMA (2020: 106, 2021: 103, 2022: 106, 2023: 88).

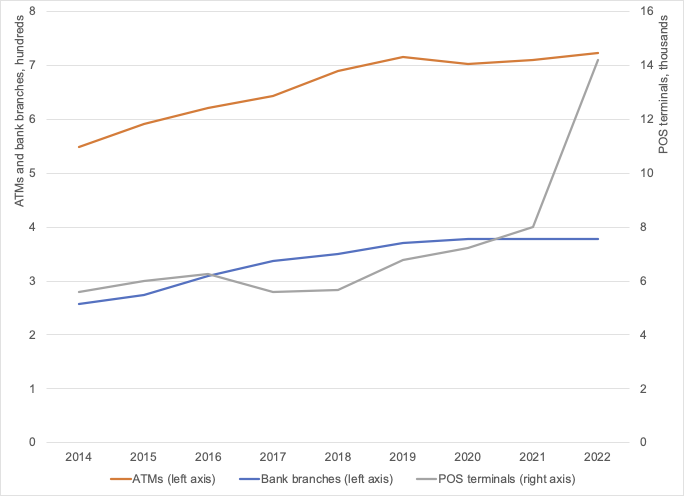

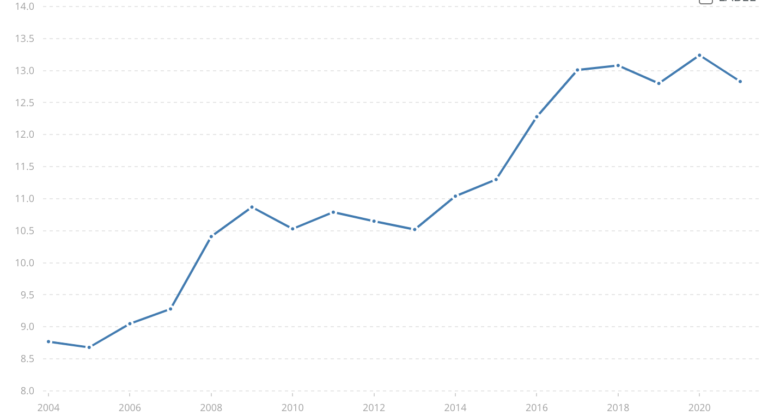

The number of ATMs per 100,000 adults in the West Bank and Gaza peaked at 24.87 in 2019 and declined to 23.24 in 2021, a 6.6% decline (see Graph 2, panel A). Commercial bank branches per 100,000 adults peaked at 13.2 in 2020 and fell to 12.8 a year after, a 3% fall (Graph 2, panel B).

Graph 2. Palestinian Territories: ATMs and Commercial Bank Branches per 100,000 adults, 2004-2021

A) ATMs

B) Commercial Bank Branches

Source: World Bank (2023).

A 2016 financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More study by the Palestinian Economic Policy Research Institute “revealed the need for more [bank] branches and ATMs, especially in the Gaza Strip, rural areas, and West Bank camps” (PMA 2016: 5). The situation has not changed much, as the U.K.’s Foreign, Commonwealth, and Development Office (FCDO) indicates that “there are fewer ATMs in the West Bank and Gaza.”

Cross-Border Payments

Cross-border payments are slow and unstable as Israeli banks seek to diminish or eliminate correspondent banking relationships with Palestinian banks, citing concerns about money launderingThe operation of attempting to disguise a set of fraudulently or criminally obtained funds as legal, in operations undeclared to tax authorities, and therefore not subjected to taxation. Money laundering activities are strongly pursued by authorities and in most countries, there are strict rules for credit institutions to cooperate in the fight against money laundering operations, to declare and report any transactions that could be considered suspicious. More and the financing of terrorism.

- Shekel flows between Israel and Palestinian territories were estimated to surpass NIS70 billion in 2022 (PMA 2023: 51). Repatriating Israeli shekels from Palestinian banks to Israel takes a long time due to limits imposed by the Bank of Israel (BoI) on cash shipments.

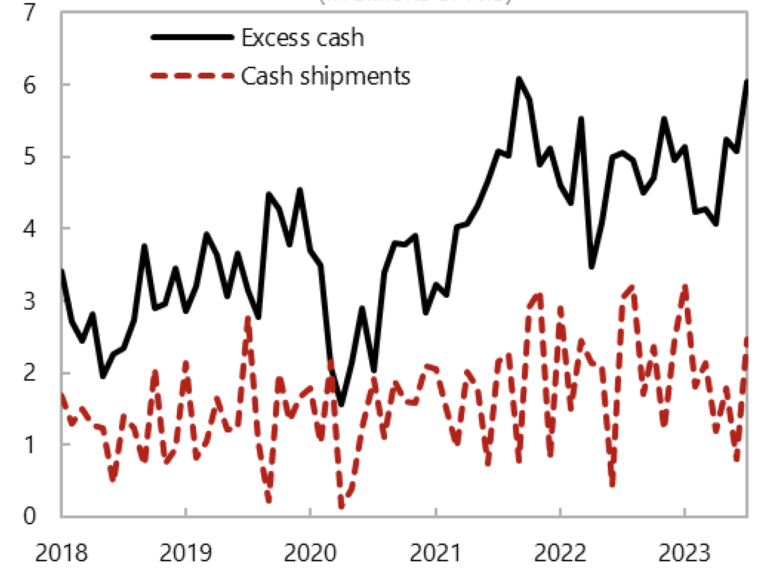

- The Palestinian banking system held an estimated NIS6 billion in excess physical shekel cash holdings by the end of July 2023 (IMF 2023: 9, see Graph 3). This surplus “complicated cash liquidityDescribes the extent to which assets or rights can be converted into cash without causing a significant decrease in the asset’s price. Accordingly, liquidity is often inversely proportional to the profitability of the asset and involves the trade-off between the selling price and the time needed to convert it to cash. In finance, cash is considered the most liquid asset and cash is sometimes used as a synonym for liquidity (e.g. cash reserves; cash pooling…). More control, escalated associated costs and risks, and emerged as a significant threat to overall financial stability” (PMA 2023: 52).

Graph 3. Palestinian Territories: Excess Cash (Billions of NIS), 2018-2023

Source: IMF (2023: 11).

Cash and Humanitarian Relief for Gaza

The United Nations Relief and Works Agency (UNRWA) and other organizations aid 77% of households in Gaza with cash or food. The Qatari government provides aid for welfare payments and public servants’ wages in Gaza by sending funds to Israel under UN supervision. Before, Qatar sent the funds in suitcases filled with cash; now, it transfers them to banks. Israeli and United Nations officials hand-carry cash from Israel across the border to Gaza, according to Reuters.

Palestinian banks operate normally in the West Bank as of October 24, per The National. The UN World Food Programme (WFP) distributes cash-based transfers to 164,000 people in Gaza and the West Bank. People can redeem electronic vouchers for food items in local shops, but supplies are winding down. The WFP is working to make available cash-based platforms for humanitarian relief.

However, cash transfers will make little without humanitarian aid to Gaza in the form of food, water, and medical supplies, as the blockade and war prevent local actors from producing goods to meet the needs of displaced populations, according to Topher McDougal, professor of economic development at the University of San Diego:

“Simple cash transfers are not really helpful in this particular case because of price elasticity of supply. In many other economies, cash transfers can stimulate local production. […] In an economy that is so cut off, such as Gaza’s, it’s so isolated – dumping currency into a market that can’t produce what’s demanded is just a recipe for massive inflation.”