73% of Euro-area Payments are made in Cash

The European Central Bank (ECB) has published the aptly named Study on the PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Attitudes of Consumers in the EuroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More Area (SPACE). SPACE investigates consumers’ use of cashMoney in physical form such as banknotes and coins. More and non-cash payment instruments at the level of each participating euro area country and for the euro area as a whole. The SPACE study follows the 2016 Study on the Use of Cash by Households in the euro area (SUCH) albeit with an amended scope as person-to-person (P2P) and remote payments are now added to the previous Point-of-Sale (POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More) payments.

The data collection was conducted in 2019 and included a one-day payment diaryAn increasingly used instrument by central banks, which consists in asking a representative sample of the population to record for a certain period of time all their transactions, as well as the payment method used. Payment diaries provide a snapshot of the use of different payment instruments. They are, however, a costly tool and do not provide real-time results, but are useful for comparative purposes. More in 17 euro area countries with 41,155 respondents. The German and Dutch central banks carried out separate surveys and the findings were included in the SPACE results.

73% of POS and P2P transactions were made using cash

The key findings show that:

- Consumers predominantly use cash for Point-of-Sale (POS) and person-to-person payments (P2P): 73% of the volume of POS and P2P transactions was carried out using cash and 27% using non-cash payment instruments;

- In value terms, cash transactions accounted for 48% of all transactions, versus 41% for card transactions;

- This compares with a share of 79% of the number of transactions and reported in the previous study (SUCH); however, P2P transactions and online transactions were not part of the scope of the previous study.

- Cards were the predominant non-cash payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More (24%);

- 38% of card transactions were made using contactless technology;

- euro area citizens made on average 1.6 POS and P2P transactions per day, with an average transaction value of €25.6;

- 48% of the POS and P2P transactions were conducted in local shops for day-to-day retail purchases (shops, supermarkets, street markets) and 19% in restaurants, bars, cafés and hotels.

The report shows that the mix of payment instruments differs significantly between countries.

4% of online transactions are paid in cash

Excluding Germany, for which comparable data on remote payments (i.e. online and bill payments) are not available, the SPACE results also show that:

- 96% of all online transactions used non-cash instruments, using cards (49% of the online transactions), e-payment solutions (27%) and credit transfers (10%); cash was used in 4% of the online transactions (e.g. by paying cash on delivery);

- Euro area citizens made on average 0.16 online transactions (using the internet, including also telephone and mail purchases) per day, with an average value of €66.9;

- 89% of all bill payments used non-cash instruments; 11% were paid in cash;

Cash is important for 55% of consumers

Consumers’ self-reported preferences for payment instruments contrast with the actual high usage of cash, as there seems to be a preference for using non-cash payment instruments. Almost half (49%) of the respondents stated that they preferred using cards or other cashless payment instruments (up from 43% in 2016 according to SUCH), whereas 27% said that they preferred cash (down from 32% in 2016), while the remaining 24% said that they were indifferent. Asked about the importance of cash, 55% of the respondents stated that it is important or very important for them to still have the option to pay with cash in the future. “Consumers’ freedom to choose their payment methodSee Payment instrument. More is of the utmost importance to us. Therefore we aim to ensure acceptance of and access to cash throughout the euro area, while promoting innovation on digital payments, including in our work on the possible issuance of a digital euro,” said Executive ECB Board member Fabio Panetta.

34% of consumers use cash as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More

Cash is also used by respondents as an alternative way of savings for precautionary motives (e.g. as a safeguard against events such as electronic payment outages or crises), since 34% of the respondents stated that they stored cash at home or in a safeSecure container for storing money and valuables, with high resistance to breaking and entering. More place.

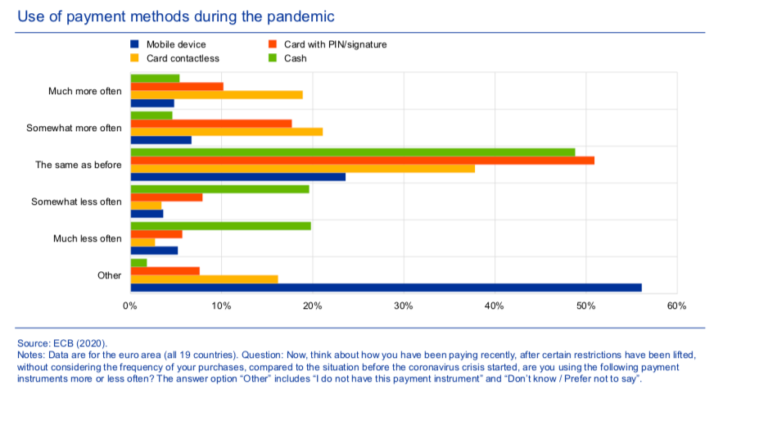

40% of consumers have used less cash during the pandemic

The ongoing coronavirus (COVID-19) pandemic appears to have accelerated the use of non-cash payments for at least some consumers. According to a separate survey on the impact of the pandemic on cash trends which was carried out on behalf of the ECB in July 2020 in all euro area countries, 40% of respondents have used less cash since the start of the pandemic, and almost 90% of them stated that they would continue to pay less with cash (46% certainly and 41% probably) after the pandemic was over.

The most often-mentioned reason for the changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More in perception was the fact that electronic payments have been made more convenient during the pandemic, e.g. by increasing the threshold for the contactless card holder having to enter his/her personal identification number (PIN) for payment authorisation into the card terminal.

Access to cash and acceptance of cash are challenged

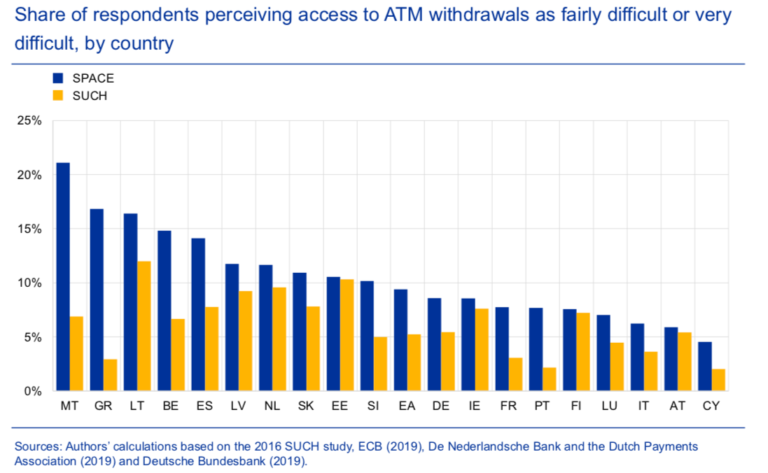

The decline in cash use for making payments raises the question about the availability of cash and its acceptance as a payment instrument. A large majority of respondents were still satisfied with their access to cash via automated teller machines (ATMs), bank branches and post offices in 2019, but compared with the 2016 results there has been a decline in the ease of access to them (from 94% to 89%) in all euro area countries. Cash acceptance at the POS is still high in most euro area countries, but in a few countries, it can no longer be said that cash is universally accepted.

According to the ECB, the SPACE report will help to “implement the Eurosystem’s retail payments and cash strategies. These include the promotion of competitive, innovative and resilient pan-European market solutions, as well as a commitment to keep cash accessible and accepted as a means of payment throughout the euro area.”

This post is also available in:

![]()