Access to Cash Review UK: The Final Report

CashMoney in physical form such as banknotes and coins. More may be declining in the UK, but in the second and final release of the 2019 Access to Cash Review, we see how digital payments will struggle to become every Brits’ cup of tea. The review was first launched in July 2018 with an interim report highlighting the country’s unprepared state to go fully cashless. Both reviews are chaired by the former head of the Financial Ombudsman Service, Natalie Ceeney and are funded by LINK, the UK’s largest cash network – while remaining independent from it.

In responding to the country’s rapid decline of cash use, the 2019 review looks at the future of UK’s access to cash through the lens of an increasingly digital society where the likelihood of leaving people behind is now becoming a serious concern.

Among its findings are:

- 47% of the UK population believe it would be personally problematic if there was no cash in society, while 17% are either unsure of how they would cope or would not cope at all.

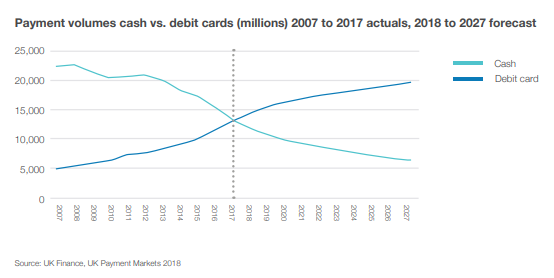

- Over the last ten years, cash payments have dropped from 63% of all payments to 34%. Whereas 13.2 billion debit card payments were made in 2017 (a 14% increase from 2016), while contactless payments grew 99% in 2017 rocketing to a total of 4.5 billion.

- Identified issues related to a cashless UK society included the viability of rural communities, the loss of personal independence and increased risks of financial abuse and debt.

- Cash use will continue to fall according to its analysis, suggesting that using cash could decline to just 10% of all payments in fifteen years’ time.

Moreover, it explores the end-to-end cash cycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More, answering the questions first raised in its 2018 interim report by proposing a concrete plan for policy makers, regulators and commercial entities to work together towards:

- Guaranteeing access to cash

- Ensuring cash remains widely accepted

- Creating a more efficient, effective and resilient wholesale cash infrastructure

- Making digital payments an option for everyone

- Ensuring joined-up oversight and regulation of cash

The review concludes that cash should leave its shadow of a mere commercial issue and find its light in being a core part of Britain’s national infrastructure. A task that may prove to be difficult, yet not impossible. The UK consumer group Which? recently launched a campaign urging government to take regulatory action while the Swiss National Bank (SNB) just unveiled the new CHF1,000 banknote amidst its less-cash or cashless critics — showing how having a well-functioning and inclusive paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More system where cash and cashless payments coexist is possible when cash plays a central role.

For many, using cash is more than just a choice – it’s a necessity – and it’s time that we do more than simply protecting one’s access but rather, committing to innovating ways of keeping cash viable.

Read the full review here