The Great Covid Cash Surge

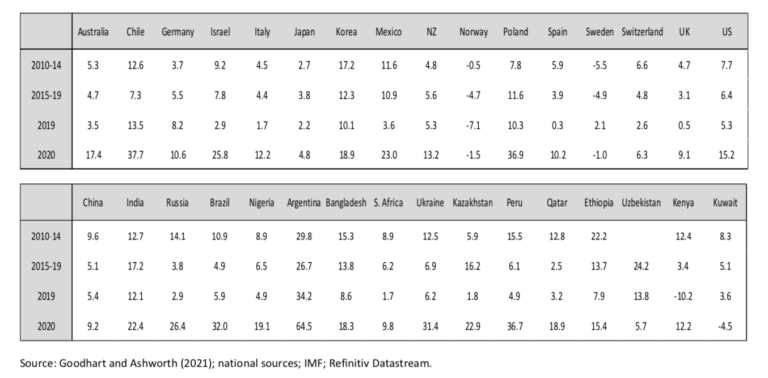

In the discussion paperSee Banknote paper. More, The Great Covid Cash Surge – Digitalisation Hasn’t Dented Cash’s Safe Haven Role, the author Jonathan Ashworth (Fathom Consulting) and Charles Goodhart (London School of Economics) analyse the long-term evolution of cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More in relation to GDP across a broad range of countries to show the remarkable surge in cashMoney in physical form such as banknotes and coins. More demand during the pandemic. The 2020 growth rates for selected 32 countries (Table 1) show that:

- 29 countries experienced positive growth in 2020. Only 3 countries (Norway Sweden and Kuwait) saw negative growth.

- 23 countries experienced double digit growth rates.

- The highest growth rates were seen in Latin America (Argentina +64.5%; Chile +37.7%: Peru +36.7%: Brazil +32%)

- Growth was not limited to international reserve currencies (USD, EUR, CHF, JPY, GBP). It was often higher in other countries.

Table 1: Annual growth in currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation (%Y)

Following the panic-driven demand for cash at the early stages of the pandemic, there also appears to have been a heightened store-of value or precautionary demand, which typically occurs during economic crises, geopolitical events and major periods of uncertainty. This is evidenced by the sharp increase in high denominationEach individual value in a series of banknotes or coins. More notes in circulation. However, a new factor also impacted demand and is specific to the pandemic: a significant reduction in the value of notes returned to the central banks during the pandemic.

Ashworth and Goodhart conclude that “The somewhat enforced intensificiation of the digitalisation of economies clearly appears to have further diminished cash’s role as a medium of exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More. However, other important aspects of digitalisation, such as the growth in private digital currencies, haven’t weakened cash’s role as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More. The recent experience shows, outside of a couple of relatively small Nordic countries, that in a major crisis people still want to retreat to the security and safety of holding bank notes, especially large denomination notes, to provide reassurance. When in trouble, people want to go back to the tried and true; in this respect holding paper moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More in their wallets.”