The Netherlands: Confidence in Cash Remains High

CashMoney in physical form such as banknotes and coins. More payments have been declining steadily in the Netherlands over the past decade, and the pandemic has further accelerated the decline. According to a study by De Nederlandsche Bank (DNB) and the Dutch Payments Association, the share of cash payments in total POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More payments fell from 65% in 2020 to 21% in 2020. In 2020 alone, the number fell by 11 percentage points.

Graph 1. Transactions (2a) and transactions value (2b) by payment methodSee Payment instrument. More, 2010-2020.

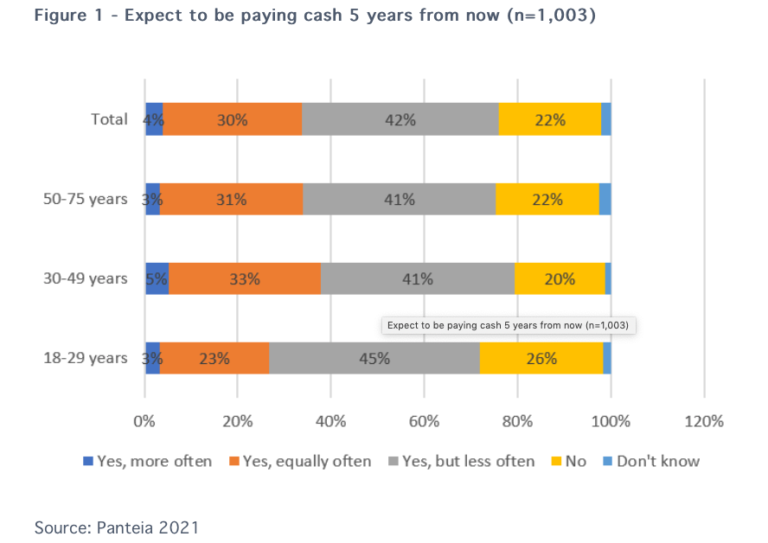

However, despite the declining use of cash for payments, the Dutch have retained their confidence in cash. According to a recent survey commissioned by the DNB, 76% of the population expect to pay in cash in five years. The figure varies only marginally across age groups, as illustrated by Graph 2.

Graph 2. Survey respondents expecting to be paying cash 5 years from now, by age group (18-29 years, 30-49 years, 50-75 years, total: 1,003).

EuroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More Banknotes Are Secure…

The Dutch are also confident in the authenticityThe condition that a security element of a banknote or security document is genuine. More of euro banknotes, with an average score of 7.7 out of 10, which has been improving over the years. A majority of the survey respondents (59%) have never checked a note for authenticity, and 90% can spontaneously cite a security feature. The watermarkA security feature used on most banknotes. It consists of variations in density and thickness created during the paper production, resulting in variations in their opacity. The combination of these variations forms an image embedded in the paper, which is visible with backlight. Due to its variations in thickness, the watermark also has a raised relief effect. More and hologramA thin microscopic diffraction structure, that transmits or reflects light so a three-dimensional image can be seen. This image appears to move as the viewing orientation is changed. More are the most frequently mentioned by 69% and 39% of respondents.

… and Clean

The Dutch are also delighted with the quality of banknotes, for example, the lack of dirt, crumples, graffiti, or sticky tape. 82% of respondents think the notes look reasonably clean, whereas only 2% find them dirty (2%).

High Denominations Are Not Very Popular

One finding of the survey is specific to the Netherlands, i.e., the limited appetite for high-denomination notes. Only 39% of the survey respondents held a €100 note in the past year; the figure drops to 14% for the €200 note and 6% for the €500 note. The three figures have declined by 6 percentage points since 2019.

The DNB attributes this to several factors. First is the difficulty accessing them as they are not often available at bank branches or ATMs; second is the Eurosystem’s decision to stop issuing the €500 denominationEach individual value in a series of banknotes or coins. More. Thirdly, high denominations suffer from a bad perception as half the population associate them with illegal activities; the fourth factor is acceptance as they are increasingly difficult to spend.

In December 2020, the DNB announced it was commissioning a study on the cash infrastructure to explore how it can remain secure, reliable, accessible, at an acceptable cost, in the future. The conclusions are expected in the summer of 2021.