France: Cash Remains King

A Banque de France (BdF) report examines the persistence of cashMoney in physical form such as banknotes and coins. More usage in France, using evidence from the European Central Bank’s (ECB) 2022 SPACE study and other data. Its authors, researchers from the BdF Cash and Retail Payments Oversight Directorate, found that “cash remains the most widely used means of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More in France (and in the EurosystemThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More) at points of sale.” (Des Beauvais, Bayol, Laplace, Araujo, Valdés-Curien 2023: 1).

Cash Remains the Most Widely Used Means of Payment

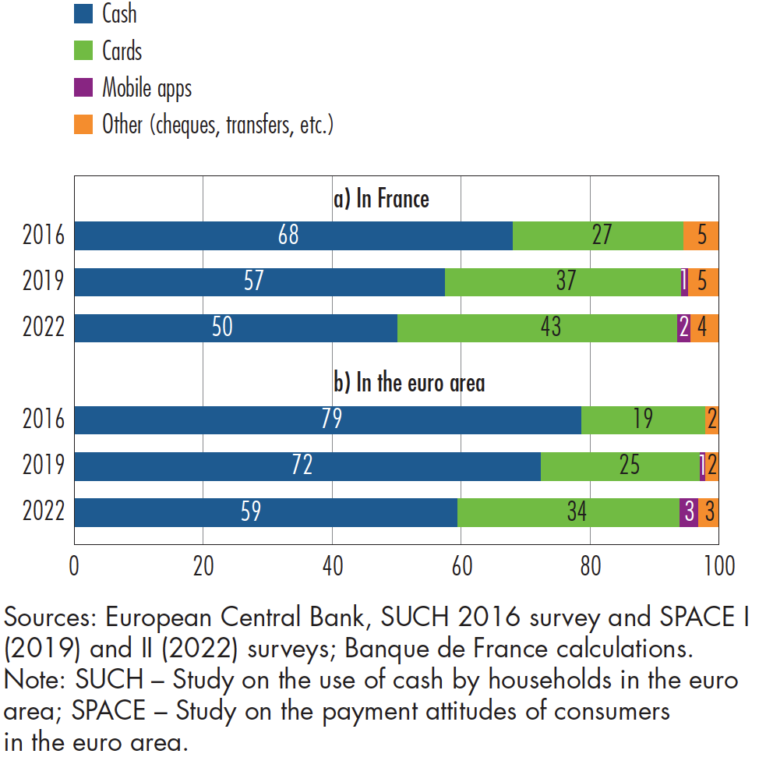

- Cash remains the most used payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More in France and the euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More area. The share of cash in retail payments in France has diminished from 68% in 2016 to 50% in 2022. In the euro area, the percentage went from 79% to 59% in the same years (see Graph 1).

- Cash use in France declined 7% by volume of transactions and 10% by value between 2019 and 2022. The decline by volume is lower than at the euro-area level (14%).

- The Covid-19 pandemic accelerated the widespread adoption of digital payments. The share of card payments in point-of-sale (POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More) transactions increased from 27% (2016) to 43% (2022) in France and went from 19% to 34% in the euro area.

- The share of mobile payments in POS transactions reached 2% in France and 3% in the euro area.

Graph 1. France and the Euro-Area: Means of Payment at Point of Sale by Transaction Volume, 2016-2022

Source: Des Beauvais, Bayol, Laplace, Araujo, Valdés-Curien (2023: 3).

Digital Payments in France

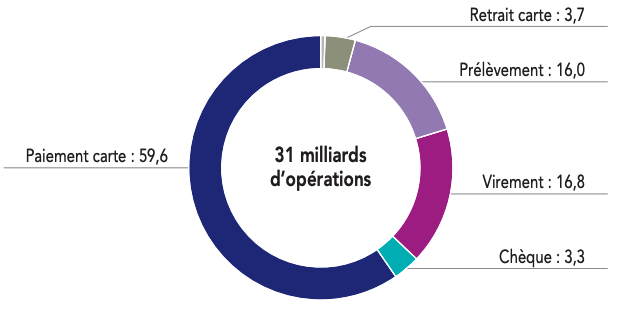

Payment cards are the most used cashless payment methodSee Payment instrument. More in France. As of 2022, they represented 59.6% of 31 billion cashless transactions. Most card payments are contactless (57% in 2021 and 61% in 2022), while 6% were with mobile wallets.

Graph 2. France: Use of Cashless Payment Instruments, 2022

Note: Paiement carte – payment card; retrait carte – card withdrawal; prélèvement – direct debit; Virement – bank transfer; chèque – cheque.

