Sweden: Cash and Digital Payments

“Most people pay digitally in Sweden today and as a result there are fewer people who use cashMoney in physical form such as banknotes and coins. More. However, those who do not have access to digital forms of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More have difficulties in paying bills or in redeeming payouts of pensions.” – Sveriges Riksbank.

Living in a Cashless Society

- Many shops, museums, restaurants, supermarkets, and most forms of public transportation have gone “cash-free,” and only accept card or mobile payments.

- In 2021, 97% of Swedes were active internet users, while 87% of the population made purchases online, according to Eurostat.

- An estimated 5,000 Swedes have a Biohax subdermal microchip implanted to store everything from IDs to membership cards, door keys, train tickets, and bank cards.

- “I would never have one implanted! Think of all the personal data produced, what would happen if it fell in the wrong hands?!” asks Silvia, a young Italian lawyer residing in Sweden since 2020.

- The Riksbank is piloting a digital currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More, the e-krona, “to give the general public access to government-issued moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More even if cash were to be marginalized further.”

- Card payments dominate retail transactions (see Graph 1). Debit cards are the most common way to pay in shops, regardless of the transaction value. Cash is used more frequently for payments below 100 kronor (SEK). Credit cards are used more as transaction value increases.

Graph 1. Sweden: Percentage of People Paying By Debit Card, Credit Card, or Cash for their Last Purchase in a Shop, 2010-2020

Source: Riksbank (2020).

Mobile Payments: The Case of Swish

- To make and receive payments, 8 million Swedes use Swish (an app for instant payments and transfers). Launched by Getswish AB (a consortium of six Swedish banks) in 2012, Swish connects users’ phone numbers to their social security number (personnummer) and bank account.

- Swish works in a privately-owned system. To mitigate operational risks, banks should transfer Swish payments to Riksbank’s RIX system before the summer of 2023.

- Swedes’ preference for splitting bills at bars and restaurants partly explains the app’s popularity. “Swedes see exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More of money and debt as a threat to friendship,” says Ella Johansson, professor of ethnology at Uppsala University.

Cash and the Digitally Excluded

“Cash is still an important means of payment for many, not least for people facing digital exclusion… [We] want cash to remain a payment option in Sweden for the foreseeable future, so that everyone can choose how they want to pay.” – Johan Nilsson, marketing manager, Bankomat AB

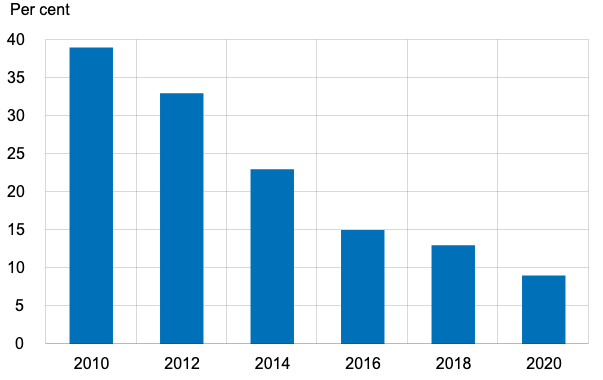

According to the Riksbank, “cash is now mostly used for small payments and primarily by older people.” Yet, cash is the preferred payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More for migrants, the disabled, rural inhabitants, and the digitally excluded. The share of Swedes using cash fell from 39% in 2010 to 9% in 2020 (see Graph 2). However, for people aged 65 to 84 years, that figure was higher, at 13%.

Graph 2. Sweden: Percentage of People Paying in Cash for their Last Purchase, 2010-2020

Source: Riksbank (2020).

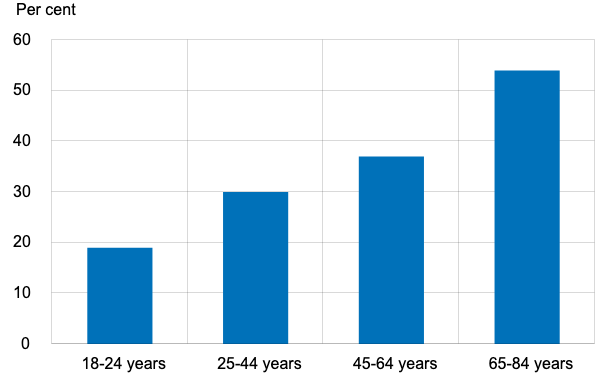

Older adults perceive more negatively the declining use of cash in society (see Graph 3).

- “If you are in a store and you pay with a card, many old people do it very slowly and they can be robbed outside the shop. Before, when you went out with SEK100 in your wallet or handbag, it was awful to be robbed but now you can be robbed of all the money you have,” says Christina Tallberg, the president of PRO, Sweden’s biggest pensioner organization.

Graph 3. Sweden: Percentage of People in Each Age Group Who Perceive Negatively the Declining Use of Cash in Society, 2020

Source: Riksbank (2020).

- While most bank branches have stopped handling cash, Sweden passed legislation requiring banks to provide adequate cash services in 2020.

- The rapid growth of digital payments has increased the divide between the young and the digitally excluded. Per Riksbank’s Payments Report 2022, “a small proportion of the population do not have access to digital payment methods and therefore have to use cash.”

Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More in Sweden

Riksbank data shows that the currency in circulation peaked at SEK113.67 billion in December 2007 (see Graph 4).

- Cash in circulation grew 1.1% in March 2020 (when the World Health Organization declared Covid-19 a pandemic) compared to March 2019. Currency in circulation kept increasing every month (compared to 2019) through August 2020.

- Currency in circulation grew 6.1% in March 2022 (compared to March 2021), the first month of the Russian invasion of Ukraine. Notably, cash in circulation has grown every month since then, compared to 2021.

Graph 4. Sweden: Banknotes and Coins in Circulation, January 1990-October 2022

Source: Riksbank (2022).

The value of banknotes in circulation peaked at SEK108.517 billion in December 2007. The value of coins in circulation peaked at SEK6.071 billion in August 2010.

- As of November 2022, SEK500 banknotes represented 76.9% of the value of banknotes in circulation, followed by SEK200 notes (launched in 2015) at 7.2%, SEK100 banknotes at 6.2%, and SEK1,000 notes t 5.1% (see Graph 5).

- The value of SEK500 notes grew the most in July 2018, at 19.7%, compared to July 2017. The value of SEK500 notes grew by 3.3% in March 2020 compared to March 2019. SEK500 banknotes grew an impressive 8.1% in March 2022.

Graph 5. Sweden: Banknotes in Circulation by DenominationEach individual value in a series of banknotes or coins. More, January 2009-October 2022

Source: Riksbank (2022).

To secure the cash supply, the Riksbank proposes that certain non-banking actors should also be allowed to enter into agreements on the receipt and distribution of cashActivity consisting of the delivery of cash throughout the territory in the amount and modality required to adequately cover the needs. It is one of the central bank’s core functions, for which the necessary logistics, materials and human resources are used, either in-house or outsourced. More at the Riksbank’s depots. In addition, the Riksbank considers that the principles for submitting cash to the Riksbank’s depots should be amended.

A Resilient Payments Infrastructure

- The Riksbank has opened two additional cash centers since 2021, concerned about the payment system’s resilience. “There need to be better opportunities to pay by card or withdraw cash in the event of disruptions to the electricity supply or data communication,” states the Riksbank.

- The Swedish Civil Contingencies Agency (MSB) advises keeping “cash, in case payment systems go down” due to extreme weather conditions, internet outages, or “armed conflict.” People should always have “cash in small denominations,” states the MSB’s brochure “If Crisis or War Comes.”