South Korea: Cash and Digital Payments

South Korea: Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More

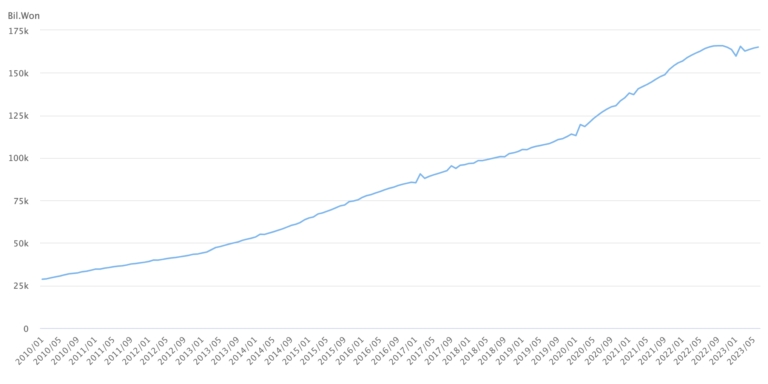

In South Korea, currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation has grown since December 2001 (Graph 1). CashMoney in physical form such as banknotes and coins. More in circulation grew more rapidly during the early onset of the Covid-19 pandemic, as it grew at the monthly rate of 5.7% in February 2020, according to Bank of Korea (BOK) statistics. Currency in circulation grew at yearly rates of over 10% from then until September 2022; then, its pace decelerated.

Graph 1. South Korea: Currency in Circulation, January 2010-June 2023 (Billions of Won, Seasonally Adjusted Averages)

Source: Bank of Korea (2023).

In December 2016, the BOK announced it would eliminate small-denomination coins due to high minting costs ($40 million annually). “If Korea goes coinless, it is good for both customers and sellers as sellers will not need to prepare enough coins for their business,” said Lee Hyo-chan, head of research at the Credit Finance Institute in Seoul.

The PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Mix

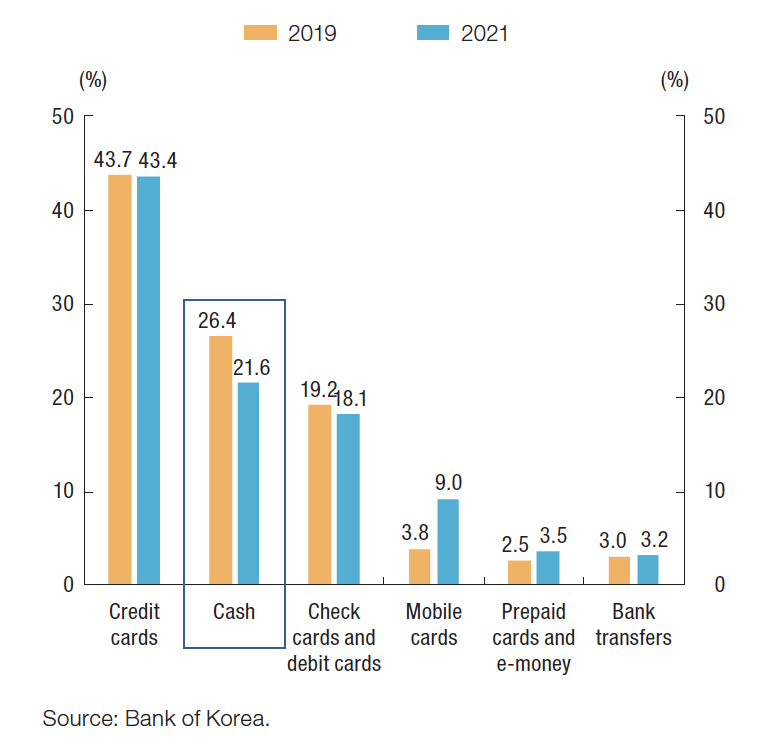

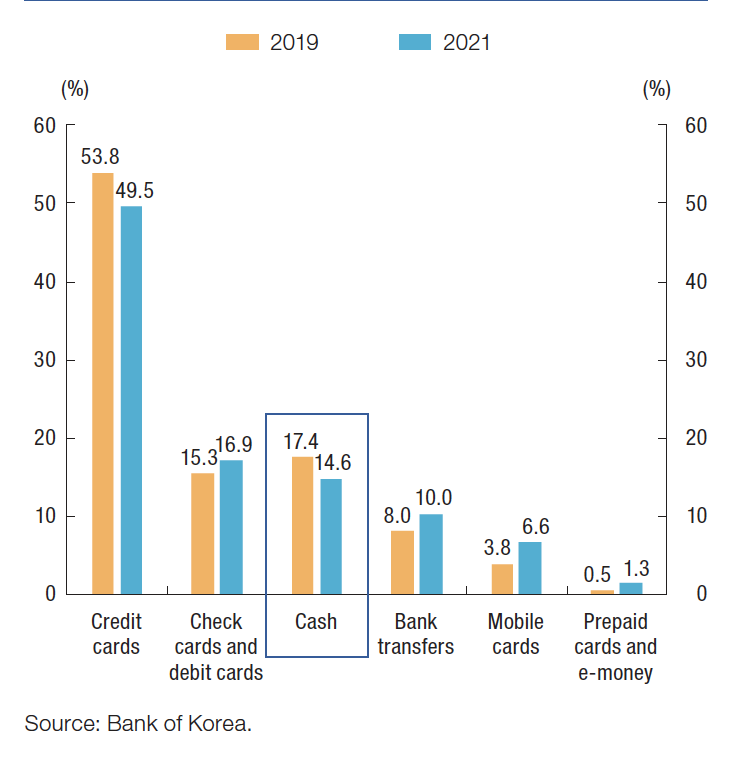

Cash is the second most used payment methodSee Payment instrument. More in South Korea, after credit cards (see Graph 2). According to a Bank of Korea (BOK) survey, the share of cash among all payment instruments fell from 26.4% in 2019 to 21.6% in 2021 by volume of transactions and from 17.4% to 14.6% by value (BOK 2023: 13).

The share of credit cards in all transactions remained stable (43%) by volume between 2019 and 2021 but declined from 53.8% to 49.5% by value as mobile cards’ usage expanded during the Covid-19 pandemic. In 2021, credit cards accounted for 78.7% of all card payments, and debit cards accounted for 21.3%.

Graph 2. South Korea: Usage of payment instruments, 2019-2021

A. Volume

Source: BOK (2023: 14).

The South Korean government promoted credit card payments to stimulate economic activity and broaden the tax base after the 1997 Asian financial crisis. (Bae 2022: 110). Despite high inflation after the Covid-19 pandemic and Russia’s war on Ukraine, the proliferation of digital payments has made it easier for Korean consumers to overspend.

“South Koreans in their 20s and 30s have been borrowing larger amounts of moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More and as a result, falling into more debt. The larger amount of credit card debt and increasing rates indicates South Koreans are spending more than they think they are, which means they will be put in an even costlier debt.” – Chyung Eun-ju and Joel Cho, The Korea Times.

Some restaurants, cafés, and retailers have stopped accepting cash payments. Concerns remain about the growth of non-cash transactions as digitally-excluded groups (such as seniors)

- “I do not normally carry any cash, and I cannot remember the last time I withdrew any cash from a bank teller. I stopped carrying cash and my credit card some time ago because most shops accept mobile cards, and at those that do not, I can simply wire the money on my phone,” said Park Kyung-jun, 35, an office worker in Seoul.

- “Seniors are still familiar with cash payments, and a gradual shift into the cashless society should be considered,” said the Korea Economic Research Institute (KERI).

- “If Korea wants to go cashless in the long term, first of all people will need to changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More their mindset when it comes to handing out cash in traditional settings, such as markets, churches or family events like weddings,” said Lee Hyo-chan, head of research at the Credit Finance Institute in Seoul.

South Korea: Financial InclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More

According to the World Bank’s Global Financial Inclusion Database, in 2021

- 97.2% of Koreans (age 15 and older) owned a mobile phone.

- 98.7% of Koreans had a financial institution account.

- 84% owned a debit card, but only 68.4% had a credit card.

- 97.9% had made or received a digital payment.

Seoul: Public Transit and Digital Payments

“Bus companies had grappled with the high management costs of maintaining the fare boxes (inside buses) while cash is dying out” – A Seoul city official.

In Seoul, 1,876 city buses on 108 routes (25% of the total) stopped accepting cash payments in March after a five-month pilot on 171 buses serving eight routes in 2021. Some buses in Daejeon, Incheon, and Sejong have also gone cashless. Commuters must pay with credit cards, pre-paid T-money transportation cards, or mobile apps. The bus system only offers free transfers between buses when digital payments are used.

The Seoul city government said the share of passengers who paid with cash dropped from 1.25% in 2018 to 0.6% in 2022, with only 20,000 commuters among 3.2 million daily bus users. Cash revenues fell from nearly 52.1 billion won ($39 million in 2012) to 8.2 billion won in 2022. Cash managementManagement and control of cash in circulation. More costs accrue to 2 billion won ($1.5 million).

The change has caused frustration and anxiety among the digitally excluded, particularly seniors and children.

- “I couldn’t think for a moment,” said Park, 72, when he could not find the fare box in his bus. Park said he is “too old and slow” to use mobile banking or transport apps.

- “Just like bus tickets and tokens, it’s about time for cash payments (on buses) to disappear into history. However, the new system needs to also provide alternative means of payment and meet the needs of minorities in the transition period,” said Professor Yu Jeong-whon from Ajou University’s Transportation System Engineering Department.

Seniors often leave cash tips to taxi drivers. “Older people, such as seniors whose daughters or sons call the taxi for them, often leave some cash to express gratitude. In the past, before all forms of payment transited to cards, a lot of people used to say ‘Keep the change’ when they paid in cash,” said Kang, a taxi driver.