Source: BdF (2023: 12)

Cash Becomes Even More Popular

- Only 14% of French consumers reported cash was their preferred payment instrument, way below the euro area average (22%). Cards and other non-cash alternatives are the preferred payment method in France (64%) and the euro area (see Graph 3).

- France was one of the euro-area countries where the preference for cash increased the most (5%) between 2019 and 2022, contrasting with a euro-area decrease of 5%.

- Most consumers in France (57%) and the euro area (60%) consider having the option to pay in cash important or very important.

- French respondents had the third-lowest cash holdings (€61) in the euro area (where the average cash in wallet is €83). France had the lowest share (30%) of people keeping extra cash reserves in the euro area.

Graph 3. France and the Euro-Area: Payment Preferences, 2016-2022

Source: Des Beauvais, Bayol, Laplace, Araujo, Valdés-Curien (2023: 5).

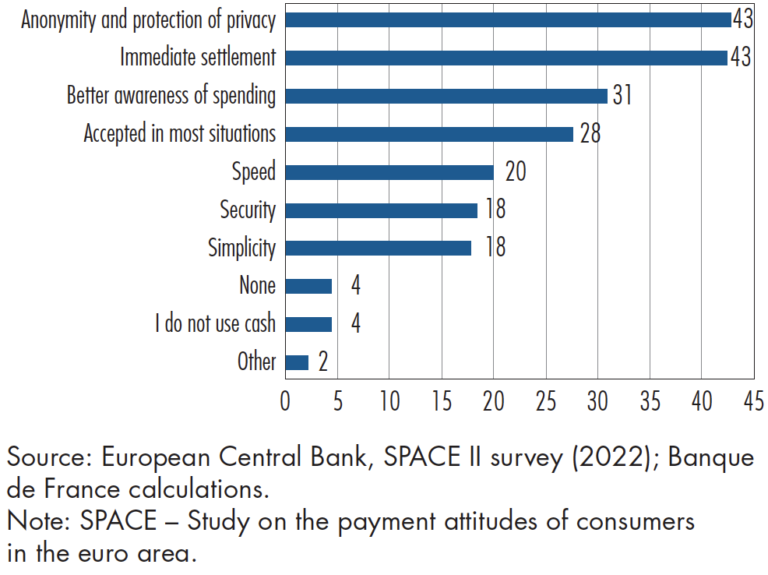

French consumers value cash the most as cash protects their privacy and offers immediate settlementThe discharge of an obligation in accordance with the terms of the underlying contract. In e-transfers the settlement may take days, whereas cash settlements are instantaneous and irreversible. More (43% of respondents, see Graph 4). They also cited cash as a payment instrument facilitating budgeting (31%) and general acceptance (28%).

Graph 4. France: Reasons for Preferring Cash, 2022

Source: Des Beauvais, Bayol, Laplace, Araujo, Valdés-Curien (2023: 5).

Per the ECB’s 2022 survey of cash usage by companies in retail, the restaurant industry, tourism, culture, and entertainment, only 12% of French companies reported cash was their preferred payment instrument. However, cash was more popular due to management costs, reliability, and quick settlement.

The researchers found that cash usage increases with age (older consumers prefer cash). While gender and occupation did not influence consumers’ cash usage, women tend to pay mainly with cards. The type of purchase and amount play a more significant role in using cash. (Des Beauvais, Bayol, Laplace, Araujo, Valdés-Curien 2023: 6, 12).

- The tendency to settle in cash is higher for day‐to‐day purchases (such as from street markets, vendors, cafes, and restaurants) than for supermarkets. The lower the transaction value, the higher the likelihood of cash settlement.

- Purchases of durable goods, petrol, hotel reservations, and services outside the home are less likely to be made in cash. However, transactions between consumers and businesses exceeding €1,000 may not be legally settled in cash.

Access to Cash

- ATMs are the primary cash source in France (78%) and the euro area (74%). Bank counters (9%) and cash reserves (7%) are also important to obtain cash in France.

- A plurality of retailers (49%) report using deposit services (cash-in machines) to credit their bank accounts with cash collected in payments. Most retailers (68%) obtain cash at bank counters.

- 92% of French consumers (89% in the euro area) find it easy or very easy to access a cash withdrawal point. The share of French consumers who found access difficult has not increased since 2019.

Cash and Budgetary Vulnerability

Per a BdF survey on the payment habits of “budgetary vulnerable” people conducted between December 2021 and 2021, people in financially vulnerable situations are 18% likelier to use cash. While primarily using cash in daily transactions, they still reported cards as their preferred payment instrument.

Close to 75% of respondents said they obtain cash through ATM withdrawals. Financially vulnerable individuals tend to withdraw less than €50 and make no more than two monthly withdrawals. They also reported difficulty accessing cash at double the rate (16%) than the overall population (8%).

This post is also available in:

![]()